Crypto intelligence firm Coin Metrics has revealed in its latest research that it has become impractical for nation-states to dismantle the BTC and ETH network through 51% attacks, given the prohibitive expenses involved.

A 51% attack involves gaining majority control over a network’s hash rate in proof-of-work systems like Bitcoin or staking in proof-of-stake networks such as Ethereum, allowing for possible manipulation of the blockchain.

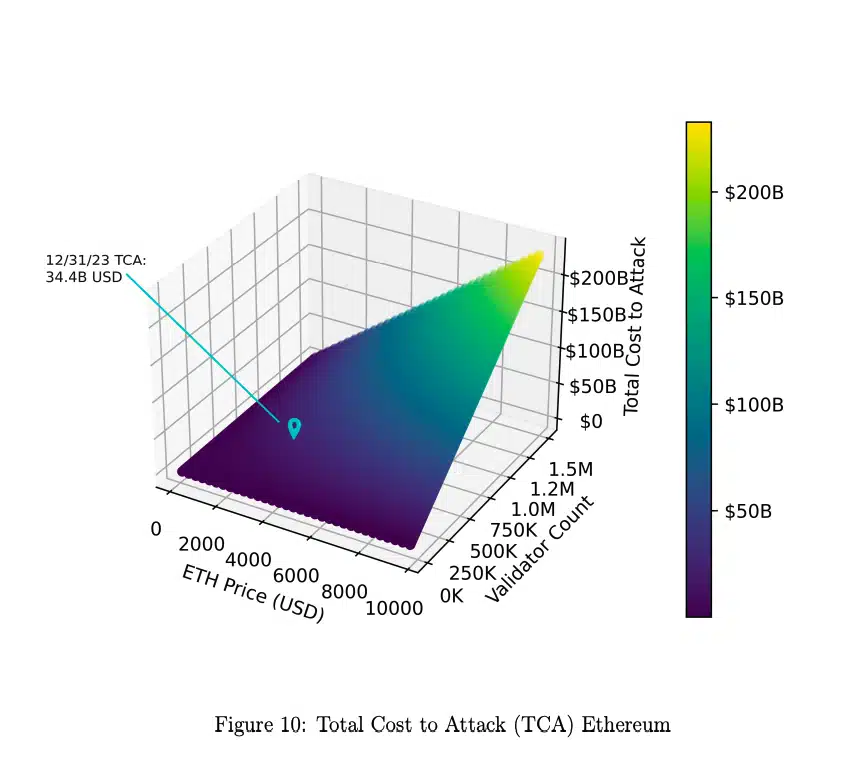

The study, conducted by Lucas Nuzzi, Kyle Waters, and Matias Andrade of Coin Metrics, introduces the “Total Cost to Attack” (TCA) metric to estimate the expenses involved in such malicious activities. Their findings suggest that attacking either Bitcoin (BTC) or Ethereum (ETH) would not be financially feasible or profitable for attackers, essentially nullifying the incentive for such actions.

For Bitcoin, the attempt to gain control would necessitate acquiring around 7 million ASIC mining rigs, an investment of about $20 billion. However, the market lacks the availability of such a vast number of ASIC rigs, and even if a potential attacker decided to manufacture them, the cost would still exceed $20 billion.

The scenario renders the attack not only impractical but also economically inefficient, with the most advantageous double-spend attack yielding a mere 2.5% return on a hypothetical $40 billion expenditure to gain $1 billion.

Ethereum faces a similar situation with its transition to a proof-of-stake model, where the report evaluated the feasibility of a 34% attack by Lido validators. The analysis concluded that any attempt to compromise the Ethereum network using Liquid Staking Derivatives (LSDs) would be both costly, exceeding $34 billion, and time-consuming, taking up to six months due to the churn limit, which restricts immediate stake deployment.

Additionally, the logistical challenge of managing over 200 nodes and incurring significant expenses, such as $1 million on Amazon Web Services, further diminishes the plausibility of such an attack.

Nic Carter, a partner at Castle Island Ventures, commended the report for providing a detailed and empirical examination of the impracticality of 51% attacks on these leading cryptocurrency networks.

He noted that previous analyses lacked the concrete, data-driven approach seen in Coin Metrics’ research, marking it as a pivotal contribution to understanding the security and resilience of Bitcoin and Ethereum against potential nation-state-level threats.

This news is republished from another source. You can check the original article here