Get your daily, bite-sized digest of blockchain and crypto news today – investigating the stories flying under the radar of today’s news.

In today’s crypto news:

- Why is crypto up today?

- Monthly Stablecoin Trading Volume Surpasses $1TN, Hits Highest Point Since 2021

- PayPal, Venmo Veterans Launch a Payment Platform With $9.5M Seed Round Led by Solana Ventures, Ribbit Capital

- Composable Modular Signature Network dWallet Network Sees Testnet Launch

__________

Why is crypto up today?

Over the past 24 hours, the crypto market has seen the majority of the top ten coins increase in price by market capitalization, making crypto news today sway into the positive.

Excluding the two stablecoins (USDT and USDC), eight coins are green today, according to CoinGecko.

Bitcoin (BTC), sitting in first place, is up 1.1% to $51,816. It’s followed by ethereum (ETH), which appreciated 3.6% to $3,011.

Bitcoin’s is the smallest increase.

Meanwhile, the best performer over the past day is BNB for the second day in a row. It’s up 5.4% to $382.82.

Moreover, the remaining coins in this category are all up between 3% and 4%.

Total market capitalization also increased (0.8%) to $2.08 trillion. The 24-hour trading volume was $100,955,097,366 at the time of writing.

Bitcoin dominance is just below 49%.

Bitcoin has recorded a growth in price amid institutional inflows this year following the spot ETF approval in the US. Data by on-chain analytics firm CryptoQuant indicates bullish sentiment toward BTC in recent weeks, resulting in a price uptick.

On the institutional side, inflows hitting millions were recorded in many products, boosting Bitcoin’s Assets Under Management (AUM) to over $36 billion.

Furthermore, the activities of whales have spiked in the last 30 days.

Meanwhile, several analysts have recently shared different data points indicating that altseason could be just around the corner.

Analyst Stockmoney Lizards, for example, opined that there is a potential 10x bull run ahead of us.

Monthly Stablecoin Trading Volume Surpasses $1TN, Hits Highest Point Since 2021

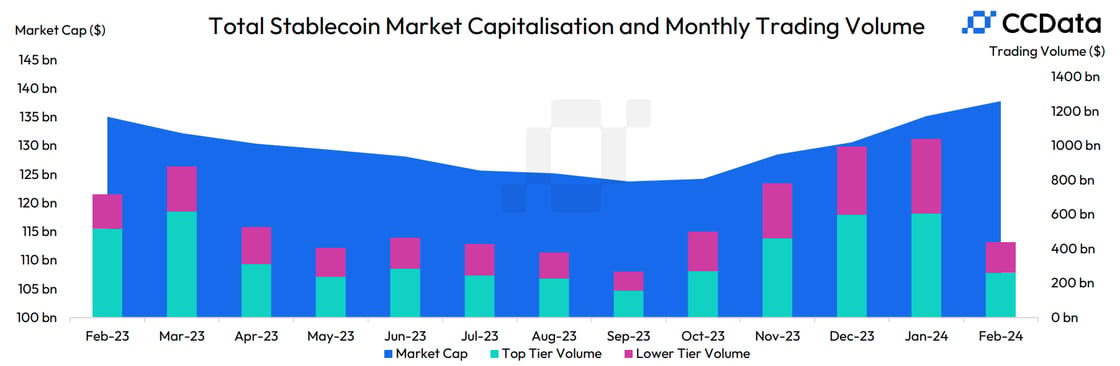

In February, the total market capitalization of stablecoins went up by 1.95% to $138bn (as of the 16th). This is the fifth consecutive monthly increase and the highest market capitalization for stablecoins since the start of 2023, according to a recent market report from on-chain analytics firm CCData.

In January, based on the end-of-month volumes, stablecoin trading volume increased by 4.54% to $1.04tn. This is the highest level seen on centralized exchanges (CEXs) since December 2021.

“Volumes are on track to record a higher total in February, having already seen $440bn in trading volume on CEXs as of the 16th,” said the report.

Meanwhile, stablecoin market dominance fell to 7.09% from 8.15% in January. This marks the sixth consecutive monthly decline and the lowest level since December 2021.

Furthermore, the market cap of USDT in February rose by 1.23% to $97.3bn – an all-time high circulating supply for the stablecoin.

USDC increased for the third consecutive month, by 5.34% to $26.9bn – the highest market capitalization since June 2023.

The market capitalization of First Digital USD (FDUSD) went up by 12.5% to $2.44bn, setting a new all-time high for the stablecoin.

Also, TrueUSD (TUSD)’s market capitalization dropped (14.3% to $1.23bn), as demand for it on Binance declined due to the popularity of FDUSD trading pairs.

Meanwhile, the stablecoins trading volume on CEXs rose 4.54% in January to $1.05tn, recording the highest stablecoins trading volume on CEXs since December 2021.

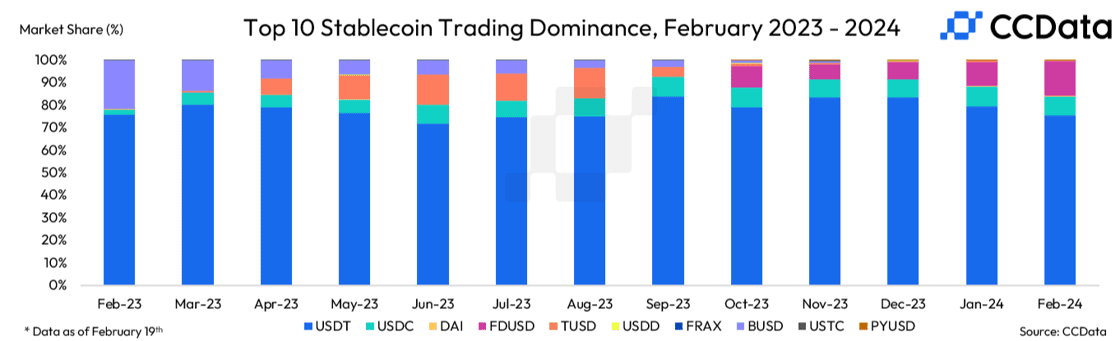

USDT still dominates the trading activity on CEXs, accounting for 75.3% of the market share among the top 10 stablecoins.

Moreover, FDUSD’s market share among the top 10 continues to rise to a new all-time high making it to the top of crypto news rounds. It now accounts for 15.6%. The BTC-FDUSD pair’s popularity on Binance following the approval of spot Bitcoin ETFs has contributed to the FDUSD’s rise.

PayPal, Venmo Veterans Launch a Payment Platform With $9.5M Seed Round Led by Solana Ventures, Ribbit Capital

Meso, a payments platform connecting banks and blockchains, announced its official launch with an on-ramp product that seamlessly connects banks and cards to crypto apps.

According to the announcement shared with Cryptonews, Meso is led by veterans of Web2 payment giants PayPal, Braintree, and Venmo, and major Web3 projects such as Solana Labs.

Per the team,

“Starting now, apps can integrate Meso to onboard users without first sending them off to a centralized exchange to fund their wallets.”

Moreover, Meso announced its seed round totaling $9.5 million, co-led by Solana Ventures and Ribbit Capital, with participation from Canonical Crypto, 6th Man Ventures, and angel investors, including Phantom co-founder Chris Kalani, Pinterest CEO Bill Ready, and Bodhi Labs’ Archie Puri.

The announcement noted that major obstacles to making blockchain finance mainstream include regulatory ambiguity, security concerns, and lack of merchant acceptance. It added that,

“But underpinning all of these are barriers of access to and from the ecosystem. “

Meso said that it tackles these barriers with software development kits (SDKs) that enable frictionless on- and off-ramps to make it easy for users to move money on and off chain.

The platform currently supports Ethereum, Solana, and Polygon. It will add Arbitrum, Optimism, and Base by the end of the year’s first quarter.

Transferring money into crypto is effortless via https://t.co/J9F9E9nk1G ✅

Ready to instantly and seamlessly move funds from your wallet to your bank?

Off-ramps launching soon 🌉 pic.twitter.com/uVIcn8vWju

— Meso (@meso_network) February 21, 2024

Composable Modular Signature Network dWallet Network Sees Testnet Launch

In other crypto news today, dWallet Labs, a prominent cybersecurity research team, today announced the testnet launch of dWallet Network. It is described as “a first-of-its-kind composable modular signature network.”

Per the press release shared with Cryptonews, the dWallet Network introduces a new primitive for multi-chain collaboration in Web3: dWallets.

This is a non-collusive and massively decentralized signing mechanism that lives on the dWallet Network, and that can be used as a building block on Layer-1s and Layer-2s to sign native transactions to all chains.

A dWallet owner can have an address on any other blockchain and can sign transactions for those networks.

David Lachmish, co-founder of dWallet Labs and dWallet Network, commented:

“There are so many exciting new use cases dWallets unlock – Imagine holding BTC on Bitcoin and ETH on Ethereum through a Solana smart contract wallet, or using BTC as collateral for a loan without bridging or wrapping, or even securing a protocol using BTC, similar to Ethereum Restaking.”

The most exciting part, he added, is that dWallets are the first Web3 primitive to enable this, and do so in a natively multi-chain way, without the risks inherent to cross-chain solutions.

The team explains that a dWallet is a programmable and transferable signing mechanism. This means that builders can create logic that governs whether a signature will be generated.

Assets always stay on their native chains because dWallets use signatures. This eliminates the cross-chain risks of wrapping, bridging, or messaging.

Also, dWallets don’t use private keys. They create signatures utilizing a field of cryptography called multi party computation (MPC). Therefore, a signature is generated by multiple parties.

Per the announcement,

“With dWallets, for a signature to be generated, both the user and the dWallet Network are required – the network can’t sign without the user, so the user’s assets are secure against collusion, and the user can’t sign without the network, which allows logic to be enforced in a decentralized way.”

dWallet Labs was founded in early 2022 by cybersecurity and cryptography veterans. The dWallet Network mainnet is anticipated to go live later this year.

Last week, dWallet Labs released 2PC-MPC. It’s the industry-first multiparty protocol that enables generating an ECDSA signature in a non-collusive way, requiring both the user and a threshold of hundreds or thousands of nodes, the team said.

The dWallet Network uses 2PC-MPC to introduce the dWallet primitive.

The key for the dWallet Network, and for the new #Web3 primitive – the #dWallet – is an MPC protocol supporting a #noncollusive and massively decentralized signing mechanism. 2PC-MPC finally makes that a reality.https://t.co/xw3nQgghHo

— dWallet Network (@dWalletNetwork) February 17, 2024

This news is republished from another source. You can check the original article here