We’re living an era where blockchain technology is embracing artificial intelligence, Crypto-IA tokens are all the rage, and are mainly driven by the successes of giants like Nvidia and the advances of OpenAI. But are these cryptocurrencies really up to the challenge of technological upheaval? We come back to this in Cryptic Analysis, after this week’s essential news.

Block 1: Essential news

The Bitcoin ETF tidal wave continues

Bitcoin hit a new high (again) at $73,700 on Wednesday. Capital flows into Bitcoin ETFs in the US are gathering momentum, with a record day of net inflows at $1.05 billion on Tuesday. Bitcoin ETFs now hold a cumulative 58.77 billion in assets under management, or 4.21% of all bitcoins in circulation. All this in just two months. Bitcoin Spot ETFs began trading on January 11, 2024.

Flows in Bitcoin Spot ETFs

SoSo Value

Microstrategy holds 1% of bitcoins in circulation

MicroStrategy has consolidated its position as a leading Bitcoin holding company, acquiring a further 12,000 BTC for an investment of $821 million, bringing its total to 205,000 BTC, or over 1% of the BTC supply in circulation. This latest purchase once again underlines CEO Michael Saylor’s determination and vision in the value of Bitcoin as a store of value. In the ranking of Bitcoin holdings, the company ranks just behind the US government, which holds 215,000 BTC following seizures linked to the dismantling of the Silk Road black market and the illicit operations of certain platforms.

Coinbase to issue convertible bonds

Coinbase has announced its intention to issue $1 billion in convertible bonds, targeting institutional investors, with an additional $150 million call option for 30 days. The bonds, maturing on April 1, 2030, will be convertible into Coinbase Class A shares. According to the company, this cash can be used to “make investments and acquisitions in other companies, products or technologies that Coinbase may identify from time to time.”

The fundraising comes after Coinbase reported a 41% increase in sales in the fourth quarter of 2023. Coinbase’s share price rose from $31.55 on January 1, 2023 to $258 this Wednesday, March 13, an increase of 756%, taking its valuation to $62.06 billion.

ETH Ethereum Spot: not for tomorrow

Initial enthusiasm for the approval of spot Ethereum ETFs following spot Bitcoin ETFs has been tempered, with approval probability estimates in May falling to 30%, according to Bloomberg. This downward revision is attributed to the prolonged silence of the SEC and Ethereum ETF applicants, contrasting with previous expectations of a 60-70% probability of approval by May. While the entry of Bitcoin ETFs has set some precedents for Crypto ETFs, the lack of apparent activity around Ethereum ETF applications suggests that approval may take longer than expected, raising the question not of approval itself, but rather of its timing.

This #Ethereum ETF cycle feels like the opposite of #Bitcoin ETF approval odds at the moment. The more we see/hear (and don’t see/hear) the less optimistic I become.

We’re ~73 days from the deadline and there really seems to be little to no movement https://t.co/N6OpM870XF

– James Seyffart (@JSeyff) March 11, 2024

Block 2: Cryptic Analysis of the week

In the wake of Nvidia’s impressive earnings announcement, Crypto-IA tokens surfed the wave and recorded significant gains. Worldcoin’s WLD jumped 40%, SingularityNET’s AGIX 43% and FetchAI’s FET 18% in the week following the release of Nvidia’s results on February 21.

This surge is not an isolated incident; a year earlier, the Crypto-IA market had been boosted by the enthusiasm generated by the launch of OpenAI’s ChatGPT. Over the past year, the capitalization of cryptocurrencies claiming to use artificial intelligence has risen from $1.75 billion to $25 billion.

But there’s a difference between traditional AI companies and Crypto-IA companies. We know what Google’s ChatGPT or Gemini do. Consumers can use them. Nvidia makes microchips that power the most sophisticated computers. What are the technologies behind Crypto-IA tokens used for?

For example, here’s how Fetch. ai describes itself: “A decentralized connectivity platform that enables devices to connect directly to digital agents providing autonomous solutions to complex tasks”. Not a very clear business.

In other words, the crypto company claims to facilitate direct connections between devices and “digital agents” to autonomously manage complex tasks, with the aim of revolution of the way users engage with “digital assistants” across a range of services, such as booking a restaurant or planning a trip.

However, while we suppose the idea is interesting, the way in which Fetch.ai and similar companies intend to surpass giants like Google, Microsoft, Amazon and Apple in the field of digital assistants remains highly ambiguous, especially considering the uncertain role of their native tokens beyond fundraising mechanisms.

As an example, the role played by their FET token in the Fetch.ai venture is (even) less clear, other than to generate revenue when the token’s price skyrockets. According to the company the FET is “the utility token and primary medium of exchange on the Fetch.ai network” explaining that “FET can be used to pay for Fetch ecosystem services and network transaction fees.”The question arises: why not just use stablecoin or bitcoin to run the network?

The business models and ambitions of companies like Worldcoin, whose founder is OpenAI’s Sam Altman, also raise questions. Worldcoin’s aim is to provide universal economic access via the WLD cryptocurrency and artificial intelligence, while using users’ iris scans to verify their identity online (Internet voting or administrative procedures). But the company has faced significant regulatory hurdles due to obvious confidentiality issues which, more recently, prompted Worldcoin to leave the markets of India, France and Brazil.

Despite this, Fetch.ai’s FET token is up 410% since the beginning of February, and Worldcoin’s WLD is up 323%. This doesn’t mean we should abandon artificial intelligence technologies for cryptocurrencies.

Fraud detection, risk protection, automation and customer experience are just some of the ways AI could revolutionize the crypto industry. And that’s without necessarily creating a crypto whose marketing veneer lurks solely around two letters: AI. Sentiment analysis, decentralized autonomous agents, and even compliance and security could probably all be improved thanks to the power of AI.

Looking ahead, AI will surely have the potential to oversee risk and compliance, and probably even make trading decisions, and even manage portfolios. With AI creating personalized advice, tailored marketing and a user-friendly experience, crypto’s barriers to entry could even soon be a thing of the past.

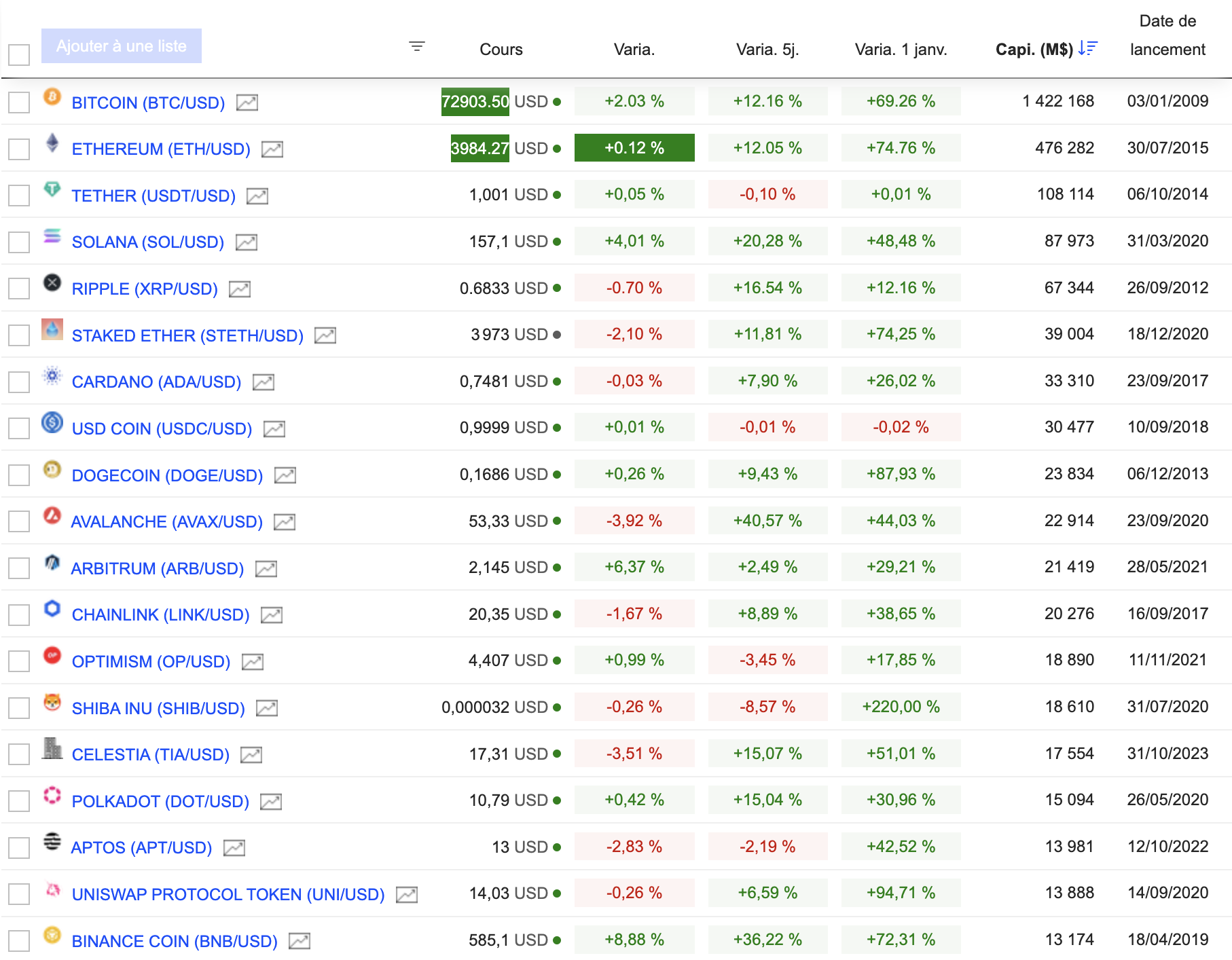

Block 3: Gainers & Losers

Crypto chart (Click to enlarge)

MarketScreener

Block 4: Things to read

Bitcoin sabotage (Bitcoin Magazine)

Why BlackRock went all in on Bitcoin (WSJ).

What’sbehind Bitcoin’s soaring price? Vibrations, mostly (Wired)

This news is republished from another source. You can check the original article here