February 19, 2024 (Investorideas.com Newswire) A new analysis reveals cryptocurrency users lost over $43.6 million ($43,655,107) last year after being targeted by scammers on gaming and metaverse platforms.

The findings come from Smart Betting Guide via the REKT Database, which found cryptocurrency users lost more than $1.7 billion ($1,759,850,729) due to exploits and exit scams last year – with 2.5% of that stolen from gaming and metaverse platforms.

The data shows that some blockchains were more vulnerable to this than others, with Binance users losing $1,493,552 and Arbitrum users losing $552,652.

It’s unclear exactly which exploits are used most often by those targeting these platforms, but they may include phishing, where users are tricked into revealing sensitive information, and fake virtual exchanges created within the metaverse, where users can deposit their assets but cannot withdraw them.

Other issues may include fraudulent NFT projects, where scammers create fake projects within the metaverse and sell them for an inflated cost or exploit vulnerabilities in gaming platforms to steal in-game assets and currencies.

The latter is particularly concerning, given many gaming companies allow players to purchase games with cryptocurrency, including GameStop, Microsoft, and Best Buy.

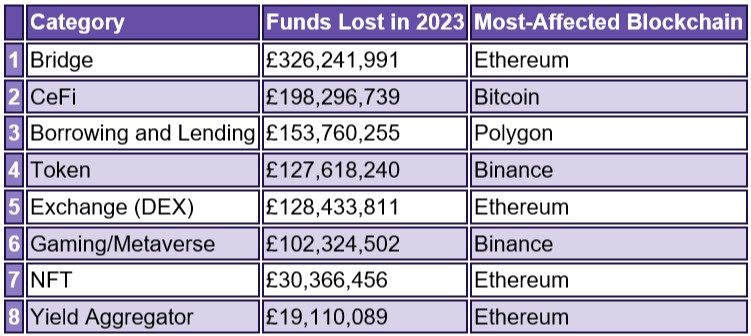

The platforms that saw the most funds lost last year due to scams

The category that saw the lowest sum lost was stablecoins, designed to maintain a stable value relative to a specific asset, such as other cryptocurrencies. In 2023, scammers stole £8,009,767 via this route – 95% below the average (£149.6k).

It’s also important that those holding cryptocurrency are particularly vigilant now, as the data reveals February is one of the worst months for being hit by scams.

February ranks third as the month that saw the most funds stolen across all affected platforms, with an average of £623,366,085 taken by scammers each year. This is 6% higher than the average monthly loss (£589,851,197).

While February was the third month that saw the most funds stolen, the worst month came out as December, with a loss of £821,716,080 (39% above the average).

Ranking second is January, with an average of £662,039,960 taken yearly. This is 12.2% above the monthly average and makes for a tough start to the year.

The risk drops slightly once we get into March, with the average sum lost equating to 2.9% less than the monthly average. Overall, the likelihood of being hit by a crypto scam is higher in the year’s first half than in the second half, excluding December.

Regarding the findings, Zigmas Pekarskas, CEO of Smart Betting Guide, said: “As with any technical asset, cryptocurrency is vulnerable to scams – especially as it continues to grow in popularity and application, much like the metaverse. This is particularly true given cryptocurrency transactions are often anonymous and typically irreversible, so it’s difficult to trace transactions back to individuals.

“Some platforms, including those in the metaverse and gaming sphere, are more susceptible to cybercrime than others. When transacting on one of these platforms, ensure you do your research and due diligence. Be cautious of ‘too good to be true’ prices or unverified items for sale, especially if purchasing an extremely limited or in-demand in-game item, as scammers will look to exploit your interest.

“Use a secure cryptocurrency wallet to store your funds and assets – ideally with multi-signature support – and report any suspicious activity or fraudulent listings to the platform’s support team as early as possible.”

Data is gathered from the REKT Database: https://de.fi/rekt-database

Scams were filtered to display data by month since 2011, with returns subtracted from losses to determine the largest deficits. Full raw data is available on request.

More Info:

This news is published on the Investorideas.com Newswire – a global digital news source for investors and business leaders

Disclaimer/Disclosure: Investorideas.com is a digital publisher of third party sourced news, articles and equity research as well as creates original content, including video, interviews and articles. Original content created by investorideas is protected by copyright laws other than syndication rights. Our site does not make recommendations for purchases or sale of stocks, services or products. Nothing on our sites should be construed as an offer or solicitation to buy or sell products or securities. All investing involves risk and possible losses. This site is currently compensated for news publication and distribution, social media and marketing, content creation and more. Disclosure is posted for each compensated news release, content published /created if required but otherwise the news was not compensated for and was published for the sole interest of our readers and followers. Contact management and IR of each company directly regarding specific questions.

More disclaimer info: https://www.investorideas.com/About/Disclaimer.asp Learn more about publishing your news release and our other news services on the Investorideas.com newswire https://www.investorideas.com/News-Upload/

Global investors must adhere to regulations of each country. Please read Investorideas.com privacy policy: https://www.investorideas.com/About/Private_Policy.asp

That’s all it takes to get an article published on Investor Ideas – Learn More

Buy a crypto guest post on Investorideas.com

This news is republished from another source. You can check the original article here