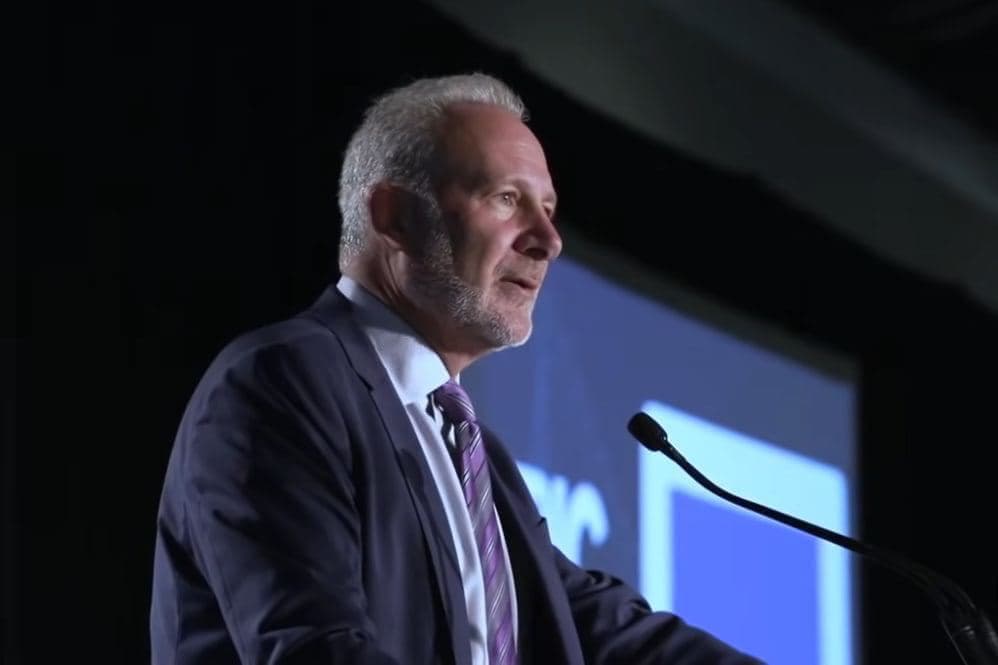

Renowned gold investor and economic commentator, Peter Schiff, has raised pertinent concerns regarding the accessibility and resilience of Bitcoin trading through Exchange-Traded Funds (ETFs). Schiff’s primary apprehension revolves around the restricted liquidity inherent in ETF trading, particularly during non-U.S. market hours.

By emphasizing this limitation, Schiff underscores the potential vulnerability of investors who may find themselves unable to execute trades during overnight market downturns. The frustration of being stranded without the ability to exit positions until the resumption of U.S. trading hours serves as a stark reminder of the challenges inherent in navigating the volatile crypto landscape through traditional investment vehicles like ETFs.

Recent Market Events

The recent turmoil in the cryptocurrency market, catalyzed by Bitcoin’s abrupt descent below the $63,000 threshold, has sent shockwaves across the global financial landscape. In the span of a mere 24 hours, the total market capitalization of cryptocurrencies experienced a significant 8% contraction, plummeting to $2.4 trillion.

This precipitous decline in Bitcoin’s valuation has reignited fervent discussions surrounding the digital asset’s resilience in the face of market downturns. Moreover, the role played by institutional investors, including ETFs, has come under renewed scrutiny amidst growing concerns about their impact on market stability and price discovery mechanisms.

Also Read: Are Solana Ecosystem Tokens Behind Crypto Market Crash?

Critique of MicroStrategy’s Actions

Peter Schiff’s critical lens has recently turned towards business intelligence firm MicroStrategy and its enigmatic CEO, Michael Saylor, regarding their strategic approach to Bitcoin acquisitions. Schiff’s interrogation centers on Saylor’s utilization of borrowed funds to fuel MicroStrategy’s aggressive Bitcoin purchasing spree, particularly following significant price surges in the cryptocurrency.

Implicit in Schiff’s critique is the insinuation that such actions may serve to artificially inflate Bitcoin’s value, potentially at the expense of unsuspecting investors. As the debate surrounding the ethical implications and broader market ramifications of corporate involvement in Bitcoin intensifies, Schiff’s scrutiny of MicroStrategy’s investment strategy adds another layer of complexity to an already contentious discourse.

Also Read: XRP Lawsuit: Ripple and SEC Agree to Seal Details in Remedies-Related Briefing

This news is republished from another source. You can check the original article here