Explore the 2024 potential of new cryptos to watch and uncover narratives that could boom in this upcoming bull run.

Bitcoin (BTC) is up over 150% in the past 12 months. According to BlackRock, industry-wide anticipation of a spot Bitcoin ETF and trillions of dollars in sidelined investor capital have added to an interesting bull cycle thesis for 2024’s crypto market.

The total value locked (TVL) in decentralized finance (defi) also grew, increasing from around $38 billion at the start of 2023 to over $54 billion as the year drew close. Despite this leap, defi’s TVL is still several levels below its 2021 peak recorded north of $179 billion per DefiLlama.

This means new cryptocurrencies launched in 2024 could benefit from significant liquidity and attention as retail and institutional investors flock back into digital asset markets. The resurgence in blockchain activity could also indicate new cryptos gearing up to enter the market, joining over 9,000 existing virtual currencies.

This article will look at three new cryptocurrencies to watch and three narratives potentially garnering steam amid growing excitement around cryptocurrencies. We picked these projects as they have already established communities, raised millions in funding from reputable venture capitals (VCs), attracted thousands to millions of followers, and most have confirmed their 2024 token launch plans.

LayerZero (ZRO)

Launched in September 2021 by LayerZero Labs, LayerZero is a cross-chain messaging protocol that allows developers to build applications that work across multiple decentralized networks. This fosters improved liquidity and utility for users. Several protocols are built on LayerZero’s technology, including Stargate Finance and Radiant Capital, which boast a combined TVL of over $600 million.

LayerZero has also raised around $250 million in several funding rounds and is now at a $3 billion market valuation, fueling community optimism about a token launch and rewards for early adopters. This can often translate into demand for newly launched cryptocurrencies.

The Vancouver-based omni-chain protocol announced plans to launch its ZRO token in H1 2024. An airdrop is included in the rollout strategy, as LayerZero is backed by some of the biggest crypto-centric investment firms like Andreessen Horowitz (a16z), Circle Ventures, OKX Ventures, and Sequoia.

Additionally, being a first-mover in the space could give LayerZero an edge over other projects and new crypto coins emerging in the cross-chain messaging ecosystem.

zkSync Era

zkSync is an Ethereum-based scaling solution built on zero-knowledge technology. The blockchain infrastructure, commonly called rollups, executes transactions off Ethereum’s (ETH) mainnet to ease network congestion and offer cheaper gas fees.

This particular layer-2 network was launched in February 2023 by Matter Labs, which has raised $458 million. $200 million out of that raise is earmarked for zkSync adoption. While the project has not officially announced when its token might be listed, a price page on CoinMarketCap added to speculation of an upcoming launch.

zkSync’s over $500 million TVL and funding positions the L2 network as one of the major new cryptocurrencies that could debut in 2024. The protocol also commands a 3.3% market share among L2s, behind only Coinbase’s Base, Optimism, and Arbitrum per l2beat.

StarkNet (STRK)

Another new digital currency to watch out for is StarkNet’s STRK coin, which already has a token contract deployed on Ethereum’s blockchain. Israeli-based blockchain firm StarkWare Industries launched the layer-2 network in February 2022 and has since attracted $36.85 million in TVL.

In December, StarkNet announced a large token distribution program and incentives to push adoption. This confirmed the network’s intention to launch a native token, an event expected by April 2024.

Furthermore, StarkNet’s plan to disburse over 1.8 million STRK coins could incentivize interest in the token, possibly earning it a place as a new listing coin on tier 1 exchanges.

Hot narratives for new cryptos to watch

While the above three tokens fall under the L2 category, typically attracting hundreds of millions in trading volume after launching new cryptocurrencies, new crypto coins will likely emerge in a basket of sectors, giving buyers and investors opportunities to select from.

Identifying narratives during market cycles is a key skill needed to optimize capital and secure gains. Here are three narratives you should be looking at to find new crypto projects.

Real World assets (RWAs)

RWAs exist by adding digital versions of traditional financial instruments like real estate onto a blockchain network. The process is called tokenization and is regarded as one of the primary crypto technology use cases.

This industry has also grown in recent months, climbing over a $2 billion market cap, per Coingecko.

Crypto AI

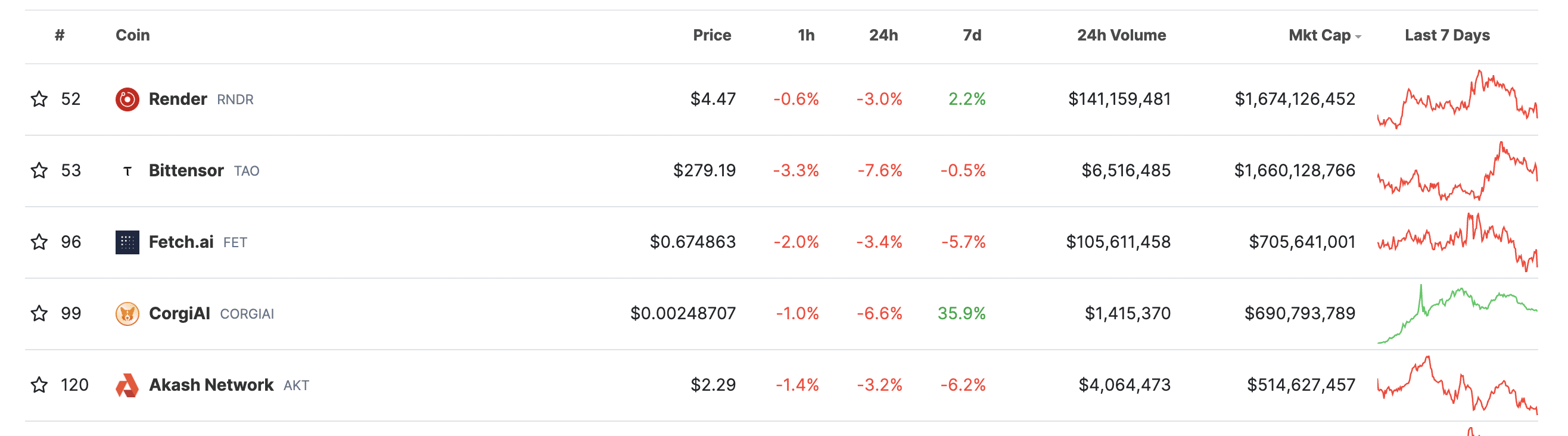

The intersection between cryptocurrencies and artificial intelligence has morphed into a $9 billion digital asset ecosystem poised to experience more growth due to increasing chatter around AI and blockchain assets.

The top five crypto AI tokens have rallied over 500% each throughout 2023, touting this category as a prime location to find new cryptos to watch.

Gaming

The global blockchain gaming scene is on the uptrend, with the market size expected to reach $614 billion by 2030. Web3 users also believe that 20% of games, in general, would adopt blockchain in some capacity, a move that could pull billions in investments into gamefi.

Coingecko placed the total gamefi market cap at $18 billion, which leaves exponential growth on the table and room for new cryptocurrencies should the blockchain gaming industry meet expectations.

Helpful tools

Investors may often struggle with finding new crypto coins early or determining which new crypto has the most potential since the digital asset landscape is fast-paced by nature. However, there are dedicated platforms where users can research tokens, and find use coin data and metrics.

Some of these tools include Coingecko, CoinMarketCap, Dextools, Dexscreener, DefiLlama, Dune Analytics, Etherscan, and TradingView. Most of these platforms are free to use, while others offer paid versions with additional features to aid users in finding new cryptos to watch and what new crypto could explode in 2024.

Conclusion

Opportunities are likely to abound as bullish sentiment floods crypto markets and retail investors once again deploy capital to risk assets. A possible spot Bitcoin ETF also solidifies institutional demand and serves as an endorsement, Ark Invest’s Cathie Wood has said.

In this cycle, investors must manage their risk and stay vigilant to avoid scams. Also, do not forget to DYOR (do your own research) when mapping out new cryptos to watch.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

This news is republished from another source. You can check the original article here