MicroStrategy this week unveiled a new customizable AI bot called Auto that lets business users interact with MicroStrategy’s data analytics offerings through natural language. But investors in the publicly traded Virginia software company may be more interested in its recent investments in Bitcoin.

The new Auto software is based on the MicroStrategy AI product suite unveiled last year and uses generative AI technology to lower the technical skills required by users to consume data using MicroStrategy data analytics offerings, the company says.

Instead of working with a “complex dashboard,” Auto lets users simply ask a question using regular language, “making it effortless to incorporate business intelligence into business decision-making,” MicroStrategy says.

For instance, a sales rep can use Auto to get data about customer production volume or product failure rates without having to open a dashboard, the company says. This also benefits data creators, or those more technically skilled folks who are typically called on to create reports and dashboards in BI tools, since Auto makes BI users more self-sufficient, MicroStrategy says.

Auto builds on MicroStrategy AI, which brings generative AI software into the MicroStrategy suite. Launched in October, the new suite includes four components, including: Auto Answers, a natural language interface into analytics; Auto Dashboard, which uses GenAI to accelerate dashboard building; Auto SQL, which translates natural language into SQL queries; and Auto Expert, an AI chatbot.

MicroStrategy customer Nena Pidskalny, a supply chain strategy and planning director for the Canadian co-op Federated Co-operatives Limited, says Auto will help the co-op by delivering more self-service access to BI.

“We think using MicroStrategy AI will unlock huge value by providing a variety of users with deeper insights that previously required more clicks and more granularity to understand,” Pidskalny said in a press release. “It’s powerful for user self-service.”

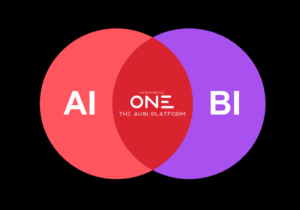

Auto can be embedded into third-party applications, or deployed as a standalone app in MicroStrategy ONE, the company’s complete suite, which includes tools for analyzing data, cataloging data, building reports and dashboards, creating predictive models, and distributing data, BI, and AI products.

Auto bolsters MicroStrategy’s AI story, says Saurabh Abhyankar, the company’s chief product officer.

“Our modern cloud architecture, proven semantic graph, and robust APIs gave us the agility to lead the market with a solution that combines the latest generative AI with trusted BI,” Abhyankar said in a press release. “And now, with Auto added to MicroStrategy AI, we’re enabling customers to build and deploy custom AI bots in minutes.”

But this is just the beginning, Abhyankar said. “We have dozens of new features underway for MicroStrategy AI that will help every organization capitalize on our vision for Intelligence Everywhere,” he continued.

While MicroStrategy’s 7,000 or so customers may be hoping that Auto helps them make use of GenAI, the investors in the company, which has recorded revenues of about $500 million for each of the past few years, may be more appreciative of another move the Tysons Corner, Virginia company has made: investments in cryptocurrency.

In 2023, MicroStrategy bought 56,650 Bitcoin at an average price of $33,580, or about $1.9 billion, the company said in its quarterly earnings report February 6. The company financed the acquisition through a combination of selling shares and issuing debt, according to MicroStrategy, which calls it self “the world’s first Bitcoin development company.”

Thanks to a rapid increase in the price of Bitcoin, MicroStrategy’s investment was worth $8.1 billion as of February 5, making it the largest corporate holder of Bitcoin in the world, the company says.

Investors in the stock, which trades on the NASDAQ under the ticker symbol “MSTR,” responded by driving its share price from about $500 on February 5 to more than $1,900 as of today, a 280% increase.

MSTR still has a way to go before breaking its all-time high of $3,130, which was set March 10, 2000, at the height of the dot-com bubble.

Related Items:

Which BI and Analytics Vendors Are Incorporating ChatGPT, and How

What’s Moving the Analytics and BI Tool Business Now

Like ChatGPT? You Haven’t Seen Anything Yet

This news is republished from another source. You can check the original article here