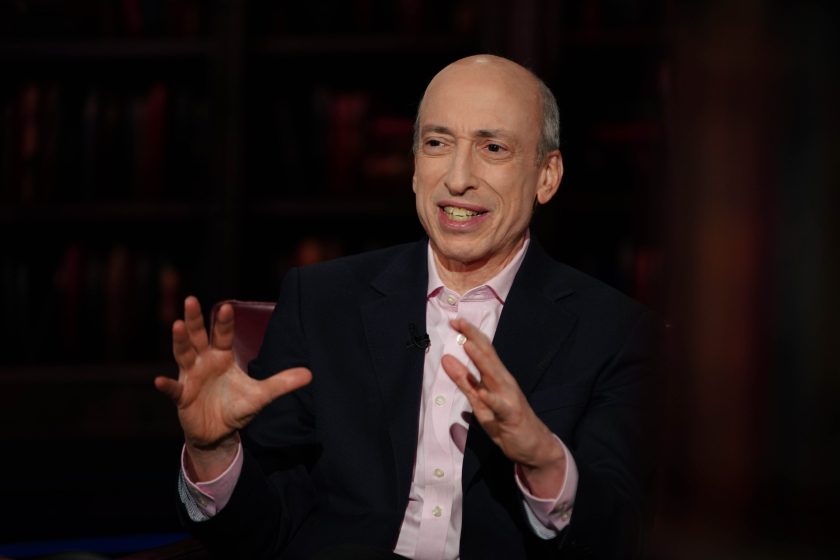

SEC Chair Gary Gensler speaks during an interview with Bloomberg News on Feb. 14, 2024. Christopher Goodney—Bloomberg via Getty Images

In a pair of interviews on Wednesday, Securities and Exchange Commission Chair Gary Gensler still didn’t seem very excited to be discussing the Bitcoin ETFs approved by his agency on Jan. 10.

And he doubled down on previous remarks that approving the investment vehicles didn’t equate to the agency changing its mind about Bitcoin’s potential risks, merely that it was a reaction to the August decision in Grayscale v. SEC where the agency, according to Judge Neomi Rao, “failed to reasonably explain” why it had previously approved Bitcoin futures products but not spot ETFs.

“While we had denied two dozen of these, a court in Washington said we did not get that right, and it got remanded to us. The most sustainable thing to do is to approve these given the court ruling,” Gensler told Bloomberg News.

The SEC chair, both in that interview and earlier in talking to CNBC, reiterated his concern over the links between Bitcoin and illicit actors, and the multitude of crypto exchanges that face little to no oversight. It’s why, Gensler noted, the recently approved ETFs are Bitcoin specific—although he didn’t elaborate on why Ethereum didn’t deserve similar consideration.

“This is a field that has been rife with fraud and manipulation, and look at all the bankruptcies,” Gensler said on CNBC when asked whether the problem was Bitcoin itself or the currency potentially being misused. “It’s entity, after entity, after entity.”

While speaking on CNBC’s Squawk Box, Gensler acknowledged that although regular currencies issued by governments are used illegally, such as for money laundering, those issued by central banks also play a massive role in supporting established economies. Meanwhile, he added, Bitcoin and crypto just “have the market share of ransomware.”

Gensler also was asked about such criticisms aimed at crypto, especially in the wake of the ETF approvals, and he insisted his agency remains impartial. “We’re merit neutral if someone is complying with the law,” he said.

In the later Bloomberg interview, Gensler elaborated on his skepticism of crypto trading platforms, Bitcoin’s relative volatility when compared with other assets, and the lack of use cases for many cryptocurrencies.

“We really do look to ensure as best we can there’s no fraud or manipulation,” Gensler continued, “but one of the challenges of the Bitcoin market is that so much is traded on trading platforms that are not compliant with our laws.”

This news is republished from another source. You can check the original article here