(Kitco News) – Gold’s recent rise to new all-time highs has excited longtime precious metals holders as their faith in the asset class has been validated, but it has been somewhat overshadowed by the rise of Bitcoin (BTC), along with new record highs for the S&P 500, Dow, and Nasdaq.

As younger investors start to see their wealth profiles rise, it’s becoming increasingly important for them to understand the reasons why gold is a strategic asset, particularly the role it serves as a safe-haven asset during times of economic uncertainty.

“Gold is a highly liquid asset, which is no one’s liability, carries no credit risk, and is scarce, historically preserving its value over time,” the World Gold Council (WGC) said in a report on gold as a strategic asset. “It also benefits from diverse sources of demand: as an investment, a reserve asset, gold jewellery, and a technology component.”

“These attributes mean gold can enhance a portfolio in three key ways: Delivering long-term returns; Improving diversification; and Providing liquidity,” the report said. “Combined, these characteristics make gold a clear complement to stocks and bonds and a welcome addition to broad-based portfolios.”

With environmental, social, and governance (ESG) concerns rising in stature among the younger crowd, WGC said the yellow metal can play a role in supporting these objectives as it is “an asset that is responsibly produced and delivered from a supply chain that adheres to high ESG standards.”

“Gold also has a potential role to play in reducing investor exposure to climate-related risks,” they said. And it’s not just climate-related risks that gold can help provide protection for, as history shows it has reliably helped preserve wealth amid economic shakeups.

“Looking back over half a century, the price of gold in US dollars has increased by nearly 8% per year since 1971 when the US gold standard collapsed,” WGC said. “Over this period, gold’s long-term return is comparable to equities and higher than bonds. Gold has also outperformed many other major asset classes over the past 3, 5, 10 and 20 years.”

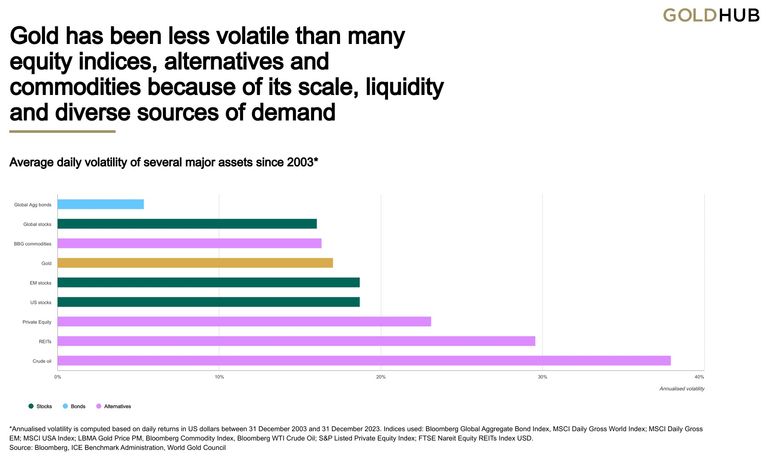

“Moreover, the diversity of its sources of demand help to make gold a less volatile asset than some equity indices, other commodities or alternatives,” they added.

With inflation remaining sticky well above the Federal Reserve’s 2% target, the report noted that “Gold has long been considered a hedge against inflation and the data confirms this: since 1971 it has outpaced the US and world consumer price indices (CPI). Gold also protects investors against high inflation. In years when inflation was between 2%-5%, gold’s price increased 8% per year on average.”

Its average price increase was even higher at more elevated inflation levels: “Over the long term, therefore, gold has not just preserved capital but also helped it grow,” the report said.

WGC’s research also shows that “gold should do well in periods of deflation. Such periods are characterized by low interest rates, reduced consumption and investment, and financial stress, all of which tend to foster gold demand.”

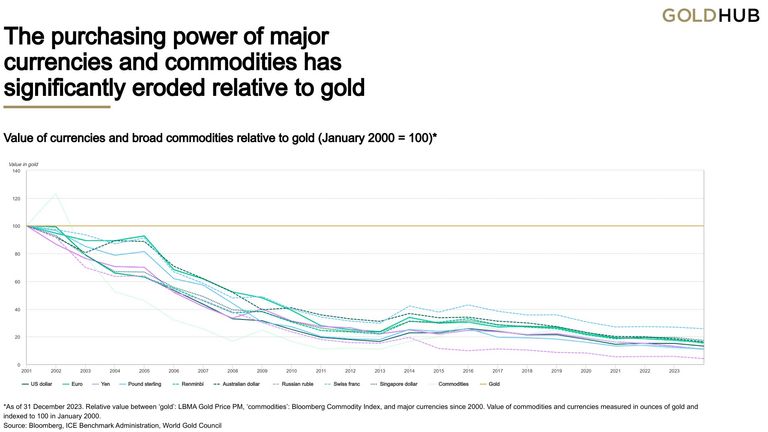

Since the gold standard was removed from backing the U.S. dollar, “gold has significantly outperformed all major currencies and commodities as a means of exchange,” they said. “And although this outperformance was particularly marked immediately following the end of the gold standard, gold has clearly continued to outperform most major currencies in the more recent past.”

“A key factor behind this robust performance is that gold mine production has grown slowly over time – increasing by approximately 1.7% per year over the past 20 years,” they said. “By contrast, fiat money can be printed in unlimited quantities to support monetary policy, as exemplified by the quantitative easing measures in the aftermath of the Global Financial Crisis (GFC) and the COVID-19 pandemic. In these crises, many investors turned to gold in order to hedge themselves against currency devaluation and preserve their purchasing power over time.”

The precious metal is a great tool for diversification as its “negative correlation to equities and other risk assets increases as these assets sell-off.” This was shown during the GFC as “gold held its own and increased in price, rising 21% in US dollars from December 2007 to February 2009,” while equities, other risk assets, hedge funds, real estate, and most commodities tumbled in value.

And when market conditions improve, the yellow metal can “also deliver positive correlation with equities and other risk assets, making gold a well-rounded efficient hedge,” they said. “This benefit arises from gold’s dual nature: as both an investment and a consumer good. As such, the long-term performance of gold is supported by income growth.”

Ample liquidity is another benefit when it comes to investing in gold. WGC estimates “that physical gold holdings by investors and central banks are worth approximately US$5.1tn, with an additional US$1.0tn in open interest through derivatives traded on exchanges or the over-the-counter (OTC) market.”

“The scale and depth of the market means that it can comfortably accommodate large, buy-and-hold institutional investors,” the report said. “In stark contrast to many financial markets, gold’s liquidity does not dry up, even at times of financial stress. Importantly too, gold allows investors to meet liabilities when less liquid assets in their portfolio are difficult to sell, or mispriced.”

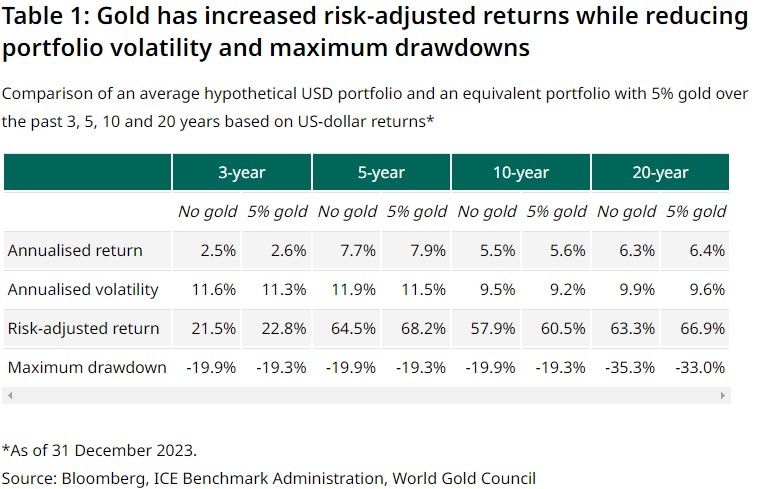

From a risk/reward perspective, WGC’s analysis of investment performance over the past 3, 5, 10, and 20 years “shows that an average USD portfolio would have achieved higher risk-adjusted returns and lower drawdowns if 2.5%, 5%, 7.5% or 10% were allocated to gold.”

“The ‘optimal’ amount of gold varies according to individual asset allocation decisions,” they said. “Broadly speaking, the analysis suggests that the higher the risk in the portfolio – whether in terms of volatility or concentration of assets – the larger the required allocation to gold, within the range in consideration, to offset that risk.”

With concerns related to global climate rising in stature, WGC said their analysis “suggests that gold has the potential to perform better than many mainstream asset classes under various long-term climate scenarios, particularly if climate impacts create or exacerbate market volatility or we experience a disruptive transition to a net zero carbon economy.”

“Furthermore, gold’s value is less likely to be negatively impacted by a rising carbon price, also offering investors a degree of insulation from the likely policy responses needed to accelerate the move to a decarbonized economy,” they added.

The main risks associated with investing in gold are that it does not directly conform to the most common valuation methodologies used for equities or bonds; offers no cash flows; and can experience significant price volatility during certain times, the report said.

“Gold’s unique attributes as a scarce, highly liquid and uncorrelated asset enable it to act as a diversifier over the long term,” WGC said. “Gold’s position as an investment and a luxury good has allowed it to deliver annualized returns of nearly 8% since 1971, comparable to equities and more than bonds and commodities.”

“Gold’s traditional role as a safe-haven asset means it comes into its own during times of high risk. But its dual appeal as an investment and a consumer good means it can generate positive returns in good times too. This dynamic is likely to continue, reflecting ongoing political and economic uncertainty, and economic concerns surrounding equity and bond markets,” the report concluded.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

This news is republished from another source. You can check the original article here