(Kitco News) – The crypto market showed renewed bullish energy on Thursday with Bitcoin (BTC) climbing back above $70,000 while Dogecoin (DOGE) spiked 22% and now trades above $0.22 for the first time since Dec. 14, 2021, as retail traders embrace the pumpalicious nature of the meme coin market.

Stocks also trended higher as a late-day rally saw the S&P 500 notch a new record high and brought an end to one of the strongest quarters of price growth in recent history. Investors are now focused on tomorrow’s personal consumption expenditures (PCE) report, and while it’s expected to show a slight uptick in inflation, any effect on stock prices will be delayed as U.S. markets are closed for Good Friday.

At the closing bell, the S&P and Dow recorded gains of 0.11% and 0.12%, respectively, while the Nasdaq fell 0.12%.

Data provided by TradingView shows that Bitcoin climbed its way higher from a daily low of $68,855 in the early morning to hit a high of $71,635 in the afternoon, and has been consolidating above $70,000 since then as bulls look to regroup before making a run at a new all-time high.

BTC/USD Chart by TradingView

At the time of writing, Bitcoin trades at $70,811, an increase of 3.30% on the 24-hour chart.

What type of bull market cycle will it be?

The January launch of multiple spot Bitcoin ETFs has had a noticeable effect on the normal crypto market bull cycle as evidenced by the fact that BTC hit a new all-time high before the halving, a feat King Crypto has never achieved before.

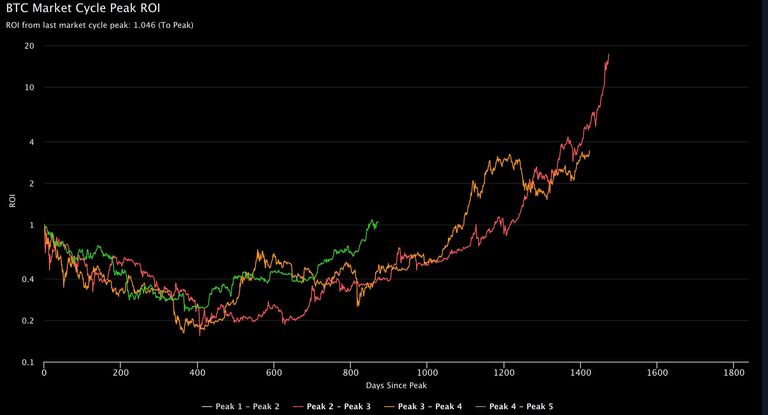

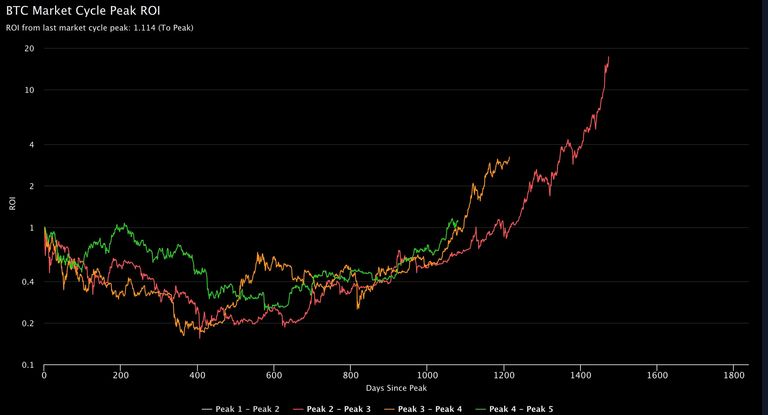

According to Benjamin Cowen, founder of Into the Cryptoverse, “As measured peak-to-peak, #BTC is ahead of prior cycles.”

That said, Cowen still thinks “the answer to whether this #BTC market cycle is a normal one or left-translated will depend on how the market reacts to rate cuts in a few months.”

“The last cycle was above its prior cycle for a while, and then once rate cuts arrived, it got back in line with the prior cycle around the 750-day mark,” he said. “So if #BTC gets a correction after rate cuts, it would potentially put it back on track with prior cycles, with a potential peak in 2025.”

“If you measure #BTC peak-to-peak ROI but from the April 2021 top, instead of November 2021, it shows we are further along in the cycle, and so far things line up well with last cycle, and a potential top in 2024,” he said.

“So if #BTC gets a long breather after the halving (coincidentally around the time that rate cuts start) like 2019, then perhaps this cycle is the same,” Cowen said. “But if we don’t get a 6-9 month consolidation period, then perhaps a left-translated peak is happening.”

He noted that during the 2013 bull market, Bitcoin had a “blow-off top in April, then another top in November,” while the 2021 bull market “had a blow-off top in April, then another top in November.”

This was in contrast to how Bitcoin’s price reacted to interest rate cuts in 2019, which led to “a 6-month bear market, followed by a recession (black-swan induced), thus making it a 9-month bear market,” Cowen said.

“If #BTC gets a correction after rate cuts arrive that lasts through Q4 (meaning no new mania phase in Q4), then I think we could get a standard cycle peak in the post-halving year,” he said. “Regardless of what happens in Q4, I would suspect that the market finally cools off after April. Then this summer the debate will be around if the market picks back up again in Q4 or if we have to wait until 2025 for another move.”

Cowen said determining whether this cycle will be left-translated or a normal cycle peak will likely “depend on exactly when the inversion of the yield curve is resolved.”

“My speculation is that the current mania dies down sometime after the halving (perhaps the halving marks the beginning of a ‘summer lull,’ just as it did in 2013 and 2021),” he concluded. “Then what happens in Q4 will dictate whether this is a normal cycle or left-translated.”

For now, the bull market remains in full swing, as noted by Cubic Analytics founder Caleb Franzen, and Bitcoin has reclaimed its 2021 ATH, which is the first step in confirming a breakout higher.

#Bitcoin is on track for the highest daily close since March 14th, 2024 (red), which is also the day that it made new all-time highs, albeit briefly.

Probably not bearish. pic.twitter.com/KrA1vawQMs

— Caleb Franzen (@CalebFranzen) March 28, 2024

Meme coins break out, altcoin market trades mixed.

Altcoins traded mixed on Thursday, with a majority of tokens recording gains, led by a resurgence in meme coins.

Daily cryptocurrency market performance. Source: Coin360

Dogecoin (DOGE), FLOKI (FLOKI), and dogwifhat (WIF) were three of the top four gainers, recording increases of 20.2%, 16.1%, and 15.9%, respectively, while Core (CORE) climbed 19.4%. Threshold (T) fell 10.9% to lead the losers, followed by a 7% pullback for Internet Computer (ICP), and a 6.9% loss for Sui (SUI).

The overall cryptocurrency market cap now stands at $2.66 trillion, and Bitcoin’s dominance rate is 52.3%.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

This news is republished from another source. You can check the original article here