We’ve compiled a list of the fastest-growing crypto and blockchain companies to watch closely in 2024.

This detailed exploration spotlights the achievements and growth metrics of the fastest-growing blockchain companies, providing insights into their developments throughout 2023. Their growth rates last year have put them on the list of entities to look out for in 2024.

Yet, regulatory hurdles, market conditions, and security issues can affect even the top promising firms in the digital currency ecosystem.

Fastest-growing blockchain companies

Solana

With 2,500 to 3,000 developers working on innovative solutions in 2023, Solana was one of the fastest-growing blockchains in the previous year.

The platform showcased its diverse and rich ecosystem through events such as the Solana Season Hackathon, the Breakpoint Conference, and the Solana Solstice Festival.

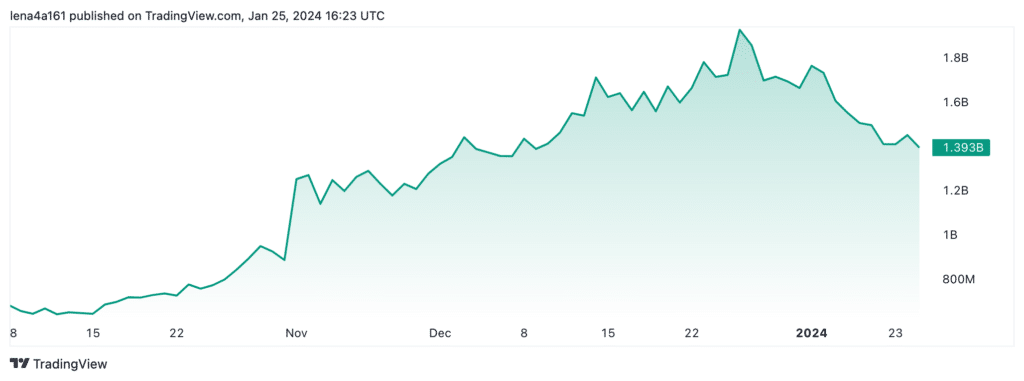

The Solana token, SOL, recorded one of the largest yearly gains of 2023, soaring 920% from January to December 2023, ending the year above the $100 mark. Solana’s total value locked (TVL) surged to a peak of $1.5 billion as 2024 started.

The Solana DEX maintained a strong performance, with more than $1 billion in volume for eight months in a row. The platform also witnessed the emergence of many community-driven projects, such as Saga, that demonstrated its technical excellence and loyal and active user base.

Sui

Sui, a layer-1 blockchain created by ex-Meta engineers, achieved a remarkable valuation of $2 billion after securing $336 million in funding in September 2022. Its mainnet went live in May 2023, sparking a surge in defi activity on its network.

Sui’s features, such as parallel execution and a new consensus algorithm, enabled its protocols to reach a TVL of more than $175 million by the end of 2023.

Besides technical accomplishments, Sui also gained mainstream attention last year, featuring in a white paper from the World Economic Forum (WEF) in April 2023, which spotlighted the protocol as one of the blockchain networks capable of enabling scaling climate action.

Cardano

Cardano stood out for its educational efforts, technological innovations, community involvement, operational reliability, and global outreach.

The Cardano Foundation launched the Cardano Academy in December 2023 and tools like Ledger Sync in November, displaying a commitment to openness and accessibility. Cardano recorded a shift to the Voltaire era last year, leading to debates and the Cardano Improvement Proposal CIP-1694.

The Cardano Summit 2023 emphasized operational dependability, showcasing the project’s ongoing development and potential as a reputable blockchain network.

Cardano’s native token, ADA, also recorded a 25% surge over the past year.

Fastest-growing crypto exchanges

HTX (formerly Huobi)

HTX, formerly known as Huobi, marked its 10th year of operation last year with a rebranding in September. The exchange claimed the third position among the biggest exchanges with a 7.8% market share in September.

HTX Ventures increased its portfolio to more than 200 ventures, covering various sectors such as defi, NFTs, SocialFi, GameFi, artificial intelligence (AI), layer 1, and layer 2 projects. It also merged incubation and research units, showing a holistic approach to assisting its ecosystem partners.

Upbit

Upbit kept its second place among the largest centralized exchanges with an 11.5% market share. It also saw an uncommon quarter-on-quarter rise in trading volume and a boost in NFT activity when other exchanges experienced considerable declines.

NFT activity increased on Upbit, as the IMX token, the native token of the NFT platform ImmutableX, gained 35% in September 2023, with Upbit dominating the volume growth. Upbit also collaborated with various NFT projects, such as CryptoKitties, CryptoPunks, and Axie Infinity.

One of the main reasons behind HTX and Upbit’s growth could be the regulatory hurdles and lawsuits that the leading crypto exchange, Binance, has been facing since Q3 2023.

Fastest-growing defi companies and protocols

Uniswap

Uniswap, one of the largest defi protocols with over $4 billion in TVL, displayed remarkable achievements in trading volume and user growth.

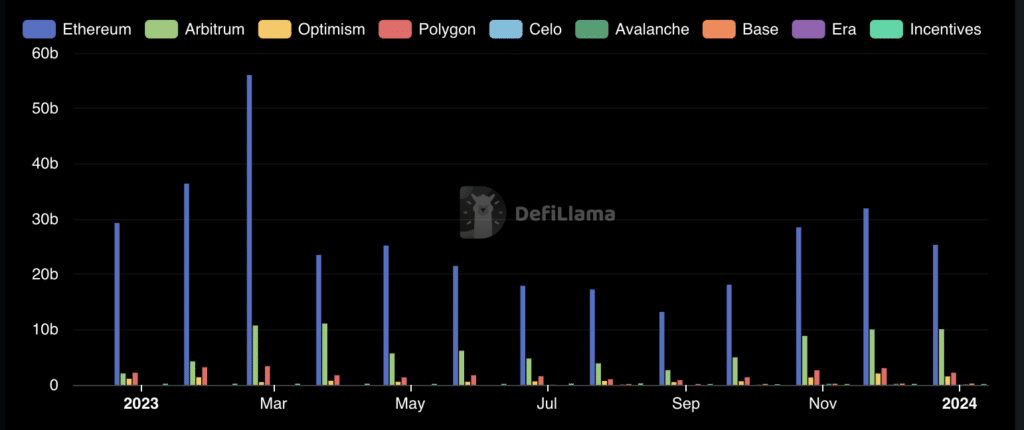

With a total trading volume of $454 billion in 2023 and 2.89 million new wallets created, Uniswap commanded most of the defi trading volume of last year. Launching three new chains and introducing defi rails emphasized its strategic growth.

As the world’s biggest on-chain protocol, Uniswap showcased its dominance by processing over $1.5 trillion in transactions as of May 2023 and emerging as the top decentralized application (dapp) on the Ethereum network, boosting its liquidity and DEX volume significantly.

MakerDAO

MakerDAO introduced the Endgame phase to become the first truly self-governing decentralized autonomous organization (DAO) powered by artificial intelligence.

With yearly revenues of about $240 million and a change in revenue streams, MakerDAO demonstrated strength and flexibility in a booming market.

The market’s positive trend in December 2023 also boosted the MKR token’s remarkable rise of 34%.

PancakeSwap

PancakeSwap grew in various ways with the launch of v3, Syrup Pools, and deflationary measures. PancakeSwap had a trading volume of $19.56 billion and a TVL above $2.3 billion by December 2023.

PancakeSwap launched several measures to attain Ultrasound CAKE to create a prosperous ecosystem with less inflation. These measures involved decreasing CAKE’s availability gradually, increasing its appeal, and enhancing its consistency in price.

Fastest-growing Bitcoin mining firms

Marathon Digital

Marathon Digital increased its active fleet by two times in six months last year, achieving 17.7 EH/s. In August 2023, it mined 1,072 BTC and 7,378 BTC on a year-to-date basis at the time, acquiring miners for an extra 5 EH/s hash rate.

The total unrestricted cash and Bitcoin of $445 million as of Aug. 31, 2023, showed Marathon Digital’s dedication to growing operations and supporting Bitcoin’s mining network.

Iris Energy

In October 2023, Iris Energy boosted its hash rate capacity by over 25%, achieving 7 EH/s. This came after its hash rate capacity surged to 5.6 EH/s in June. Iris Energy aimed to have a data center capacity of 10 EH/s by early 2024, showing its bold plans for growth and eco-friendliness in Bitcoin mining.

The BTC mining company acquired 8,380 T21 miners from Bitmain Technologies Delaware Limited in December 2023 — the value of the miners is reported to be over $22 million.

Cipher Mining

In November 2023, Cipher Mining increased its hash rate by 6.5% from the previous month. The firm mined 433 BTC in November, with up to 70,000 deployed rigs.

Its latest update confirmed that the firm mined 465 BTC in December last year, a notable rise from the November figure.

Fastest-growing AI and big data companies

Render Network

Render Network leveraged AI and NFT features to target the 3D rendering market. The company saw a remarkable growth of 63% in its Render Token and an increase in rendered frames in Q3 2023, showing its ability to adapt to a fast-changing industry.

By using AI, Render Network enhanced its performance and added new NFT capabilities.

Moreover, RNDR, Render Network’s native token, also registered a 360% surge over the past year.

SingularityNET

SingularityNET grew steadily in 2023 as AI and big data tokens took the central stage. The company hired a new AI chief of staff to drive its innovation agenda. Moreover, SingularityNET saw the successful Cogito Utility Token launch and more marketing and outreach activities.

The company completed Phase 2 of the AI-DSL project, making progress towards building a smart AI system. SingularityNET won the 2023 Crypties Award for AI Achievement in December, highlighting its impact on the AI field.

The firm also made progress with Round 2 of Deep Funding, a SingularityNET program that supported over 80 promising AI proposals. This program showed the company’s dedication to nurturing creative AI solutions through a funding platform.

Akash Network

Akash Network’s native token, AKT, saw a remarkable 1,200%, driven by a series of updates in August. The company improved its “Supercloud” with several upgrades, making it easier for developers to use high-performance chips like NVIDIA A100s and H100s.

The company also updated its multi-stage token economics plan to reduce the cost and increase the scale of computing resources, reflecting its vision of building a reliable and effective ecosystem.

Moreover, Akash Network received nominations such as the Crypto Project of the Year by Coinage and recognition for its AI work, showing its growing influence on both the crypto and AI domains.

In addition, the firm integrated with SubQuery, enabling fast data indexing and showing its flexibility to new technologies. The high demand for cloud computing, powering large language models and applications, led to record GPU leases on the Akash Supercloud.

This news is republished from another source. You can check the original article here