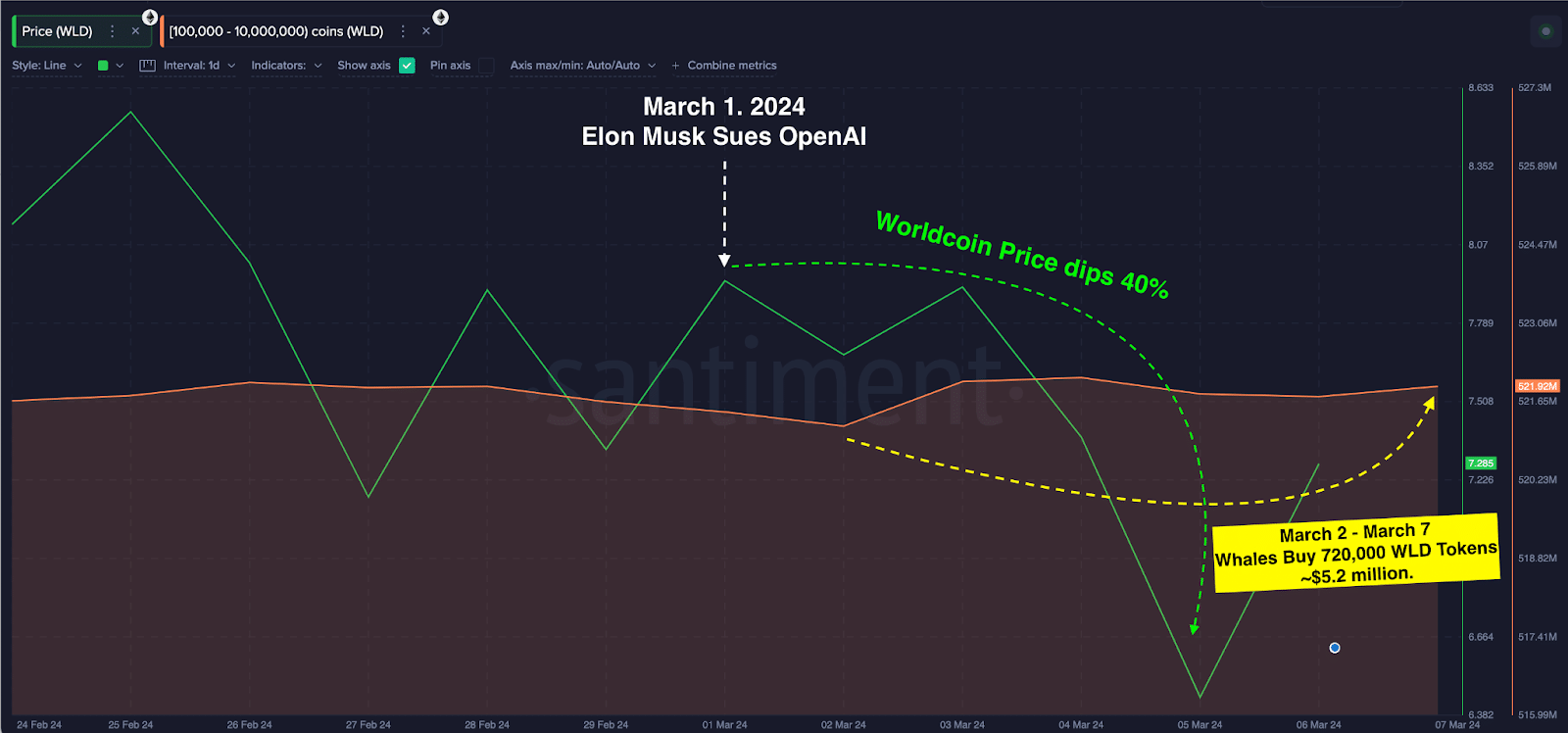

Between Feb. 25 and March 7, WLD prices dipped 40% from its $9.50 all-time high after Elon Musk filed a lawsuit against Worldcoin’s parent firm.

Between bullish tailwinds from the NVIDIA-led Crypto AI renaissance and bearish headings from the legal battle between Elon Musk and OpenAI, Worldcoin price levers have been pulled in opposite directions since March 1.

On-chain data trends provide vital insights into how initial response among crypto whales and Worldcoin long-term investors could impact WLD short-term price action.

Worldcoin price initially dipped 40% after Elon Musk filed lawsuit

On March 1, Elon Musk filed a lawsuit against Worldcoin’s parent company, OpenAI, for breach of fiduciary duty and claims of unfair business practices. The news effectively truncated a historic February rally for the Worldcoin’s native WLD token.

WLD’s price soared 320% to an all-time high of $9.50 on Feb 25, which momentarily saw its market cap surpass the $1 billion mark. As news of Elon Musk’s lawsuit against OpenAI broke, it set off a panic yard sale, sending Worldcoin’s price spiraling 40% to a two-week low of $5.60 on March 5.

It has now been a week since Elon Musk’s lawsuit against OpenAI. The two major stakeholder blocs within any cryptocurrency network are long-term holders and whale investors. On-chain indicators show that both groups have taken on a bullish disposition on Worldcoin.

Crypto Whales continue investing in Worldcoin

With one eye on the crypto AI, rave partly triggered by NVIDIA’s record-breaking 2023 fourth-quarter earnings and growing adoption of the controversial iris scanning orbs, risk-seeking Worldcoin whales have refused to throw in the towel.

The Santiment chart below depicts real-time changes in whale wallets holding 1 million to 10 million WLD balances. It shows that the week following Elon Musk’s lawsuit filing, the whales acquired another 720,000 WLD tokens between March 2 and March 7.

Valued at the current price of $7.20 per token at press time on March 7, the newly acquired tokens are worth approximately $5.2 million. This shows that rather than exit, the whales have capitalized on the price dip to scoop up more tokens in anticipation of more significant future gains as the project develops.

Investors with a high-risk appetite often gravitate towards distressed coins, or crypto projects embroiled in regulatory or legal contests, in hopes of a big payday if the lawsuit yields a positive outcome.

This whale cohort holds over 521.9 million WLD, representing 5.2% of Worldcoin’s 10 billion total circulation supply. On-chain buy/sell trends have historically been positively correlated to WLD price movements. If whales keep buying, WLD could avoid a dramatic price downswing as the lawsuit unfolds.

Worldcoin long-term investors are standing firm

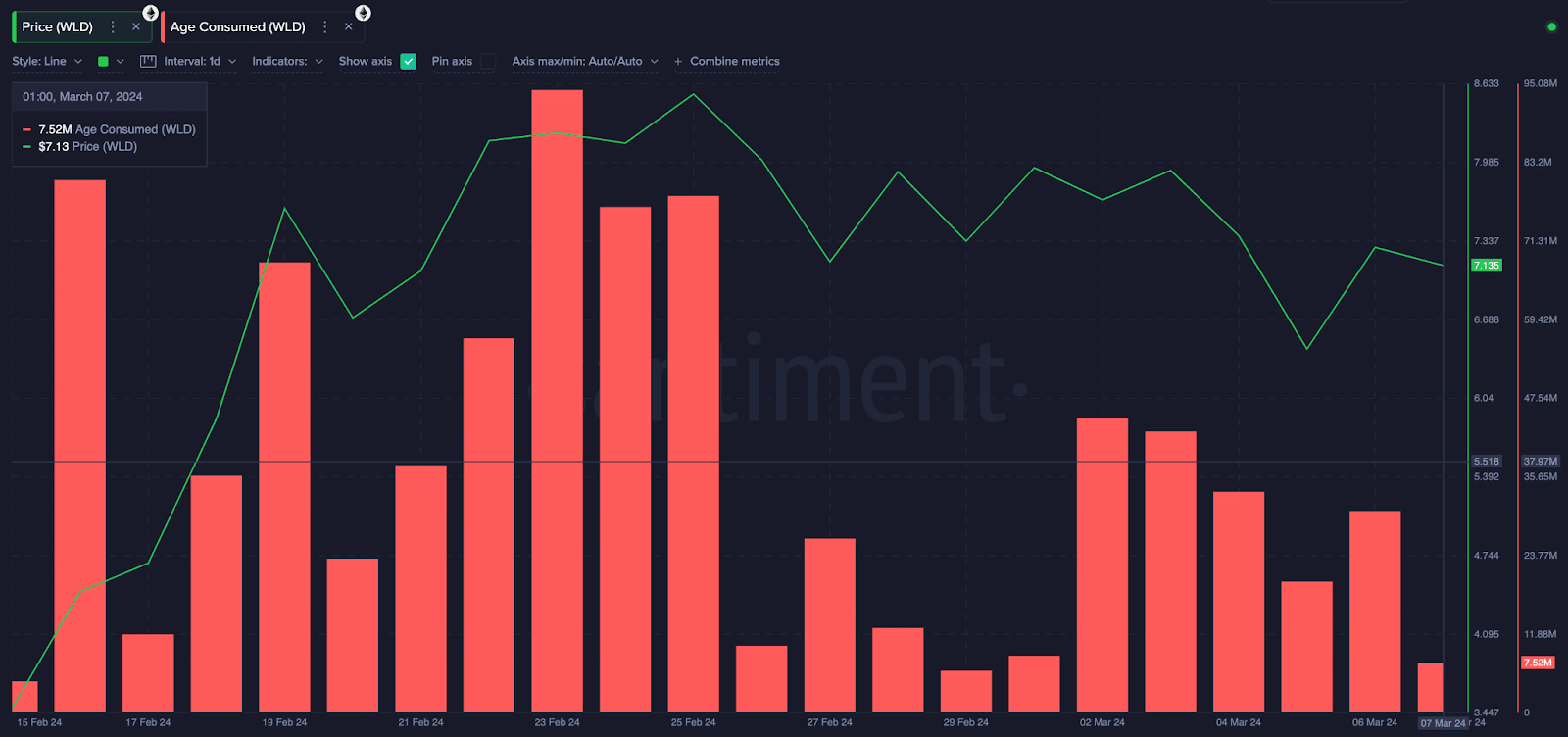

Furthermore, another critical on-chain indicator shows that Worldcoin long-term holders are refraining from selling their tokens amid the legal crisis.

Santiment’s age consumed metric tracks long-term investors’ trading activity by multiplying the number of recently-traded coins by the number of days since they were last moved.

Age-consumed figures rise when long-term investors and project insiders are on a selling spree, with many previously long-held coins on the move.

But interestingly, the on-chain trends observed on the Worldcoin network this week show that WLD Age Consumed has been in decline since Elon Musk’s lawsuit.

Specifically, the 7.5 million coin days consumed on March 7 represents an 83% drop-off from the initial spike recorded on March 2. This metric shows that the Worldcoin long-term investors continue to show diamond hands despite the swirling controversy in the past week.

When it occurs during a period of heightened market fear, uncertainty, and doubt it could boost other investors’ confidence.

How will Worldcoin price react to Elon Musk’s lawsuit?

The early bullish reactions from Whales and long-term investors suggest they will likely prop up WLD prices in the near term. By continuing to HODL amid intense bearish headwinds from the legal battle between Elon Musk and OpenAI, these key stakeholders convey confidence in the long-term prospects and value of Worldcoin.

Unsurprisingly, rather than head into a downward spiral as initially feared, WLD price has now rebounded from its weekly low of $5.60 on March 5 to reclaim $7.20 territory at press time on March 7.

This rare bullish conviction may stem from belief in the project’s fundamentals or a strategy to front-run massive gains if OpenAI experiences its own Ripple (XRP) breakout moment with a legal victory over Elon Musk.

If the current dynamics persist as the lawsuit lingers, Worldcoin price could defy the odds and enter another leg-up towards $10.

This news is republished from another source. You can check the original article here