Blockchain leader and Bitcoin (BTC) platform Coinbase Global (COIN) has struggled to make moves to the upside this quarter, off 19% in April and 25% off its March 25 two-year high of $283.48. COIN’s recent setback could be short-lived, if past is precedent, as the equity approaches a historically bullish trendline.

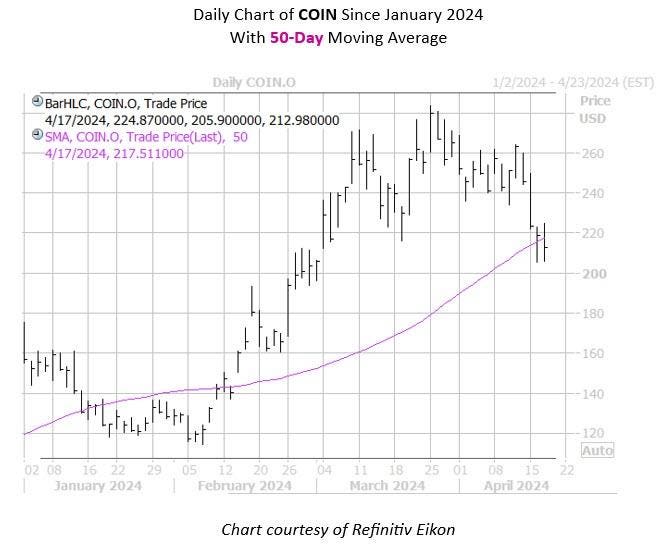

Per data from Senior Quantitative Rocky White, COIN has come within one standard deviation of its 50-day moving average, after spending a lengthy amount of time above it. COIN has seen three similar signals in the past three years, after which it was higher one month later 67% of the time, averaging an impressive 11% gain. From its current perch of $212.27, a move of similar magnitude would put the shares at roughly $235.61.

Daily COIN with 50MA

A short squeeze could help fuel the bounce back. Short interest fell 10% in the two most recent reporting periods, yet the 11.63 million shares sold short accounts for a healthy 6.3% of COIN’s total available float. And despite the recent drawdown, the security is up 22% in 2024, so a rally could prompt analysts to shift their tune; 12 of the 20 in coverage maintain “hold” or worse ratings.

Options are the preferred route, as Coinbase Global stock’s Schaeffer’s Volatility Scorecard (SVS) stands at a 76 out of 100, indicating the stock exceeded option traders’ volatility expectations in the past 12 months — a boon for premium buyers.

This news is republished from another source. You can check the original article here