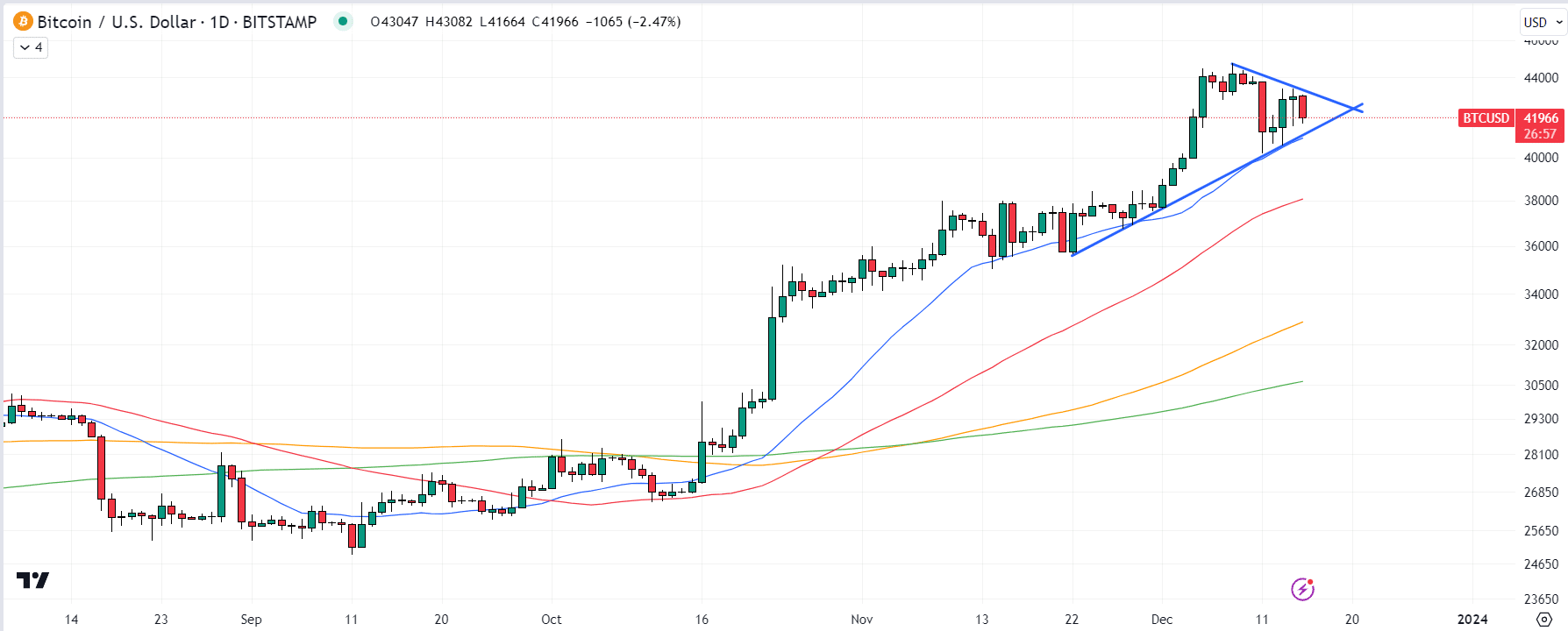

Bitcoin (BTC) chart analysis suggests the price has formed a key short-term technical pattern that could be a harbinger of extreme volatility ahead, with quick dump to $38,000 or pump towards $48,000 possible depending on how the pattern is broken.

Amid its consolidating back from the year-to-date highs near $45,000 it hit earlier this month, the BTC price has formed a pennant structure, characterized by the price being gradually squeezed by higher lows and lower highs.

These patterns often form in periods of market consolidation (like we have seen over the course of the past week) and usually proceed a meaningful breakout to the upside of downside.

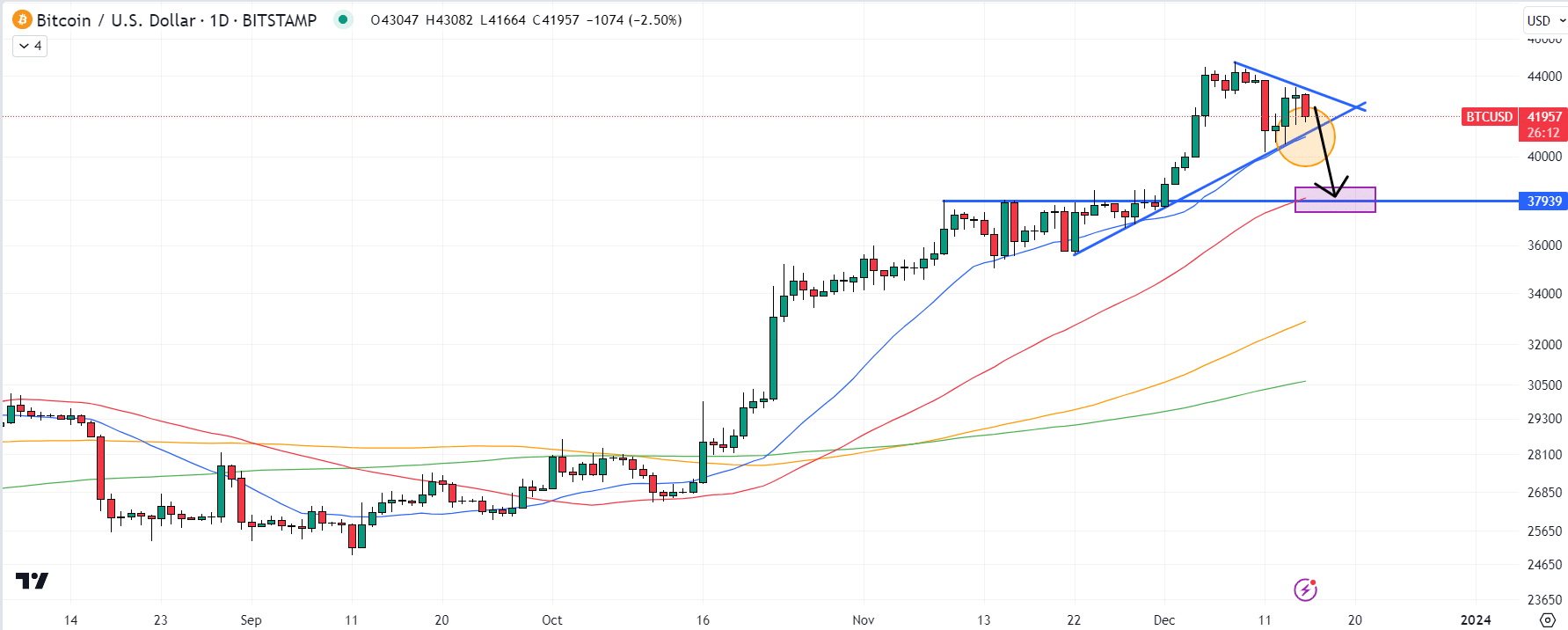

If BTC was to break its pennant structure to the downside, which would also mark a break below its 21DMA, a quick test of the $40,000 level would be very likely due to technical selling.

A retest of $38,000 would also be very likely, given that many Bitcoin bulls may be reluctant to dip buy until they saw the $38,000 level (where the 50DMA also resides) tested and confirmed as support.

Conversely, if BTC was to break to the upside of its recent pennant, a fast bounce to the yearly highs near $45,000 would be in order and bulls would probably once again start pushing for a retest of the 2022 highs above $48,000.

Is There Lack of Fresh Near-term Bullish Catalysts to Drive Further Upside?

Bitcoin’s powerful near-70% rally from its October lows has primarily been driven by 1) anticipation that spot Bitcoin ETFs will gain approval in the US soon, driving institutional demand and 2) amid easing macro conditions as traders up theirs bets that a Fed rate cutting cycle will begin in early 2024.

But some are now arguing that spot Bitcoin ETF optimism is now priced (i.e. analysts at JP Morgan) and with approvals still a few weeks away, the market may struggle to find fresh spot Bitcoin ETF catalysts that can drive lasting near-term upside, until confirmation of approvals officially comes in, that is.

Moreover, the Fed’s messaging to the market has been confused this week; first, the sent dovish signals on Wednesday, signalling no more rate hikes and three rate cuts next year.

But then on Friday, influential Fed policymaker John Williams was on the wires pushing back against market bets for rate cuts, saying its premature to talk about them (even though the Fed is literally forecasting them) and saying hikes remain on the table (even though Fed Chair Jerome Powell sent a very different message on Wednesday.

Risks of profit-taking as a result of a pause in spot Bitcoin ETF optimism and Fed policy confusion are rising, increasing the risk that Bitcoin breaks to the downside of its pennant structure.

Various Indicators Show Cooling of Bullish Bets

Various indicators of market sentiment are also showing a cooling in bullish bets that may also forecast a higher likelihood of a near-term price drop versus another price pump.

For one, the 25% delta skew of Bitcoin options expiring in 60, 90 and 180-days each just hit their lowest levels since October according to data presented by The Block.

That shows that, in light of the BTC price pump over the last two months, investors are paying less of a premium for Bitcoin options that pay out incase of upside over the next two to six months.

This could reflect waning optimism about the sustainability of the Bitcoin price rally, although the fact that the delta skew remains positive suggests investors still see upside risks to the price on balance.

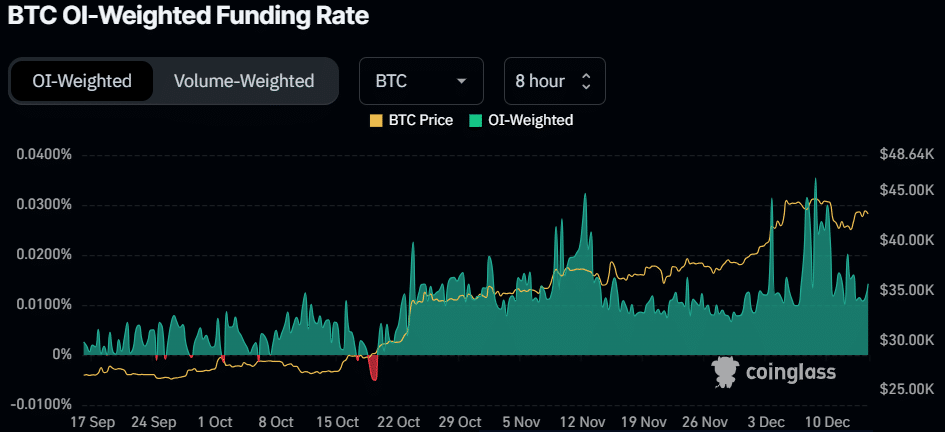

Elsewhere, the funding rate paid by Bitcoin futures traders opening leveraged positions has stabilised around 0.015%, well below the multi-month highs it hit earlier in the month above 0.035%, as per coinglass.com.

A positive funding rate means leveraged long traders are paying funding to leveraged short traders, a result of higher relative demand for long positions versus short positions.

When this funding rate falls, this means the dominance of bulls is fading.

Coinglass.com data also shows that the outstanding value of leveraged futures positions (otherwise known as “open interest”) has continued to pull back in recent days, despite BTC’s consolidating around $42,000.

While some may hail less leverage in the market as a good thing, speculators utilizing leveraged long futures positions can be a key source of buying pressure that supports the market, in the short-term at least.

So if the bulls are waiting on the sidelines (as indicated by a falling funding rate and falling open interest), this could be concerning for BTC’s short-term price outlook.

Where Next for Bitcoin (BTC)?

Price risks seem tilted towards a correction.

But the long-term bullish case for Bitcoin remains strong, so dips remain subject to aggressive buying by longer-term-minded investors.

Spot Bitcoin ETF approvals in the US will mark a historic moment in the cryptocurrency’s broader societal adoption, as it opens the door for BTC to become part of every average American’s pension or ordinary investment portfolio.

The Bitcoin issuance rate halving in late March/early April will cut the rewards paid out to miners in half, which will systematically reduce sell pressure (as miners always need to sell some coins just to keep the lights in their facilities on).

And whilst there might be some confusion (not helped by recent Fed communications) regarding the timing and speed of Fed interest rate cuts in 2024, easier financial conditions lay ahead.

All of these longer-term price drivers look set to support the BTC price as it continues to closely follow its historic market cycle characterized by year-long bear markets (November 2021 to November 2022) followed by roughly three-year bull runs (November 2022 to November 2025?).

Short-term setbacks are a feature of any bull market.

Longer-term investors should not lose the faith that Bitcoin could be back at record highs in 2024/2025.

This news is republished from another source. You can check the original article here