- Bitcoin’s risk-adjusted relative returns in the past five years are competitive with Gold and many other asset classes.

- A macroeconomic expert argues that BTC is volatile, but the volatility cuts both ways.

- Bitcoin funds noted nearly $133 million in fund inflows from institutional investors.

Bitcoin has been compared to Gold on several occasions over the years. Initially BTC was examined as a “safe haven” similar to Gold and now analysts are comparing the two investments to determine whether Bitcoin’s properties qualify it as “exponential Gold.”

Also read: Cardano hits three-month peak, climbs to $0.50 despite bearish on-chain metrics

Bitcoin’s risk-adjusted relative returns compared to Gold

In the past five years, through November, Bitcoin’s Sharpe Ratio has been competitive when compared to Gold and other proven asset classes in the market. Sharpe Ratio is defined as the difference between the risk-free return and the return of an investment divided by the investment’s standard deviation.

In simple terms, the Sharpe Ratio adjusts the performance for the excess risk taken by investors for a particular asset.

Bitcoin Sharpe Ratio compared to other assets

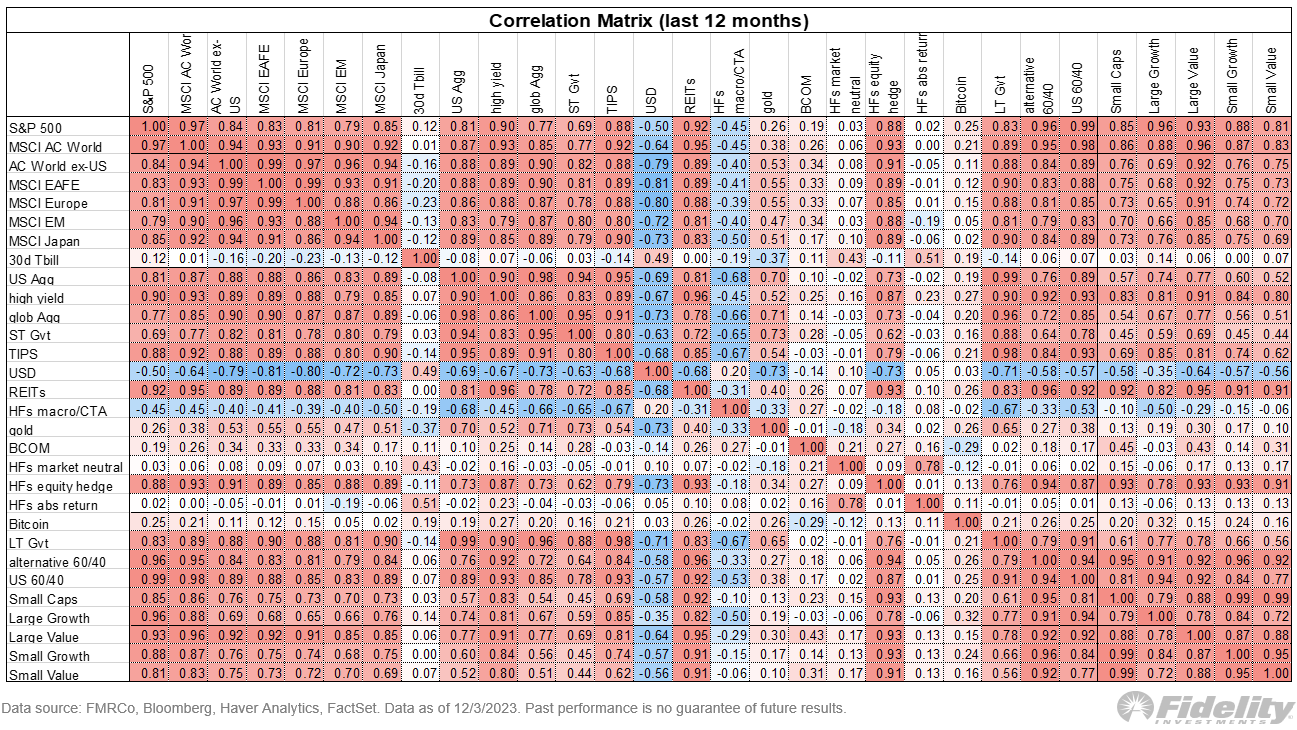

Jurrien Timmer, Director of Global Macroeconomics at Fidelity notes that Bitcoin’s correlation to the S&P 500 (+40%) is higher than Gold’s (+14%) in a five year timeframe. However, the correlation between BTC and US equities has reduced over the years and is less than most asset classes.

In the past 12 months, the correlation between BTC and the S&P 500 is down from 40% to 25%.

Bitcoin and S&P 500 correlation in the past 12 months

Timmer argues that Bitcoin is more volatile than most other assets but volatility cuts both ways and BTC investments have a risk-reward class of their own, just as seen in the past decade.

Institutional investors continue to invest in Bitcoin funds, the weekly inflows as on December 4 are 132.8 million, according to a CoinShares report. At the time of writing, Bitcoin price is $44,162 on Binance.

This news is republished from another source. You can check the original article here