(Kitco News) – Bitcoin (BTC) and the broader crypto market are trending down in early training on Wednesday after the Securities and Exchange Commission scored a legal victory over Coinbase and its staking program.

Coinbase sought to have charges related to its staking service dismissed, but the Judge overseeing the case rejected their motion.

“The SEC has sufficiently pleaded that Coinbase operates as an exchange, as a broker, and as a clearing agency under the federal securities laws, and, through its Staking Program, engages in the unregistered offer and sale of securities,” the Judge wrote in her decision.

The case will now move on to discovery. This is the second day in a row that a major development related to a cryptocurrency exchange has put pressure on the market following yesterday’s unsealed indictments against KuCoin and two of its executives.

The developments have led to a spike in volatility for Bitcoin. Wednesday’s decision resulted in a whipsaw as BTC price spiked to a high near $71,800 before the ruling was announced, only to plunge to $68,385 after it was made public.

BTC/USD Chart by TradingView

Bulls have since pushed it back above $69,260 for a loss of 1.5% on the 24-hour chart.

The quick bounceback by Bitcoin highlights an increasingly common trend in its price action: limited downside moves with larger and quicker uptrends.

“Dips in #Bitcoin keep on getting shorter and shorter. Meanwhile, rallies are lasting longer and moving quicker,” said analysts for The Kobeissi Letter. “This is a textbook sign that shorts are being squeezed as we hit fresh all-time high territory.”

Because of this, the analysts warned that Bitcoin may be setting up for a short squeeze.

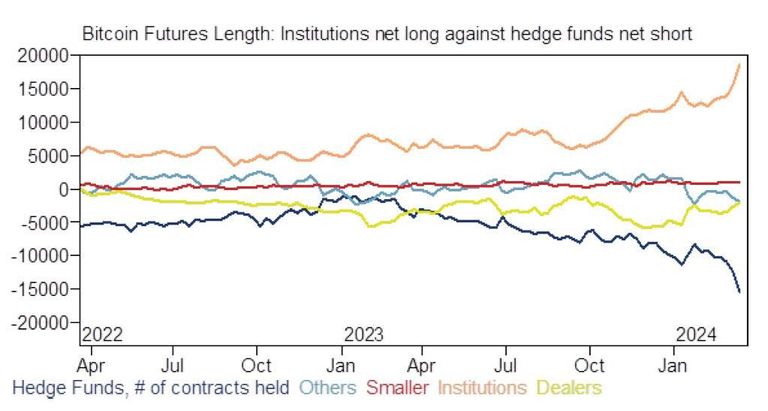

“Currently, the gap between institutional longs and hedge fund shorts is at a record high,” they said. “While hedge funds hold nearly 15,000 in net short contracts, institutions hold nearly 20,000 in net longs.”

“This is likely why price action has been so sporadic over the last few days,” they added. “Longs are not giving up and each new record high in #Bitcoin is being fueled by widespread short covering. How long can the shorts hold on?”

Based on analysis from crypto market intelligence firm CryptoQuant, the pressure on shorts is likely to continue moving forward as the Bitcoin market continues to move closer to a liquidity crisis.

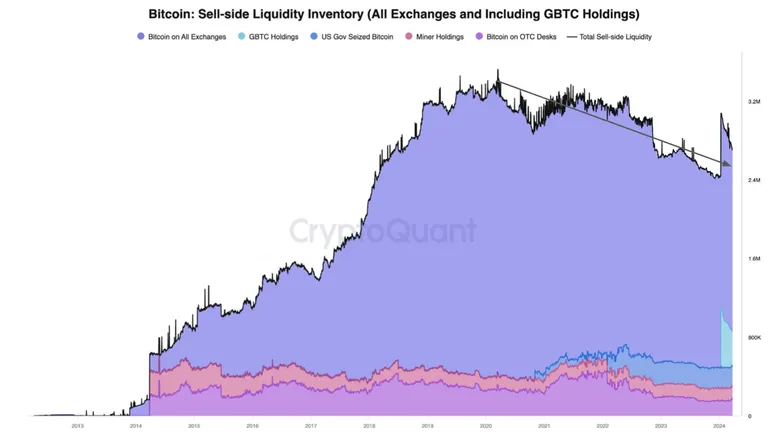

“Bitcoin demand has soared to unprecedented levels this year. We estimate monthly Bitcoin demand has increased from 40K Bitcoin at the start of 2024 to 213K Bitcoin as of the time of publishing,” the firm said in its latest Weekly Crypto Report. “An important factor behind this demand growth is ETF buying, but as of late other large investors have also increased their Bitcoin allocation.”

“On the supply side of the equation, the total Bitcoin readily available for selling continues to decline,” they noted. “The total ‘visible’ amount of Bitcoin at key entities stands at 2.7 million Bitcoin, down from an all-time high of 3.5 million Bitcoin in March 2020.”

“Record Bitcoin demand paired with declining sell-side liquidity has resulted in the liquid inventory of Bitcoin plunging to its lowest ever in terms of months of demand,” the report said. “We estimate that the present Bitcoin sell-side liquidity inventory is only enough to cover the current rate of demand growth for six to twelve months. A declining liquid inventory would support higher prices.”

There is even less liquidity available when exchanges outside of the U.S. are excluded from the calculation.

“The Bitcoin liquid inventory drops to six months of demand if we exclude the Bitcoin on exchanges outside the US,” the report said. “We exclude these exchanges considering that US spot Bitcoin ETFs will only source Bitcoin from US entities.”

According to CryptoQuant founder and CEO Ki Young Ju, sell-side liquidity is now “much lower” than it has been historically relative to demand.

#Bitcoin Liquid Inventory Ratio reached an all-time low.

Sell-side liquidity is currently much lower than historical levels relative to demand. pic.twitter.com/ZVcnGtIIHe

— Ki Young Ju (@ki_young_ju) March 27, 2024

Evidence of the supply crunch emerged in the form of 2000 Bitcoins mined in 2010 recently being moved to newly created addresses. According to CryptoQuant Head of Research Julio Moreno, “The 2,000 Bitcoins have been transferred to other addresses. The pattern of the transactions suggests these coins were sold [over the counter].”

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

This news is republished from another source. You can check the original article here