Key takeaways:

- AI algorithm predicts Bitcoin’s price will surge to $95,500 on April 12th, just days before the next halving event.

- Bitcoin halvings, which happen every 4 years, reduce new BTC supply entering circulation by 50% – sparking major price rallies after past events.

- The algorithm’s bullish forecast aligns with expectations of a 2024 Bitcoin bull run, driven by spot ETF approvals and the halving

The crypto space has received a lot of fresh recognition, with Bitcoin being the most discussed cryptocurrency due to its recent price surge. On March 11, 2024, the cryptocurrency hit a new high of $72,179, an incredible 13% increase from its former all-time high of $64,000 as of 2021.

Following this, algorithm has predicted bitcoin to continue on an uptrend trend to hit a massive $95,500 just about a week before the highly anticipated “Bitcoin Halving” event.

The Bitcoin Halving – A Simple but Powerful Event

The Bitcoin halving is one of the most important events in the industry, and the next halving is expected to occur in April 2024.

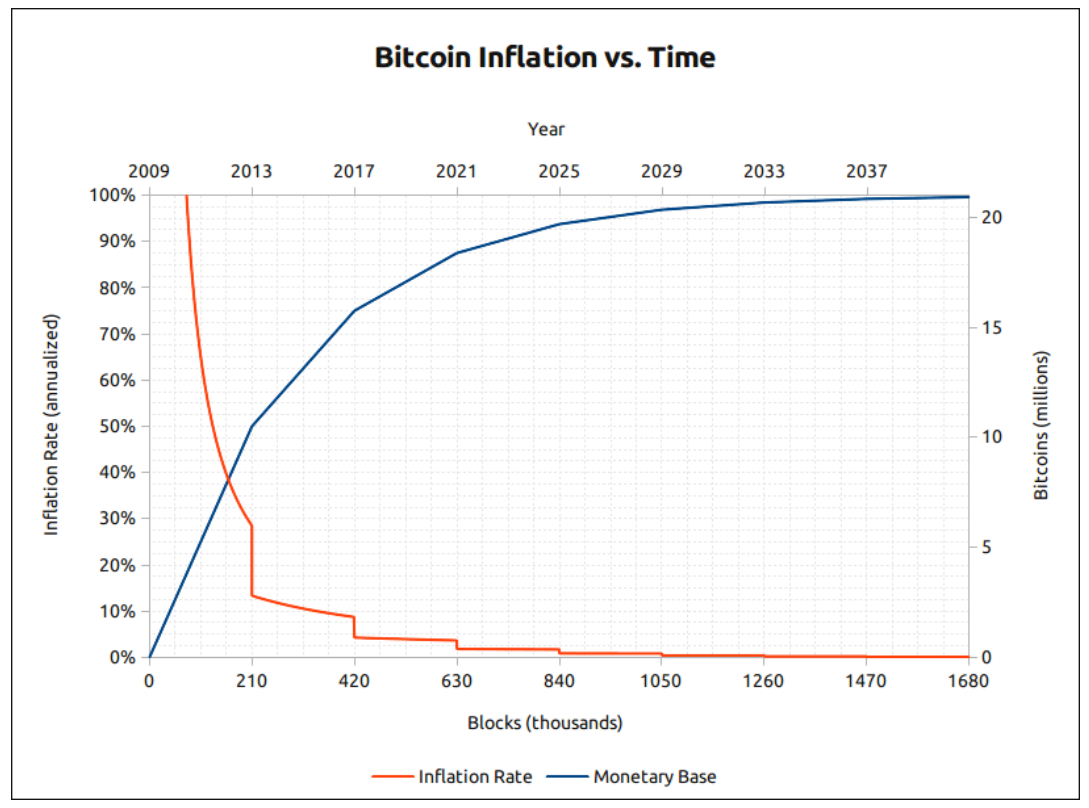

Here’s why the Bitcoin halving is such a big deal: New Bitcoin is constantly being released into circulation through the mining process, where miners are rewarded with fresh Bitcoin for verifying transactions on the blockchain. However, to control inflation and keep Bitcoin becoming too abundant, the reward miners receive gets cut in half every 210,000 blocks, roughly every 4 years.

In simple terms, it means the rate at which new Bitcoin enters the supply gets slashed in half with each halving.

When Bitcoin launched over a decade ago, the reward for mining each new block was a hefty 50 BTC. Today it’s just 12.5 BTC per block. But after this next halving sometime between April 18-22, 2024, the per-block reward will drop to only 6.25 BTC.

Source: Bitcoin Block Half

Bitcoin Has Historically Skyrocketed After Halvings

Looking back at previous halving events, this controlled supply squeeze has routinely resulted in absolutely massive price surges for Bitcoin in the year after the halving occurred:

- After the first halving in 2012, Bitcoin shot up nearly 10X in price over the following year

- The 2016 halving acted as a catalyst for an insane 30X rally that peaked in late 2017 just over a year later

- Most recently, Bitcoin exploded for an 8X price surge in the 18 months after the 2020 halving, hitting an all-time high of $69,000

This pattern complements the $95,500 prediction. If it’s correct, it would represent a more than 11% increase from current price.

For the entire year, such a peak in April would translate to absolutely mind-blowing gains of over 140% from Bitcoin’s starting price of around $40,000 in January 2024.

Signs of an Epic 2024 Bitcoin Bull Run are Everywhere

To be fair, 2023 has already set the stage for Bitcoin’s price to potentially go stratospheric in 2024:

- Bitcoin nearly tripled in value over 2023, starting around $16,000 and ending well above $40,000

- More importantly, U.S regulators finally bit the bullet and approved the spot Bitcoin ETFs, which has driven a massive influx of institutional investment

With solid fundamentals restored, new pathways for mainstream investment, and the well-established supply crunch from Bitcoin’s halving all converging in 2024, it’s easy to see why projections for 6-figure BTC prices are becoming the norm rather than the exception.

Cathie Wood of Ark Invest is one of the most ambitious Bitcoin believers, forecasting it could top a staggering $1.5 million by 2030. Others like crypto trader, Tardigrade, however, set a relatively “modest” target of $130,000 for Bitcoin before 2024 is over.

What if #Bitcoin breaks this Cup with Handle Pattern near the date of Halving (around 2 months later)?

The target for this pattern is $130k.

In other words, it is the last opportunity for accumulation in these 2 months before it sends above hundred thousands. pic.twitter.com/fujU2DafqK— Trader Tardigrade (@TATrader_Alan) February 6, 2024

Charles Edwards of Capriole Investments has also set a 2024 target of $280,000 for Bitcoin.

If Bitcoin’s post Halving returns are the same as 2020, we are looking at $280K Bitcoin next year.

You might reasonably argue this cycle’s returns are less than 2020.

However, I believe the 2020 cycle performance was mediocre and an outlier. pic.twitter.com/pzOkAd0ORm

— Charles Edwards (@caprioleio) February 5, 2024

Bottom line: A Volatile Rollercoaster Ride Guaranteed

Of course, no discussion of Bitcoin’s future would be complete without referencing its trademark volatility.

Nevertheless, Bitcoin’s current trajectory combined with the historically positive price impact of halvings has investors positively giddy over the potential for incredible profits in 2024. All eyes will be locked on the charts over the next six weeks leading up to April 12th to see if the AI’s lofty prediction manages to hit the mark.

With the bullish BTC price prediction potentially ushering in a new crypto bull market, check out the algorithm’s latest price predictions for several key altcoins: Ethereum (ETH), Solana (SOL), Vechain ( VET), Cardano (ADA), and Shiba Inu (SHIB).

This news is republished from another source. You can check the original article here