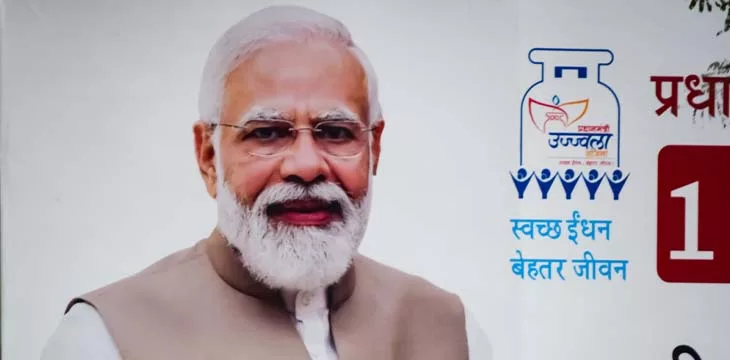

New technologies like artificial intelligence (AI) and blockchain have completely changed the methods of banking, India’s Prime Minister Narendra Modi said.

As a result, the role of cybersecurity has become highly significant in the growing digital banking era. Innovations in fintech will create new methods of banking, he said.

“In such a situation, we need to think about the changes that will be required in the country’s banking sector and its structure. We may need new financing, operating, and new business models,” Modi said while speaking at the 90th-anniversary celebration of the Reserve Bank of India (RBI).

Modi also stressed the need for RBI to plan and chart out a path for the future trajectory of the Indian banking system to support the growth aspirations of the country in the next decade.

India will hold its elections later this month, and Modi predicts that his party and allies will win more than 400 seats to have a majority in the 543-member lower house of Parliament for the next five years. The world’s biggest democracy, with a 1.4 billion population, will go into polls from April 19 to June 1, when about 970 million Indians—or over 10% of the global population—are eligible to vote.

Modi, with his Viksit Bharat (developed India) goal, will leverage AI and blockchain technology as key catalysts to achieve the $5 trillion economy target by 2027-2028. The world’s most populous country recently approved over Rs 10,300 crore ($1.24 billion) for the IndiaAI Mission, slated over the next five years. The financial infusion aims to boost the country’s AI ecosystem, innovation, and entrepreneurship.

India is also expected to release a draft regulatory framework for AI by July to use the technology for economic growth while setting up guardrails to prevent misuse. The South Asian nation expects to become a major player worldwide in emerging technologies and become the third-largest economy after the United States and China.

“As consumer preferences change, the banking and financial services industry would have to reorient their business models, processes and products. To cater to this change, the RBI has started its groundwork on enhanced use of technology in banking such as use cases of artificial intelligence, digital ledgers, and so on,” M. Rajeshwar Rao, deputy governor of RBI, said in March.

“Let me also add here that technology brings its own set of challenges in the form of data protection, cyber security, and technology-induced frauds. These are in fact areas which are increasingly engaging the attention of regulators not just in India, but also at a global level,” Rao added.

The RBI, which uses blockchain technology for its central bank digital currency (CBDC) or the e-rupee, said it is looking to enable additional functionalities of programmability and offline capability in CBDC retail payments. The CBDC retail pilot currently enables person-to-person and person-to-merchant transactions.

While the RBI has set no specific timeline for the ‘full-fledged’ launch of its CBDC, the size of the pilot project has made significant progress. India has about 4.3 million retail users of CBDC and an additional 400,000 merchants are using the e-rupee.

In order for artificial intelligence (AI) to work right within the law and thrive in the face of growing challenges, it needs to integrate an enterprise blockchain system that ensures data input quality and ownership—allowing it to keep data safe while also guaranteeing the immutability of data. Check out CoinGeek’s coverage on this emerging tech to learn more why Enterprise blockchain will be the backbone of AI.

Watch: Enterprise Utility Blockchain Summit highlights—India is scaling big for a better Internet

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section, the ultimate resource guide to learn more about blockchain technology.

This news is republished from another source. You can check the original article here