In this piece, I evaluated two cryptocurrency stocks, Coinbase (NASDAQ:COIN) and Riot Platforms (NASDAQ:RIOT), using TipRanks’ comparison tool to determine which is better. A closer look suggests a bearish view for Coinbase and a bullish view for Riot Platforms.

Coinbase operates the largest cryptocurrency exchange platform in the U.S. by trading volume, while Riot Platforms is a bitcoin mining and digital infrastructure company. Shares of Coinbase have soared 66% over the last three months and 307% year-to-date.

Meanwhile, Riot Platforms stock is up a comparable 338% year-to-date, including a 35% gain over the last three months.

Coinbase’s and Riot Platforms’ similar year-to-date gains demonstrate how they’re both linked to Bitcoin (BTC-USD), which is up 67% over the last three months, almost exactly matching Coinbase’s three-month gain. Meanwhile, the cryptocurrency is up 164% year-to-date.

A closer look at Coinbase and Riot Platforms is in order to determine which cryptocurrency stock is better. However, since they address the market from two different angles and neither company is profitable, a comparison of their valuations may be less useful than a comparison of the other factors discussed below.

Coinbase (NASDAQ:COIN)

Some interesting dynamics with Coinbase suggest we could be in the early stages of a correction. The stock has pulled back somewhat from its 52-week high, but it remains in overbought territory. Coinbase has faced selling pressure from insiders and at least one well-known and long-running crypto bull, suggesting a bearish view might be appropriate.

What’s important to note about the insider trading activity in Coinbase is that most of those sales have been Auto Sell transactions, which do not trip TipRanks’ meter for measuring insider sales because they are considered “Uninformative Sells.” However, a large number of those Uninformative Sells were actually Auto Sell transactions, which is critical.

Insiders often establish prices at which to automatically sell their company’s shares as part of their preset trading plans. Thus, the large number of auto sales suggests insiders don’t expect Coinbase stock to rise much further from current levels.

Additionally, long-time crypto bull Cathie Wood of ARK Invest has been dumping Coinbase shares recently, adding to the selling pressure by insiders by unloading another $24.3 million worth of shares on Wednesday.

Finally, Coinbase has been in overbought territory for some time. While its Relative Strength Index (RSI) has backed off somewhat amid all those sales, it remains at 76, suggesting Coinbase stock is overbought since its RSI is over 70.

What is the Price Target for COIN Stock?

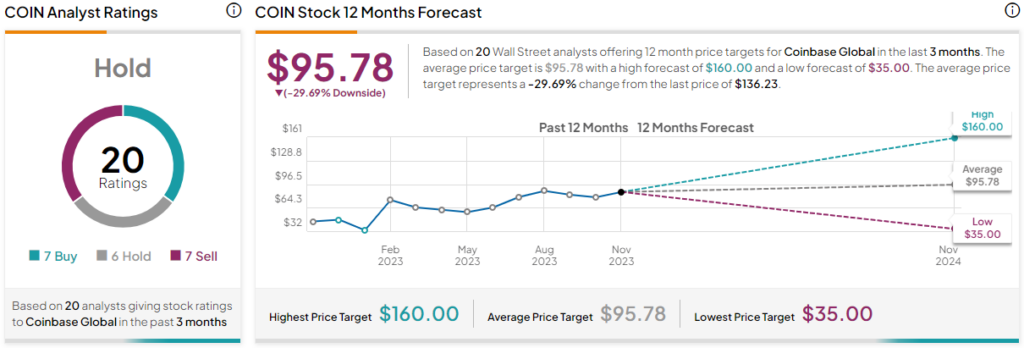

Coinbase has a Hold consensus rating based on seven Buys, six Holds, and seven Sell ratings assigned over the last three months. At $95.78, the average Coinbase stock price target implies downside potential of 29.7%.

Riot Platforms (NASDAQ:RIOT)

While Coinbase is certainly tied to fluctuations in the Bitcoin price, as a Bitcoin miner, Riot Platforms is even more closely tied to it. In fact, Riot Platforms’ business model as a miner rather than a crypto exchange has provided some additional positive catalysts for its stock price. Thus, a bullish view may be appropriate.

There’s no denying that Riot Platforms has reported some exciting news recently. In fact, its November production and operations update revealed some real promise for the company’s future. Riot Platforms reported that it produced 18.4 Bitcoins per day last month versus 14.8 in October and 17.4 in November 2022.

Of course, Bitcoin also rose last month, boosting the average net price per Bitcoin sold to $36,278 in November from $28,408 in October and $18,009 in November 2022. Meanwhile, the company’s dependency on power credits, which it receives from its utility company for shutting down during peak electricity demand periods, has decreased considerably. In fact, the number of power credits used fell 77% since October and was up only 1% year-over-year.

Looking forward, the next halving event for Bitcoin is expected in early 2024, which slashes the payout to miners in half. In the last three halving events, the price of Bitcoin spiked due to a sudden shift in the supply/demand balance.

Leading up to that next halving event, Riot Platforms continues to deploy more miners, with its November rig count up 6% month-over-month and 56% year-over-year. Thus, the company looks well-positioned to benefit enormously from that next halving event, especially as it continues to deploy more miners.

Unfortunately, Bitcoin miners have extraordinarily high costs associated with bringing more miners online and replacing those that wear out. As a result, Riot Platforms has never been profitable. Generally, analysts seem to expect the company to record its final loss in 2024 and generate $160 million in profits in 2025.

If that does come to pass, Riot Platforms stock will likely soar. The company’s net income margin has improved to -110.2% over the last 12 months, although it worsened dramatically from -7.2% in 2021 to -196.6% in 2022. Thus, this situation requires careful monitoring for a worsening of Riot Platforms’ financial position, but for now, more upside seems likely in 2024 due to the bitcoin halving. In fact, the stock is up 773% over the last five years, so it certainly is a long-term gainer for investors who can stomach the extreme volatility.

What is the Price Target for RIOT Stock?

Riot Platforms has a Strong Buy consensus rating based on seven Buys, zero Holds, and one Sell rating assigned over the last three months. At $16.01, the average Riot Platforms stock price target implies upside potential of 8.47%.

Conclusion: Bearish on COIN, Bullish on RIOT

While Coinbase and Riot Platforms have both benefited from the soaring Bitcoin price this year, their different business models and other factors reveal a clear winner, at least for now. Unfortunately, Coinbase has faced significant selling pressure from insiders and at least one long-term crypto bull, all of whom are probably taking profits after the stock’s meteoric rise this year.

However, there are enough other positive catalysts for Riot Platforms that make it the clear winner of this pairing, including the upcoming Bitcoin halving, its steadily rising miner count, and its excellent November operational report.