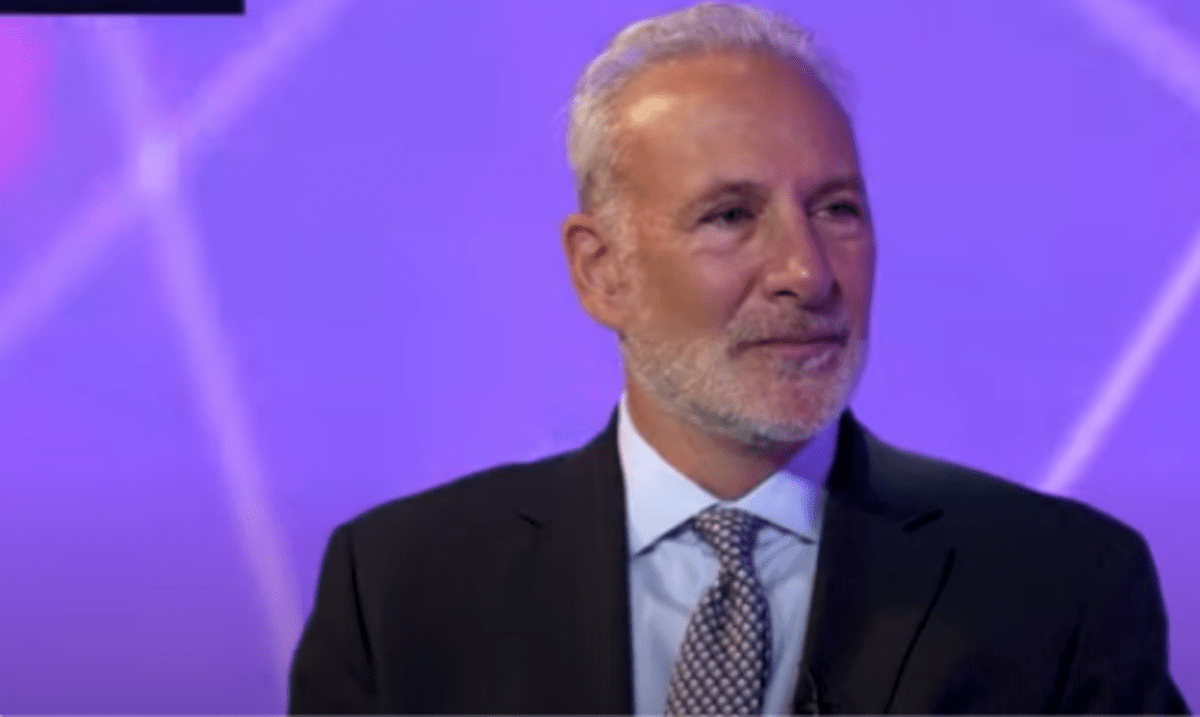

Popular Bitcoin critic Peter Schiff predicted on April 14 a potential slump in BTC’s price to $20K. He also warned that Microstrategy, the largest corporate holder of Bitcoin, could potentially lose an estimated $2.7 billion if the price crashes.

Peter Schiff disclosed his Bitcoin price prediction in an X post while stressing the importance of the asset’s $60K support level.

Peter Schiff Anticipates “Triple Top” Pattern

The vocal advocate for gold and Bitcoin skeptic cautioned that a further slump below Bitcoin’s $60K price level could trigger a sharp decline that might lead to a major drop to $20K.

Schiff proceeded to highlight the potential impact of the price drop on MicroStrategy’s Bitcoin investments.

$60K is critical support for #Bitcoin. A decisive break below that level will create a formidable triple top. The immediate downside projection is a move to $20K. At that price $MSTR will have a $2.7 billion unrealized loss on 214K Bitcoin acquired at an average price of $34K. pic.twitter.com/F1P0NpLS3X

— Peter Schiff (@PeterSchiff) April 14, 2024

MicroStrategy currently holds 1% of the total supply of Bitcoin, approximately 214,000 BTC, acquired at an average price of $34K. But a drop to $20K would result in an estimated “unrealized loss” of $2.7 billion for the company.

While MicroStrategy’s Bitcoin holdings have recorded losses during bearish markets, the company’s CEO, Michael Saylor, has always been optimistic about Bitcoin. He has consistently encouraged investors to hold with a long-term approach. According to him, chaos in traditional markets tends to benefit Bitcoin.

Chaos is good for #Bitcoin.

— Michael Saylor⚡️ (@saylor) April 13, 2024

This is not the first time Schiff has targeted Microstrategy amid uncertainties in the crypto market. In March, the gold advocate criticized Microstrategy’s acquisition of $623 million worth of BTC, warning that the Bitcoin investment firm could record a huge loss if the Bitcoin price falls to $20K.

Schiff’s prediction of a price drop to $20K looks unlikely based on current market trends, technical analysis, and records of doomsday projections for Bitcoin’s price, however.

Peter making up numbers for his Bitcoin TA pic.twitter.com/fekexhC1cB

— Walker⚡️ (@WalkerAmerica) April 14, 2024

While there has been a dip toward the $60K level, which Schiff identifies as “critical,” there’s no strong basis for a major drop to $20k.

According to CoinCodex Bitcoin price prediction analysis, Bitcoin’s 50-day and 200-day Exponential Moving Averages (EMAs) of $63,128 and $47,900 can, respectively, provide much-needed support levels.

A sustained level above these EMAs could cancel out Schiff’s “triple top” forecasts scenario. A recovery above $60,000 could strengthen bullish sentiments around Bitcoin, while a breakthrough above recent highs near $67,500 would signal a market recovery.

Peter Schiff Continues to Shun “Bitcoin Rally” Potentials

Schiff had projected a continuous fall in Bitcoin price before this recent doomsday prediction on the asset.

#HODLers, do you remember how bullish you all were in Nov. 2021 when #Bitcoin traded $69K? I do. How many still have your laser eyes? A year later Bitcoin traded below $16K, almost 80% lower. Given that most are even more bullish now, an even bigger crash likely lies ahead.

— Peter Schiff (@PeterSchiff) March 19, 2024

On March 19, Schiff drew a parallel between Bitcoin’s 2021 bullish run, during which the asset price peaked at $69K but lost about 80% of its value as it traded at $16K in November 2022.

Based on this parallel, Schiff expected a much bigger drop. This was short-lived as the asset scaled past the $71K price mark on April 4, however.

Schiff’s latest $20,000 projection of BTC came amid geopolitical tensions and renewed hostilities in the Israel-Iran conflict, which has affected the price of BTC and major markets.

The Bitcoin market suffered a similar fate in February 2022, when the trading volume of BTC dropped in the wake of the Russia-Ukraine war, but the market had a strong rebound after the instability it experienced at that time.

Regardless, Schiff’s Bitcoin price prediction has received many and varied comments from the crypto community. Crypto expert Stephan Livera believes the Bitcoin critic’s analysis is made up and holds no important value, for example.

This news is republished from another source. You can check the original article here