Raoul Pal has outlined his new bull and bear case for the crypto market, including a shocking Solana price prediction that suggests SOL price could hit $1,000.

On a recent episode of Real Vision Finance Podcast, Raoul Pal—the CEO of Real Vision and a titan in the world of macro—spilled his guts about the crypto bullrun, spotlighting Solana (SOL) as this cycle’s 2021 Ethereum to 5 or 10x from current prices. So, SOL to $1,000?

“If you kind of replicate what ETH did last cycle, that was a 45x from the low. So you get somewhere like about $500,” Raoul disclosed on Rug Radio YouTube channel.

“If I look at the other charts, I get somewhere between $500 and $1,000. And it just depends on the structure of this market. If we get a bubble cycle, it will go to $1,000. If we get some left-translated cycle, it gets to $500. It’s something like that.”

Could Bitcoin Halving Event Trigger Mid-Cycle -50% Crash?

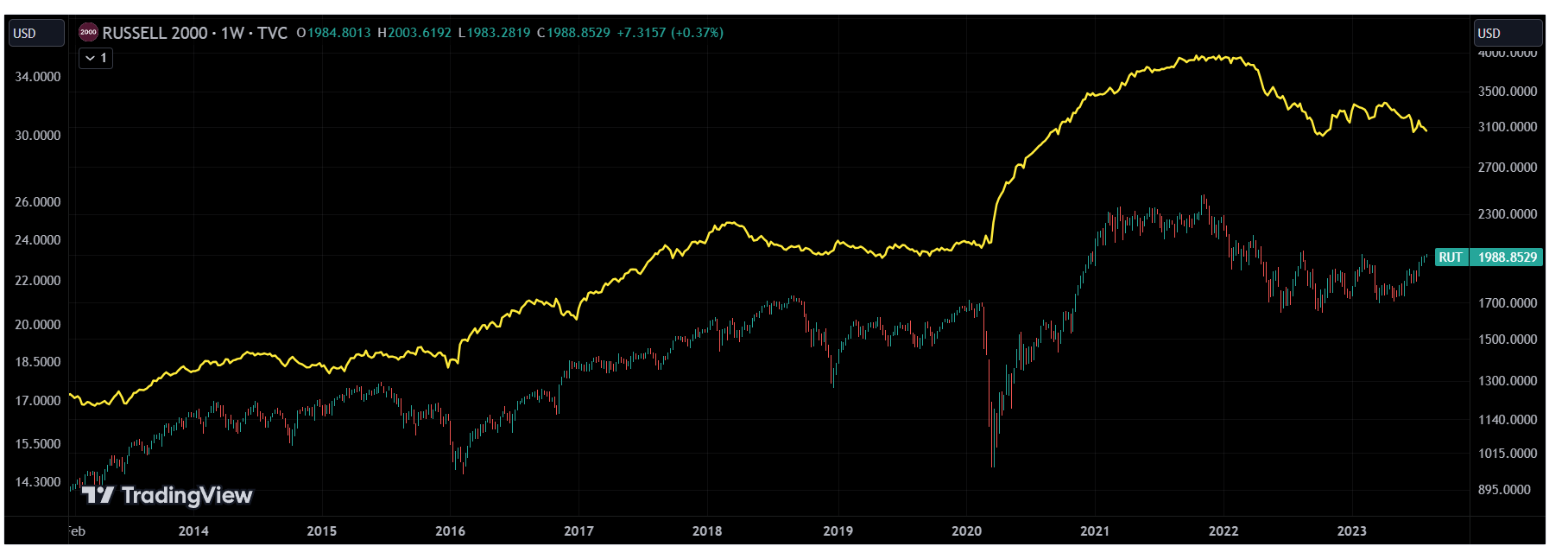

Conversely, Raoul fears a mid-cycle 50+% crash into a mammoth pump (reminiscent of 2020 when BTC plummeted by -40%) that will clean out retail investors around the Bitcoin Halving event.

Dubbing this current bull market “crypto summer,” Pal predicts Bitcoin and altcoins will rally for the entire year and slow down in 2025.

Here’s what else you should know about his new bull and bear case for crypto, and Solana price to $1,000.

Crypto Bull Case: Macro Summer Until 2025 (SOL Price to $1000)

As Raoul describes, Macro Summer is characterized by significant uptrends like Solana price to $1,000 – punctuated by the typical crypto volatility we’ve come to expect—swift pullbacks that only the brave can stomach.

In this type of market—which he expects to continue until 2025—there will be a critical velocity moment when markets hit ‘Macro Fall’—a moment when ETH is expected to outperform Bitcoin, while Solana is set to outperform ETH, leading a parade of altcoins that will likely skyrocket into a full-blown meme coin season.

It’s a domino effect spurred by increasing global liquidity and an invigorated business cycle.

Amidst this bullish backdrop, Pal touches on the SEC’s stance on Ethereum.

While there’s a concerted effort to throttle the crypto migration to protect traditional financial sanctuaries, Pal suggests that the aim is to slow down crypto’s takeover rather than ban it entirely.

“Everyone knows how messy the system is,” Raoul said, referring to US banking.

“Their one job is not to allow the migration into crypto land to happen too fast. I don’t think they want to stop it; I don’t think even the banks want to stop it. But I think their real job is to slow it down.”

Raoul’s Bear Case for Crypto Markets and Other Takeaways

With significant Bitcoin ETF inflows marking the current landscape, questions linger about potential outflows as we transition from macro summer to fall. There’s also the specter of high inflation and increased market manipulation from crypto to worry about.

Raoul says to remember to buy when everyone else is selling. Remember 2008? The big risk then is a big risk now: FOMO. Fear of missing out is bait in a bear market rally.

“Bulls make money. Bears make money. Pigs get slaughtered,” claimed Raoul.

This lesson still goes over many investors’ heads as they invest during market rallies or FOMO into shitcoins instead of slurping dips.

Aside from SOL price, here are some other trends Raoul Pal has noted over the last few days:

- AI Bubble: When you get such a breakthrough in technology that everyone has to use it — it will probably lead to a huge bubble, Raoul told Yahoo Finance.

- Web3 200X: Raoul believes Web3 (predominately apps on Ethereum) will grow “200x” from here. “I have never seen anything like this because nothing like this has ever happened in human history in such a short space of time.”

RELATED: 99BTC Presale Launches – Here’s Why Big Money Investors Are All In On This Learn-To-Earn Token

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

This news is republished from another source. You can check the original article here