miners are adjusting operational strategies and running up their coin stashes as the cryptocurrency market braces for Bitcoin’s halving, a quadrennial event due around April 20, a recent industry report highlights.

Data tracked by BTIG shows that mining companies like Cleanspark (NASDAQ:), Marathon Digital (NASDAQ:), and Riot Blockchain (NASDAQ:) have reduced their Bitcoin sales in the first quarter of 2024. According to its “Crypto Mining Corner: #29” report, this strategy aims to increase their Bitcoin reserves in preparation for the post-halving price movements, while also tapping into the capital markets to finance their operations.

Cleanspark reported selling roughly 13 Bitcoins in Q1 2024, a sharp decrease from about 1,257 in the previous quarter. Marathon followed suit, with sales dropping to around 730 from 2,365 Bitcoins, while Riot Blockchain sold 212 Bitcoins, ceasing sales entirely in February and March.

This trend among miners to “HODL” – a crypto-community vernacular for holding onto assets instead of selling – is expected to tighten the available supply of Bitcoin. The upcoming halving will cut the mining rewards by 50%, further exacerbating supply constraints.

The report also sheds light on the performance of Bitcoin and mining stocks, noting that despite Bitcoin’s price resilience, mining stocks faced downward pressure. BTIG attributes this to a shift in investor interest towards Bitcoin spot ETFs.

Moreover, the global hash rate – a measure of the computational power used in mining and transaction verification processes – has seen a strong year-over-year increase, signaling heightened mining activity as companies ramp up operations ahead of the halving.

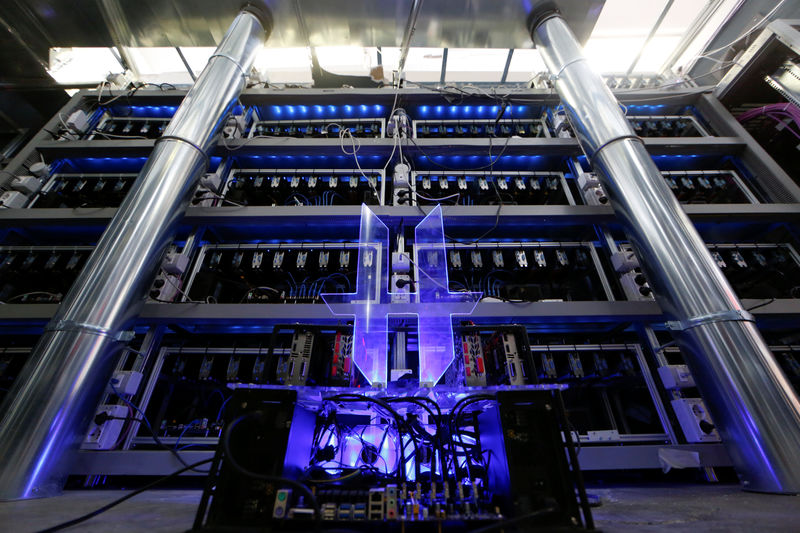

Miners are responsible for creating valid Bitcoin blocks that add transaction records to the blockchain, the public ledger. With each block they successfully add, miners are rewarded with newly minted coins. They also collect transaction fees.

Currently, miners earn 6.25 BTC for each block they mine. But the halving event will decrease this reward to 3.125 BTC, effectively halving their earnings per block. To boost their profitability in light of this revenue reduction, miners often try to invest in more efficient mining equipment and reduce operational expenses.

This news is republished from another source. You can check the original article here