Long-term Bitcoin (BTC) holders have started selling their holdings to a wave of new investors, sparking a fresh surge in the cryptocurrency’s price and realized capitalization.

Per an April 2 analysis report from Glassnode, Bitcoin’s recent rise in price discovery above new all-time highs has tempted holders who were already high into profits to distribute to a fresh investor cohort.

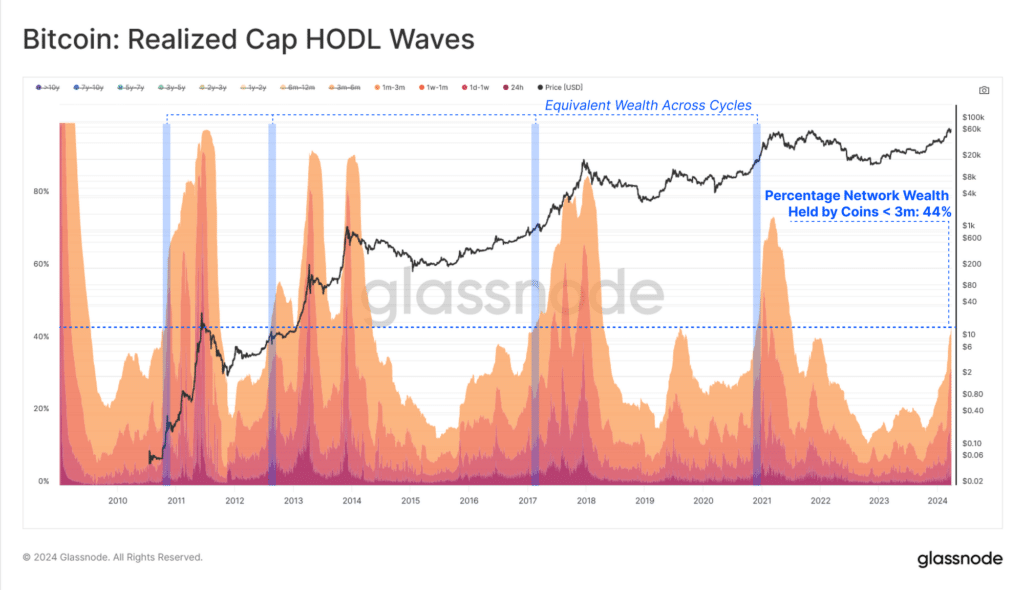

Glassnode employs the Realized Cap metric, which logs the transaction price for each Bitcoin to determine the proportion of holders making a profit or a loss. The metric has reached an all-time high (ATH), indicating a significant market milestone, according to Glassnode.

“This results in spent coins generally being revalued from a lower cost-basis, to a higher one. As these coins change hands, we can also consider this to be an injection of fresh demand and liquidity into the asset class.”

This mechanism is neatly depicted by the Realized Cap statistic, which tracks the total USD liquidity ‘stored’ in the asset or class. The Realized Cap has reached a new ATH value of $540 billion and is growing at an unprecedented rate of more than $79 billion each month.

According to Glassnode, 44% of all BTC in circulation are now held by newer addresses that have been active for less than three months. According to the firm’s statistics, rising above the 44% threshold is generally associated with mid-stage bull markets.

“If we segregate for coin-ages younger than 3 months, we can see a sharp increase over recent months, with these newer investors now owning ~44% of the aggregate network wealth.”

It determined that there has been a “distinct shift in investor behavioral patterns.”

“Long-Term Holders are well into their distribution cycle, realizing profits, and re-awakening dormant supply to satisfy new demand at higher prices.”

According to Glassnode researcher Checkmatey,’ the realized cap is increasing as old coins are revalued higher, with GBTC accounting for approximately 30% and HODLers selling the remainder.

However, the analysis was conducted when Bitcoin approached an all-time high for the second time, and markets began to fall earlier this week. BTC reached a high of $73,734 on March 14, fell by about 17%, and recovered to $71,550 on March 28 before resistance proved too powerful.

It fell slightly below $65,000 during the Wednesday morning Asian trading session, reaching $64,573 before rising to $66,111 at the time of writing, per CoinMarketCap. Bitcoin is currently down 10% from its all-time high price.

The overall market capitalization is down 1% on the day to $2.5 trillion, or approximately 20% lower than its all-time peak set in November 2021.

Aside from a few hyped meme coins, altcoins haven’t moved much in this market cycle.

Today, most of them are all down, with XRP down 2.3% to $0.576 and Dogecoin down 2.7% to $0.180.

This news is republished from another source. You can check the original article here