It appeared that the huge Bitcoin (BTC) rally seen over the past year had stalled recently, but that looks like it has only been a temporary pause. The leading crypto is again back above $70,000 and only a few percent away from the mid-March all-time high of $73,750. Investors are seemingly laying to rest concerns around the recent big outflows from the spot Bitcoin ETFs and might be setting their sights on the next big catalyst.

The Bitcoin halving – that is, the once in 4yrs software-defined event when the rewards for mining BTC get slashed in half – is due to take place on April 19th and that has historically been the opening bell for a crypto bull market.

While the consequence of the halving is that the Bitcoin supply becomes more constrained, thereby raising demand and causing the price to soar, the fact there are fewer bitcoins entering circulation makes the event more difficult for Bitcoin miners. Less Bitcoin mined means less Bitcoin to sell, and therefore it is imperative that a miner’s business is in a sound state when there are fewer rewards coming in.

With this in mind, J.P. Morgan analyst Reginald Smith has been assessing the prospects of some of the U.S.’s biggest Bitcoin mining firms – amongst them Riot Platforms (NASDAQ:RIOT) and Marathon Digital (NASDAQ:MARA) – and has come down clearly in favor of one over the other. So, we’ve decided to give them a closer look and see which one the banking giant thinks is poised for future success. With help from the TipRanks database, we can also see what the rest of the Street’s analysts have in mind for these names.

Riot Platforms (RIOT)

We’ll start with Riot Platforms, a vertically integrated Bitcoin miner whose operations are divided into three main segments: self-mining Bitcoin, hosting data centers for other miners, and manufacturing mining equipment, including electrical components and immersion cooling technology.

In addition to its own BTC mining activities, the company provides extensive infrastructure for large-scale Bitcoin mining operations at its facilities situated in Rockdale, Texas (known as the Rockdale Facility) and Navarro County, Texas (referred to as the Corsicana Facility). Riot highlights its Rockdale Facility as the largest singular Bitcoin mining establishment in North America in terms of developed capacity, with potential expansion plans currently in progress. Additionally, Riot is actively developing the Corsicana Facility, expected to reach a capacity of around one gigawatt once construction is finalized.

Riot’s February production and operation update showed the company mined 418 bitcoins during the month, a 20% decline from January and 38% below the same period a year ago. Still, as of the end of the month, the company held 8,067 bitcoins, up from the 7,648 BTC it held at the end of January and the 7,058 in February 2023.

The lack of hashrate growth, in addition to equity dilution and possibly some profit-taking after a big rally, has seen the shares underperform this year; they show a 19.5% year-to-date decline. However, the company is set to significantly increase its operational hash rate, aiming to more than double its current levels by the end of the year. More precisely, Riot intends to power up to 19 EH/s at its upcoming Corsicana facility by the year’s end. This figure compares favorably to both peers CleanSpark and Marathon, as both companies will need to acquire smaller mining sites to achieve their year-end hash rate goals.

It’s the prospect of expansion, amongst other sound fundamentals, that J.P. Morgan’s Smith finds appealing here.

“Riot currently operates 12.4 EH/s at its 700MW Rockdale facility, and plans on energizing nearly 20 EH/s at its new 1GW Corsicana facility throughout 2024, which will also improve the company’s fleet efficiency and mining economics,” Smith explained. “We like Riot’s unique combination of industry-leading power contracts, scale and liquidity (Riot last reported ~$600M in cash and $470M worth of bitcoin), and think shares offer the best relative upside among the three largest and most liquid U.S.-listed mining stocks… We think shares are well positioned to rebound once Riot begins to show meaningful hashrate growth, which could be as soon as April/May.”

To this end, Smith upgraded RIOT from Neutral to Overweight (i.e., Buy) while his $15 price target makes room for 12-month returns of ~20%. (To watch Smith’s track record, click here)

Overall, it looks like the Street is in full agreement here. Based on Buys only – 8, in total – the analyst consensus rates the stock a Strong Buy. The average target is more bullish than Smith will allow; at $20.25, the figure implies share appreciation of ~62% for the coming year. (See Riot stock forecast)

Marathon Digital (MARA)

Let’s now take a look at Marathon Digital, a U.S. Bitcoin miner that is an industry leader on several fronts. First of all, Marathon has a market cap of $5.9 billion, the biggest among U.S. miners. It is also the largest by hashrate, with an installed hashrate of 28.7 EH/s, as of the end of February. Additionally, during the month, its operating fleet grew by 8% to ~231,000 Bitcoin miners.

The company also holds the most Bitcoin on its balance sheet, showing a total of 16,930 unrestricted BTC as of the end of last month, even after selling 290 bitcoins in February. In the latest operational update, the company said it mined around 833 bitcoins in February, less than the 1,084 bitcoins mined in January, with Marathon citing “operational challenges” that lowered its output for the month.

Historically, Marathon has primarily operated using an asset-light model, relying on third-party data center hosts, and its mining rigs are distributed across 11 sites spanning three continents. But it is now transitioning to a more vertically integrated model. It acquired two new data center sites last year, one located in Kearney, Nebraska, and the other in Granbury, Texas, for a total cost of $179 million. And recently, the company announced it will acquire Applied Digital’s Bitcoin mining data center in Garden City, Texas, for a purchase price of $87.3 million. This way, the company will have greater control over resource utilization and more influence over power management.

While JPM’s Smith thinks the transition is a good one, it is not currently enough to alter the bear case.

“Marathon Digital is an ‘asset light’ bitcoin miner in the midst of moving towards a more traditional, vertically integrated model. Unlike the majority of publicly listed digital asset miners, MARA traditionally entered into hosting agreements with data center owners (rather than build and operate its own sites),” Smith explained. “MARA’s ‘infrastructure light’ approach maximizes investment in revenue generating assets (i.e., ASIC miners) rather than power infrastructure and data centers. Because of this, MARA has a high variable cost base (power prices and hosting fees) and, in our view, is the bitcoin miner most levered to BTC prices. That said, through several recent acquisitions, MARA is beginning to operate their own mining facilities, which should begin to improve its blended power costs.”

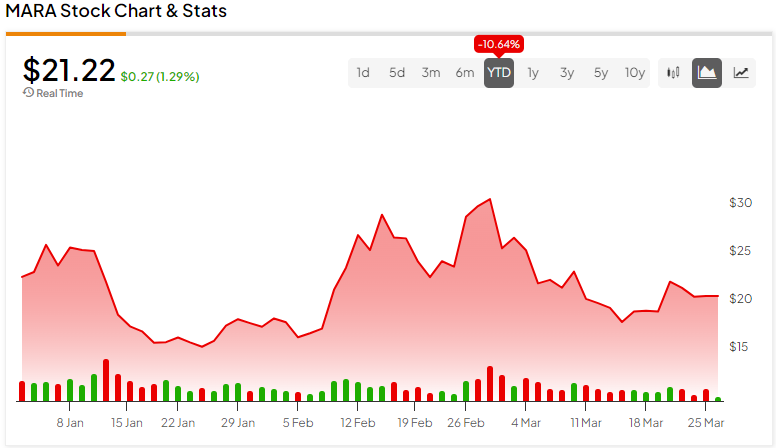

Nevertheless, for now, Smith has an Underweight (i.e., Sell) rating on MARA shares backed by a $16 price target, suggesting the stock has downside of ~23% from current levels.

How does Smith’s bearish stance weigh up against the word of the Street? It appears that most other voices are not as willing to bet on MARA, as demonstrated by TipRanks analytics, which classify the stock as a Hold. Based on 7 analysts tracked in the last 3 months, 4 give the bitcoin miner a Hold (i.e., Neutral) rating, 2 suggest Buy, and only Smith recommends Sell. However, going by the $22.55 average target, a year from now, shares will be changing hands for a 7% premium. (See MARA stock analysis)

And now analyst Smith’s choice is clear – if you’re looking for exposure to the Bitcoin market, buy into RIOT as the superior bitcoin stock.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

This news is republished from another source. You can check the original article here