GM DOers! 😎

“Blockchain has no REAL use cases,” is what they’ve been saying. 🧐

“Nothing drives any real profit; it’s just speculation and gambling.”

And while they’re right that much of this industry IS about speculating and gambling (unfortunately 🙁)…

There are still some REAL, sustainable businesses and industries being born on the backbone of blockchains. Most people just aren’t paying attention. 🚀

It turns out that value can be created atop “permissionless, open, and global databases” (a.k.a blockchains).

And guess what? It’s already happening! ✅

Web3 and blockchain may not be used by the mainstream, but there are “real use cases” generating millions of dollars per year already.

In today’s report, I’m going to share three blockchain use cases that not only make the internet experience better but are doing so with profitable and sustainable business models. 💼

At the end, I’ll also share how you can capitalize on this and join in on the upside of these markets by understanding how value grows in web3.

But before we jump in, keep in mind that this report is only scratching the surface on ‘how blockchains become sustainable and how they accrue value’.

However, this is perhaps the most important thing to understand as an investor in web3.

Before allocating any capital, into any asset, you need to analyze whether or not that asset can grow sustainably, and doesn’t fully rely on hype.

Let’s start this report with a bit of a curveball: NFTs… 🎨

1. NFTs Aren’t Dead. You’re Just Looking At It Wrong… 🤔

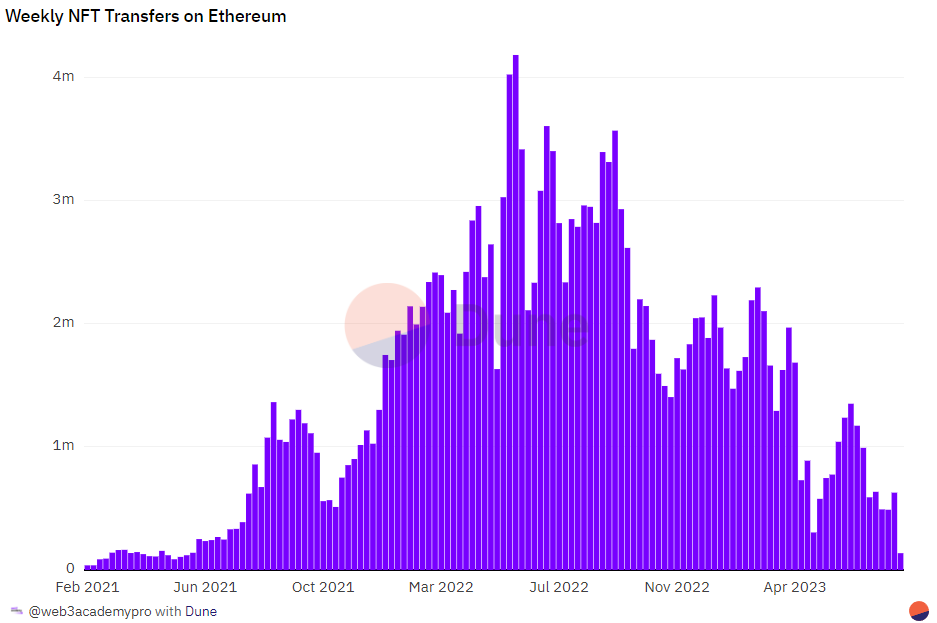

You’ve likely seen many charts about the NFT market plummeting to zero. In terms of those high-priced profile picture (PFP) NFTs on Ethereum, it sure seems that way.

Here’s one chart showing the decline in NFT transfers on Ethereum 📉

And another highlighting the drop in active wallets trading NFTs on Ethereum 📉

As a result, the fees on Ethereum (a.k.a. Ethereum Revenues) from NFTs are also taking a nosedive 📉

This doesn’t paint a rosy picture for NFTs, does it? 🥀

But as we’ve been stressing for over a year now: “High-priced, PFP art projects are not the future of NFTs and web3 tech.”

They were an obvious hype cycle. Plus, minting them on Ethereum’s Layer 1, costing $20-$100+ to mint and transfer, makes no sense. 🤷

What does make sense? NFTs on Layer 2s, which cost nearly nothing to mint or transfer.

What makes even MORE sense? NFTs on Layer 2s that cost near $0 to mint or transfer and offer ownership, interoperability, and resale value to in-game items like skins, equipment, avatars, awards, and more. 🎮✨

Combine NFTs with affordable blockchain space and real utility, and what do you get? This 👇

No bear market… just consistent use! The chart above shows the NFT transaction numbers on Immutable (an Ethereum Layer 2) during this so-called “NFT bear market.”

Transactions and fees are steady, and in fact, fees on Immutable are up year to date – the complete opposite of Ethereum.

What does this mean? Games are earning revenue by selling in-game items (as they did pre-blockchain), but now players can resell them to other gamers, generating secondary revenue.

Thanks to a small gas fee with every transfer, the protocol also earns revenue.

From the chart above, we see that Immutable is raking in more than $100,000 per week in 2023 – that’s $5.2 million per year! 🤑

Part of this goes to $IMX holders that stake their tokens ($IMX is Immutable’s native token), rather than value only accruing to the game or the platform (ie. Xbox, Playstation)

Now, value accrues to the game, the players, the tech platform, and the gaming community (token holders) – how cool is that? 😎

Need another example to see that NFTs aren’t dead and value is being created?

This news is republished from another source. You can check the original article here