-

Bitcoin’s roller-coaster price action triggered nearly $700 million in crypto liquidation over the past 24 hours, CoinGlass data shows.

-

The sell-off echoed throughout all digital assets, resulting in the CoinDesk20 Index falling almost 5% on Wednesday.

Bitcoin’s {{BTC}} breakneck rally quickly turned sour early Wednesday afternoon, with the price plunging 7% from a $64,000 high, turning into a bloodbath for leveraged traders.

BTC rapidly surged earlier during the day, surpassing the $60,000 level for the first time since November 2021. After hitting a high of $64,037, it abruptly fell to $59,400, the CoinDesk Bitcoin Index (XBX) shows. Its price had bounced back over $61,000 before another wave of sell-off pushed it again to near the same level. At press time, BTC was changing hands at $61,122.

The sell-off reverberated across the broader digital assets market, with the CoinDesk 20 Index (CD20) dropping almost 5% after hitting a fresh all-time high of 2,260 earlier on Wednesday. Major cryptocurrencies in the CD20, such as ether {{ETH}}, Solana’s SOL, XRP, Cardano’s ADA, dogecoin {{DOGE}} and Avalanche’s AVAX also dropped as much as 4%-9% in an hour.

Crypto leverage wipe-out

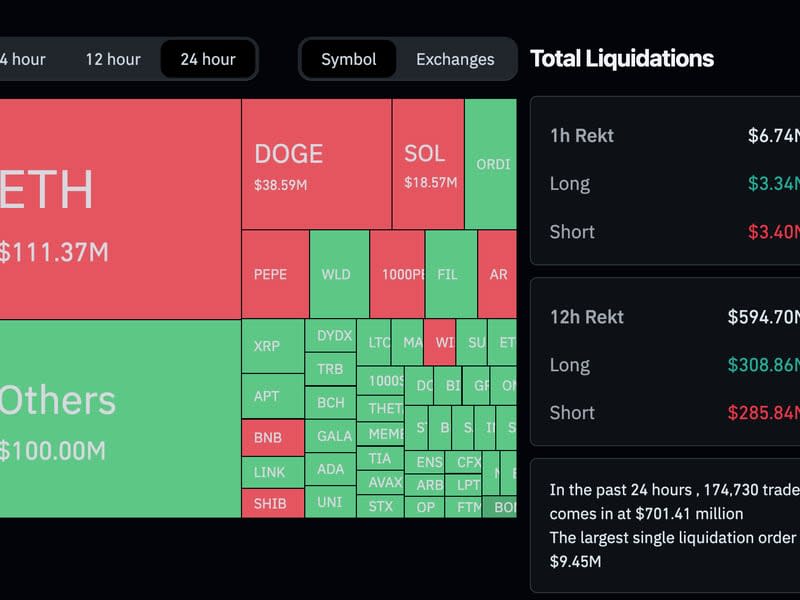

The sudden drop in prices caused a total of $700 million in liquidations for all digital assets over the past 24 hours, flushing out leveraged derivatives trading positions, CoinGlass data shows.

Liquidations happen when an exchange closes a leveraged trading position due to a partial or total loss of the trader’s initial money down or “margin” – if the trader fails to meet the margin requirements or doesn’t have enough funds to keep the trade open.

Wednesday’s action was likely the largest wipe-out since last August, when bitcoin’s sudden drop to $25,000 liquidated $1 billion of derivatives positions across all crypto assets.

The liquidations equally impacted long positions (bets on higher prices) and shorts (bets on prices to fall) as crypto prices rallied and then tumbled.

Record-breaking spot bitcoin ETF volumes

Wednesday’s wild price action also brought record trading volumes for U.S.-listed spot bitcoin exchange-traded funds (ETF).

BlackRock’s IBIT saw $3.3 billion of shares traded, more than double than Tuesday’s record-breaking day. In comparison, the spot ETFs combined booked nearly $8 billion in trading volume, Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, noted in an X post.

Meanwhile, amid the digital asset market’s roller coaster, some Coinbase users were surprised to see zero balances in their exchange accounts. The company has since remedied the issue for some users.

Read more: Amid Ferocious Bitcoin Rally, a Coinbase Snafu Shows $0 Balances for Customers

UPDATE (Feb. 28, 18:47 UTC): Updates to include revised price action.

UPDATE (Feb. 28, 22:38 UTC): Updates headline with latest liquidation figures, adds bitcoin ETF trading volumes and more context.

This news is republished from another source. You can check the original article here