By Amy Castor and David Gerard

“she let me keep all the NFTs in the divorce because she’s stupid and still loves me and is obsessed with me”

— dril

And I’m never wrong about this stuff. Never.

Goodbye, FTX

FTX will not come back as a crypto exchange once more. It will liquidate. It expects to have “sufficient funds to pay all allowed customer and creditor claims in full,” said FTX lawyer Andrew Dietderich in a hearing on January 31. [Verge]

There may be some weasel wording here — FTX has said elsewhere that customers won’t be fully repaid, with FTX.com customers bearing a greater percentage of the losses. [Bloomberg, archive]

The claim of payment “in full” is based on dollarized prices at the petition date — after the crypto market crashed in the days leading up to the filing. So creditors would get 100% of what they had as of the precise moment they officially lost it. Some creditors feel this is unfair because FTX caused the crash — but mostly because they want free money now that crypto prices are up again.

We’re also pretty sure that quite a lot of the assets in question are unsaleable illiquid altcoins. Crypto routinely hides a huge amount of terrible nonsense behind mark-to-market accounting.

“This hopefully puts to bed the alternative narrative that this business was just fine all along,” said Dietderich. “It was an irresponsible sham, created by a convicted felon. The costs and risks of creating a viable exchange from what Mr Bankman-Fried left in a dumpster were simply too high.”

FTX still has to sort through millions of claims, and creditors have to prove their claims are legitimate if they want to get their money back.

FTX gets an examiner

A year ago, Judge John Dorsey denied a request by the US Trustee to appoint an examiner for the bankruptcy of FTX. He said it would duplicate the efforts of John Jay Ray’s team and cost creditors another $100 million or so, just what they didn’t need.

The Trustee appealed and a three-judge panel overturned the lower court’s ruling — so FTX is getting an examiner. [Opinion of the Court, PDF]

The law says the court must appoint an examiner if the Trustee asks for one and the debtor’s debt exceeds $5 million. The panel added that an examiner is necessary given Sullivan & Cromwell’s work for FTX before the bankruptcy. (They now work for John Jay Ray, who is managing the bankruptcy.)

We can see the appeal court’s point. Ray has one job: to recover funds for the creditors. But the examiner can show what steps need to be put in place for a situation like this to never happen again.

The appeal court argues that working out what happened is in the public’s interest. The information would also be usable in future court cases. There were many people who were up to their necks in FTX but have not been charged. Yet.

More FTX fun

Sam’s parents, Joe Bankman and Barbara Fried, are asking the court to dismiss FTX’s adversary lawsuit against them, which claims the millions of dollars their son’s company sent to them were fraudulently transferred. They argue they were not company insiders since neither of them ever held an executive role at the company — and therefore the transfers were not fraudulent! — and that the $16 million property in the Bahamas was not their primary home. [Reuters, archive; Doc 20, PDF]

FTX was hacked for “$400 million” in crypto in November 2022, just after declaring Chapter 11 bankruptcy. The mystery of who did it may be solved — the DOJ has charged three people with a years-long SIM-swap phone hacking conspiracy that hit multiple companies. The indictment mentions only “Victim Company-1” — but Bloomberg says that’s FTX. [Ars Technica; indictment, PDF; Bloomberg, archive]

Over in the criminal case, Sam Bankman-Fried has hired a new lawyer, Marc Mukasey of Mukasey Young, in the hope of getting a lighter sentence on March 28. Mukasey helped get Trevor Milton, founder of electric truck fraud Nikoka, a much lighter sentence of only four years instead of eleven. He’s also a defense attorney for Celsius’s Alex Mashinsky. [Bloomberg, archive]

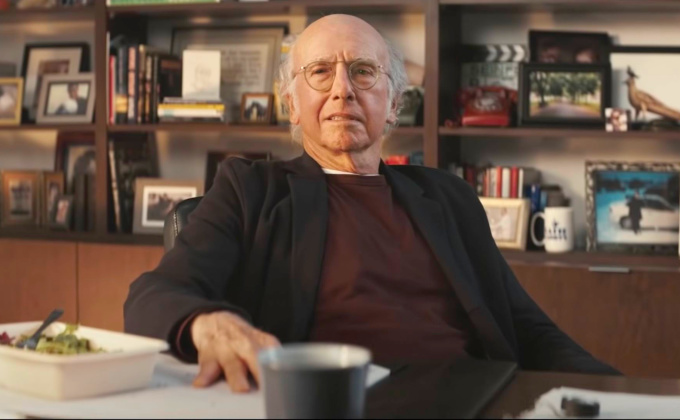

Larry David was not only foolish enough to do the FTX Superbowl ad because his “friends” told him that crypto was good and solid stuff — he also took part of his fee in crypto. He regrets it a whole lot. [Twitter]

News from chapter 11

Terraform Labs has filed for chapter 11 in a Delaware bankruptcy court to fend off likely penalties from the SEC winning summary judgment on its claim that that TerraUSD and luna were unregistered securities. Chapter 11 automatically stays payment of any judgment against Terraform. The company’s liabilities and assets are both in the range of $100 million to $500 million. [Filing, PDF; first-day motion, PDF]

The SEC sued Genesis Trading and the Gemini crypto exchange in November over the Gemini Earn product, claiming it was an unregistered security. Genesis wants to settle with the SEC for a $21 million fine, which will become a general unsecured claim in the bankruptcy. The SEC’s case against Gemini proceeds. [Doc 1220, PDF]

Celsius Network is emerging from bankruptcy to distribute what funds remain to its creditors and shut down. Creditors will also get shares in the new bitcoin mining company Ionic — the Celsius NewCo discussed previously. Ionic will be managed by Hut 8. [press release]

ETFs

With spot bitcoin ETFs, the people who already stopped buying bitcoins have a new way not to buy bitcoins anymore.

It’s clear by now that ETFs were not the magic rocket fuel that would take bitcoin to the moon. And there is no evidence that the ETFs are attracting fresh liquidity to push up the price of bitcoin and let holders cash out.

We love how Grayscale fought so hard to bring spot bitcoin ETFs to the US, and the first thing that happened was GBTC getting drained — $4.3 billion in outflows so far.

FTX is partly to blame — it’s dumped about $1 billion (22 million shares) of GBTC. We know that Genesis is also sitting on a pile of GBTC, which they’ll probably need to dump at some point to cover the massive hole in their books. Sam Bankman-Fried is trashing bitcoin from his jail cell. [CoinDesk]

Grayscale is now trying to introduce a covered call ETF based on options on its Bitcoin Trust ETF (GBTC). [FT, archive; Form N-1A]

Covered ETFs are designed to reduce risk. It involves selling a call option on the asset held by the ETF — in this case, bitcoin. By owning bitcoin or a bitcoin ETF, you’re “covered” if the price of bitcoin rises and the call option expires in the money. [Investopedia]

Roundhill Investment has a Bitcoin Covered Call ETF (YBTC) that has already started trading. [FT, archive]

Bitcoin ETFs turn out to be good news for the CME bitcoin futures, which are cash-only bets that never touch a bitcoin. Traders use the CME futures to bet on the price and hedge that bet with ETF shares rather than having to touch a bitcoin themselves. [FT, archive]

The bitcoin ETF market is cutthroat, thanks to the SEC approving 11 ETFs at the same time. Invesco and Galaxy Asset Management have reduced the fee of their spot bitcoin ETF to 0.25% from 0.39%. They have also waived the fee to 0% for the first 6 months or $5 billion in asset). [Press release]

We talked about the risk of ETFs keeping large piles of bitcoins at a custodian. Valkyrie has added BitGo as a second custodian to mitigate this risk. [CoinDesk]

Tether is in the money

Tether published their attestation for the quarter ending December 31. They report $3 billion in profit — $1 billion in interest on US Treasuries and $1.85 billion from appreciation in their reserves of bitcoin and precious metals. So, $1 billion actual cash profit. [Tether, archive]

This is a snapshot of what Tether told their accountant, this time BDO Italia, about their assets on the last day of 2023. It is absolutely not a proper audit and it gives Tether lots of wiggle room to make things up, something they’ve been extensively documented as doing in the past.

Tether has been issuing tethers to its biggest customers as loans, with the only backing being the loan itself — that is, they print the tethers out of thin air. No fresh actual dollars flow into the system this way.

We’re pretty sure that loans are how most of the recent tether issuance is coming into being — anyone with real dollars has been putting those into the ETFs.

Tether claims they have now overcollateralized sufficiently — $4.8 billion in secured loans versus $5.4 billion of excess reserves — that the loans aren’t at risk anymore:

Tether is proud to announce that it has achieved its goal of removing the risk of secured loans from the token reserves. While such secured loans are widely overcollateralized, Tether accumulated enough excess reserves to cover the entirety of the exposure. This is in response to the community’s past expressed concerns about this part of the portfolio.

This has been read by a lot of people as Tether not having those loans at all now — but that’s not what their very precise wording says.

Who is breathing down Tether’s neck that they need to reassure by issuing this statement? Surely not the “community.”

It’s one AK, CZ, what could it cost, six hundred dollars?

The use case for crypto keeps being found — crypto for Hamas. OFAC’s press release announcing a fifth round of sanctions on Hamas entities emphasizes the crypto angle. [Treasury]

In the wake of the October 7 Hamas attacks on Israel, three families of American victims are suing Binance, ex-CEO Changpeng Zhao, Iran, and Syria for financing the attacks. The filing accuses Binance and CZ of allowing Hamas to use the platform to conduct financial transactions and make payments: “Incredibly, Binance went out of its way to protect users associated with Hamas and other terrorist groups from regulatory scrutiny, especially if they were ‘VIP’ users who generated huge profits for Binance.” [Semafor]

Extreme bingo

It turns out that bitcoin mining stocks are a bad investment. Stock short trader J Capital published a report on Hut 8, linking it to a penny stock ring. The stock (USBTC) has lost two-thirds of its price since Christmas. [J Capital; Protos]

The US Energy Information Administration is requiring US bitcoin miners to detail for them their energy consumption starting in February and going through to July 2024. Bitcoin in the US is already using as much energy as the state of Utah. [EIA]

The International Energy Agency forecasts that global electricity demand from data centers, cryptocurrencies, and AI will more than double over the next three years, adding the equivalent of Germany’s entire power usage. [Bloomberg, archive]

More good news for bitcoin

OPNX was an exchange for trading distressed crypto debt that was set up in early 2023 by the founders of the defunct crypto hedge fund Three Arrows Capital and the defunct crypto exchange CoinFLEX. It’s shutting down — users have until February 14 to get their funds off the platform. 3AC’s Zhu Su is blaming the shutdown on FTX seeking full recovery of funds. Also, Dubai regulators didn’t like OPNX. Also, OPNX didn’t really have users — the highest daily volume was $624,000. [CoinDesk]

Congresswoman Maxine Waters worries that Facebook is trying to pull a Libra again. Meta has filed five trademark applications related to digital assets services and blockchain technology. Waters has written a letter asking them to explain themselves and reassure Congress that they’re not going to try to start a crypto again. [Letter, PDF]

The US Department of Justice has filed securities fraud and wire fraud charges against Sam Lee, founder of the HyperVerse crypto-ish Ponzi scheme from Australia. The one that had the fake CEO. Also charged were Rodney Burton and Brenda Chunga. Lee is at present safely in Dubai. [press release]

Coinbase has hired former UK Conservative Party chancellor George Osborne as an advisor. Hard to think of a better fit, really. [FT, archive]

This news is republished from another source. You can check the original article here