This week, our top cryptocurrencies — XRP (XRP), Dogecoin (DOGE) and Injective (INJ) — take center stage, on the heels of Bitcoin’s (BTC) slump and the global crypto market cap losing about $100 billion due to price upswings and dumps.

Bitcoin reached a two-year high of $49,000 on Jan. 11, when bitcoin ETFs began trading in the U.S. Since then. the asset plummeted and is now trading at $41,807.60, up by just .34% on Sunday, Jan. 21.

XRP battles $0.55

The latest market collapse impacted most mainstream assets, and XRP did not evade the onslaught.

Recall that XRP dropped to a low of $0.50 on Jan. 3 amid a mixed start to the year.

The asset eventually recovered from this slump, recovering the pivotal $0.55 price threshold.

However, this week saw the bears attempt to push XRP below the price level. The bearish trend from the previous week spilled into this week, leading to a bearish consolidation between a low of $0.5216 and a high of $0.5895.

XRP hit this high on Jan. 15, at the start of the week. Nonetheless, the bears battered it below the price threshold, and it has continued to record lower lows since then, slipping to the $0.55 zone. XRP defended the $0.55 support fervently, but eventually gave it up on Jan. 18.

As the bearish pressure heightened, the asset collapsed to the $0.5216 low on Jan. 19. XRP staged a comeback, gaining 1.67% the next day to reclaim the $0.55 territory. Currently trading for $0.5525, the token seeks to seal its position above this price point.

Failure to do this would bring the support at $0.5487 into play, XRP’s last defense against further declines. The asset must register a measured move to the Jan. 9 high of $0.5780, currently at Fib. 0.382. Closing above this resistance level could signal a looming price reversal.

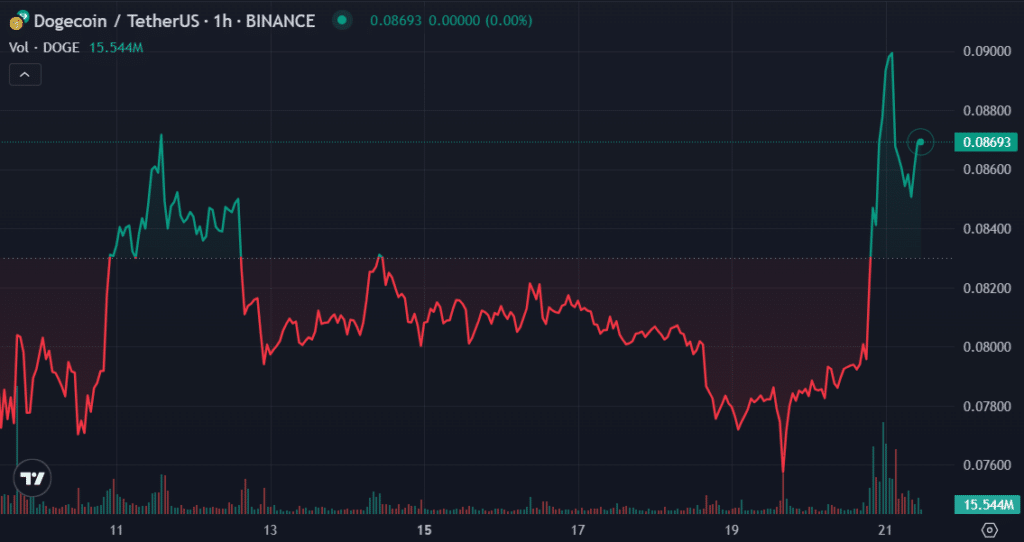

Dogecoin bucks trend with 7% gain

Dogecoin showed exemplary resilience in the fears of the bearish pressure this week.

While Bitcoin and other assets largely faced bearish consolidation throughout the week, DOGE recorded impressive gains, looking to close the week with a surprising 7% gain.

While other assets tumbled, DOGE began the week on a positive note, rising to a high of $0.08258 on Jan. 16. However, the canine-themed memecoin eventually dropped to a low of $0.07484 on Jan. 19, collapsing below the crucial support levels at $0.08 and $0.075.

Dogecoin’s breakthrough came up on Jan. 20, when the crypto asset rallied to a high of $0.09058, breaching the pivotal $0.09 resistance point in an attempt to clinch $0.1. Despite the roadblock at the $0.09 level, DOGE showed resilience, closing the day with a massive 11.71% gain.

Dogecoin began Jan. 21 with a renewed uptrend, surging to $0.09046. Nonetheless, the bears have captured the scene, resulting in a drop to $0.08468. Despite the recent impedance, DOGE is up 7.6% this week, sealing a spot among the top 10 gainers this week.

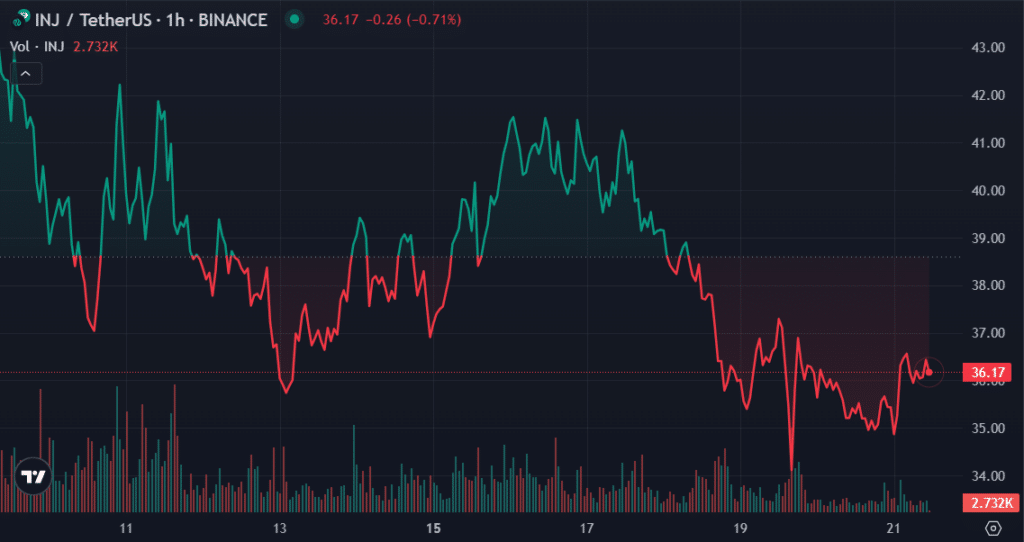

Injective forms bullish pennant

Injective succumbed to the bearish pressure dominant in the crypto scene this week. The asset had hit a high of $41.9 on Jan. 16 following an 11% intraday gain the previous day. However, this bullish move was negated by the ensuing correction.

INJ recorded three consecutive intraday losses from Jan. 16 to 18, facing an 8.18% drop on Jan. 18, its largest collapse since Jan. 7.

The sustained drop brought the asset below $37. Injective is currently looking to recover some of these losses, as it changes hands at $36.2 with a 2.25% increase today.

Zooming out, INJ appears to have formed a bullish pennant structure amid the ongoing consolidation. Notably, the flagpole of the pennant was formed from Dec. 6 to Dec. 24.

The asset surged 161% from $17.19 on Dec. 6 to a high of $44.89 on Dec. 28, forming a lengthy flagpole.

However, following the $44.89 peak, Injective faced a roadblock, leading to a mild retracement and subsequent consolidation.

This consolidation spilled into this week, resulting in the formation of the pennant. This structure typically signals a pause to the uptrend and a looming continuation.

This news is republished from another source. You can check the original article here