In a landscape where technology reshapes traditional finance, we are witnessing a pivotal change led by web3 and decentralized finance (DeFi) systems. These innovations are setting the stage for revolutionary investment models, while new products like spot Bitcoin exchange-traded funds (ETFs) could redefine the industry.

Alex de Lorraine, CEO of Archblock, shared his insights in an interview with CryptoNews, offering a unique perspective on the evolving landscape of web3. Archblock, founded in 2017, initially aimed to develop software for trust companies but quickly pivoted towards leveraging blockchain technology. The company provides web3 services for institutional users, offering tools including Archblock Institution Platform.

De Lorraine views web3 as a significant advancement in the digital world, one that extends beyond the realms of technology into the very fabric of financial interaction and empowerment. He emphasizes web3’s potential to democratize access to financial services, making them more inclusive and accessible.

Reflecting on the essence of web3, de Lorraine stated,

“I strongly believe that web3 encompasses everything. I think that web3 is the next generation of finance systems. It can do way more. I get that, but I’m focusing on finance only.”

Web3 Empowers Financial Accessibility

“And when I saw what the system can do. I got excited because it’s the first time in hundreds of years that we actually are changing something completely,” said de Lorraine. “What I mean by that is like, first I looked at it from an accounting point of view. Web3 allows you to do stuff that we’re not able to do in a normal kind of finance world.”

De Lorraine elaborated on the unique capabilities of web3 that traditional finance systems lack. He highlighted the unparalleled scalability of web3, likening it to the internet in its ability to underpin a vast array of services and systems. “It’s like having one system that powers everything,” he explained. This aspect of web3, according to de Lorraine, allows for a level of integration and efficiency that traditional banking systems cannot match.

Furthermore, de Lorraine pointed out the transformative nature of web3 in terms of transparency and accountability. He mentioned how web3 could offer a new level of transparency in financial transactions, which is not possible with traditional finance. In an environment where every transaction is recorded and open to trace, one simply “cannot lie,” de Lorraine emphasized.

Highlighting the accessibility of web3, de Lorraine remarked on its potential to level the financial playing field. He underscored, “Web3 is about democratizing finance. It’s about making financial services accessible to anyone with internet access.”

Bitcoin ETFs’ Potential Impact on Web3

As the first spot Bitcoin ETFs got approved by the U.S. Securities and Exchange Commission (SEC), the finance world is also changing and potentially intersecting with DeFi. “Spot Bitcoin ETFs are a game changer,” de Lorraine commented in the interview. “They offer a way for traditional investors to engage with digital assets within a familiar and regulated framework.”

“Bitcoin ETFs could serve as a bridge between the traditional financial system and the emerging world of digital assets,” he said.

He noted that while they do not directly leverage the decentralized nature of web3, their presence in mainstream markets is a testament to the growing acceptance and legitimacy of cryptocurrencies. “It’s about acknowledging the value and potential of digital assets in a format that traditional investors are comfortable with,” de Lorraine added.

“For many, diving directly into buying and holding cryptocurrencies can be daunting due to the perceived risks and technical barriers. Bitcoin ETFs simplify this, making it easier for a wider audience to participate in the crypto market without needing deep technical knowledge.”

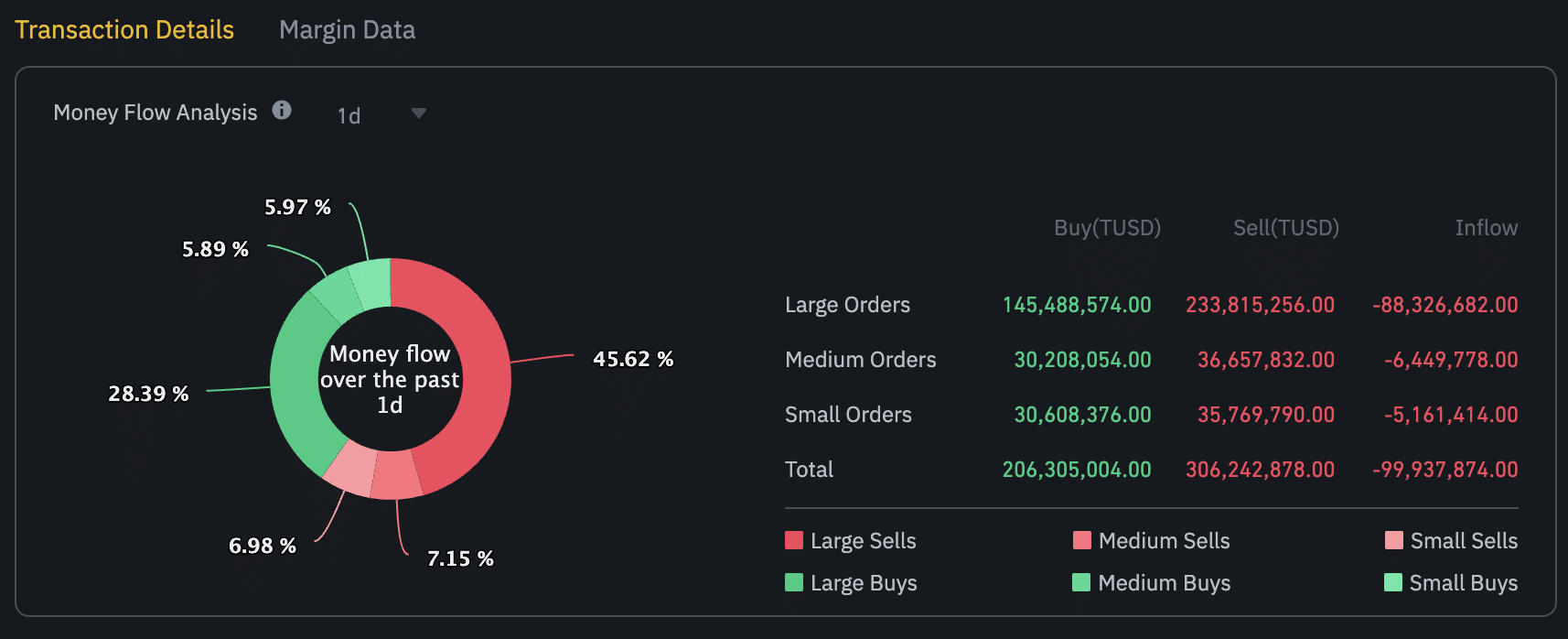

TrueUSD Stablecoin Depegged to $0.984

TrueUSD (TUSD), a stablecoin originally issued by Archblock, experienced a notable drop below its $1 peg. On Jan. 16, TUSD dropped to $0.984, a significant deviation for a stablecoin designed to maintain parity with the US dollar.

According to Binance’s TUSD-USDT trading page, the coin faced almost $100 million net outflow over the past 24 hours. TUSD bounced back to $0.991 later the day.

This news is republished from another source. You can check the original article here