Last updated:

• 16 min read

Looking to invest in the best micro-cap cryptocurrencies for upside potential? In this guide, we discuss quality micro-cap coins that could generate huge returns during the next bull run. Read on to discover the next 100x crypto gem.

The Best Micro-Cap Cryptocurrencies to Invest in

Here’s a list of the best micro-cap cryptocurrencies for 2023:

- Love Hate Inu – Best Micro-Cap Crypto to Invest in Now

- Fight Out – Fitness Games in the Metaverse With Train-to-Earn Rewards

- C+Charge – Gain Exposure to the Future of EV Charging in Web3

- Tamadoge – Earn TAMA Tokens in the Metaverse by Minting an NFT Pet

- SushiSwap – Decentralized Exchange With Borrowing and Lending

- Gala – Blockchain Guild Hosting Play-to-Earn Games

- inSure DeFi – Web3 Insurance for Crypto Portfolio Scams

- Ribbon Finance – Yields Generated Through Automated Derivative Strategies

- Prom – NFT Marketplace for In-Game Assets

- Band Protocol – Cross-Chain Data Oracles for Smart Contracts

- JUST – DeFi Tools for the TRON Network

A Closer Look at the Top Micro Market Cap Crypto Coins

When selecting the best micro-cap crypto to buy, investors need to look at factors other than just the market capitalization. This includes the use case of the crypto token, what market it operates in, and the upside potential of the project.

Below, we analyze the best micro-cap cryptocurrencies to invest in today.

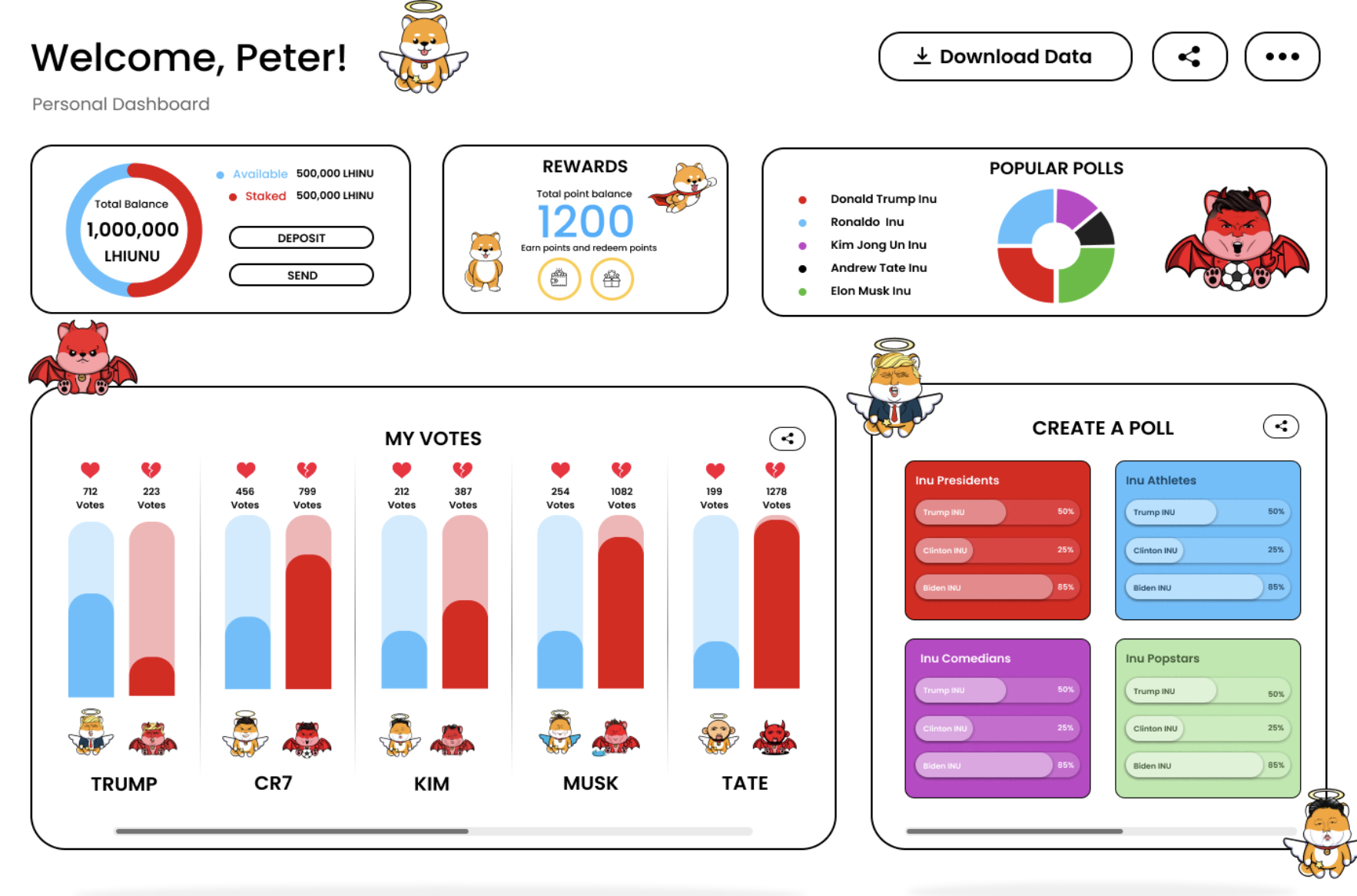

1. Love Hate Inu – Best Micro-Cap Crypto to Invest in Now

After researching a considerable number of projects, we found that Love Hate Inu (LHINU) is the overall best micro-cap crypto to buy. In particular, we are bullish on its highly marketable vote-to-earn concept. The main premise is that users will buy and stake LHINU tokens to access the voting dashboard. In doing so, the staked tokens will generate passive rewards.

Moreover, not only does staking enable users to cast votes, but further rewards will be earned. The vote-to-earn concept will cover a wide range of topics, from opinion polls and political events to social issues and sports matches. In fact, voting topics can be set by the Love Hate Inu community.

In addition to incentivizing voters with LHINU rewards, Love Hate Inu solves a range of real-world issues. For example, voters no longer need to worry about voter intimidation, as all votes are anonymous. Double-counting, fraud, and other reconciliation issues are also alleviated. This is because Love Hate Inu uses blockchain and smart contracts to process votes.

Moreover, the risk of having bots place votes is solved via the stake-to-vote mechanism. We also like that 90% of the LHINU is being sold during the presale campaign. This not only ensures that the project cannot be rugpulled, but the community will have a majority stake. The presale, which launched just two weeks ago, has already raised $1.4 million from early investors.

This was expected, as Love Hate Inu offers a huge discount to those investing in the early stages of the presale. For example, while LHINU is currently priced at $0.00009, this will increase to $0.000145 by the final stage. Investors should value this as a 60% upside, considering that LHINU will trade on a crypto exchange as soon as the presale finishes.

| Presale Started | March 7, 2023 |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Ethereum |

| Min Investment | N/A |

| Max Investment | N/A |

2. Fight Out – Fitness Games in the Metaverse With Train-to-Earn Rewards

Fight Out (FGHT) is creating a sea-change in the $90 billion global fitness industry. Through blockchain technology, Fight Out is developing an ecosystem that will reward people for keeping fit. Each and every fitness regime will be tracked in real-time via the Fight Out app. Users will earn rewards for completing tasks and playing games in the Fight Out metaverse.

For example, let’s suppose that the user is interested in cardio exercises. The Fight Out app might set a series of treadmill challenges, where the user needs to complete a 1km sprint in a certain timeframe. As the user completes each challenge, they will receive tokenized rewards. In addition to personal challenges, users can also compete against other Fight Out players.

This will be conducted in the Fight Out metaverse and will include one-vs-one competitions as well as larger tournaments. For example, 100 users could enter a 20km bike race, but in their own physical location. The race would be viewed in the metaverse, providing a truly immersive experience. We also like that users will have their own avatar in the Fight Out metaverse.

The avatar will mirror the progress made by the user, in terms of their fitness achievements. When it comes to rewards, Fight Out makes distributions in REPS. The tokens can be used to purchase in-game items within the Fight Out metaverse. This includes boosters that enable users to amplify the number of REPS tokens earned.

REPS can also be used to buy merchandise or swap for FGHT, the main utility token of the project. FGHT is also the micro-cap token that enables users to invest in Fight Out. The project is nearing the end of its crypto presale and more than $5.7 million has been raised. FGHT is available to buy at just $0.03090. After the presale, FGHT will be listed on an exchange.

| Presale Started | December 12, 2022 |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Ethereum |

| Min Investment | $1 |

| Max Investment | N/A |

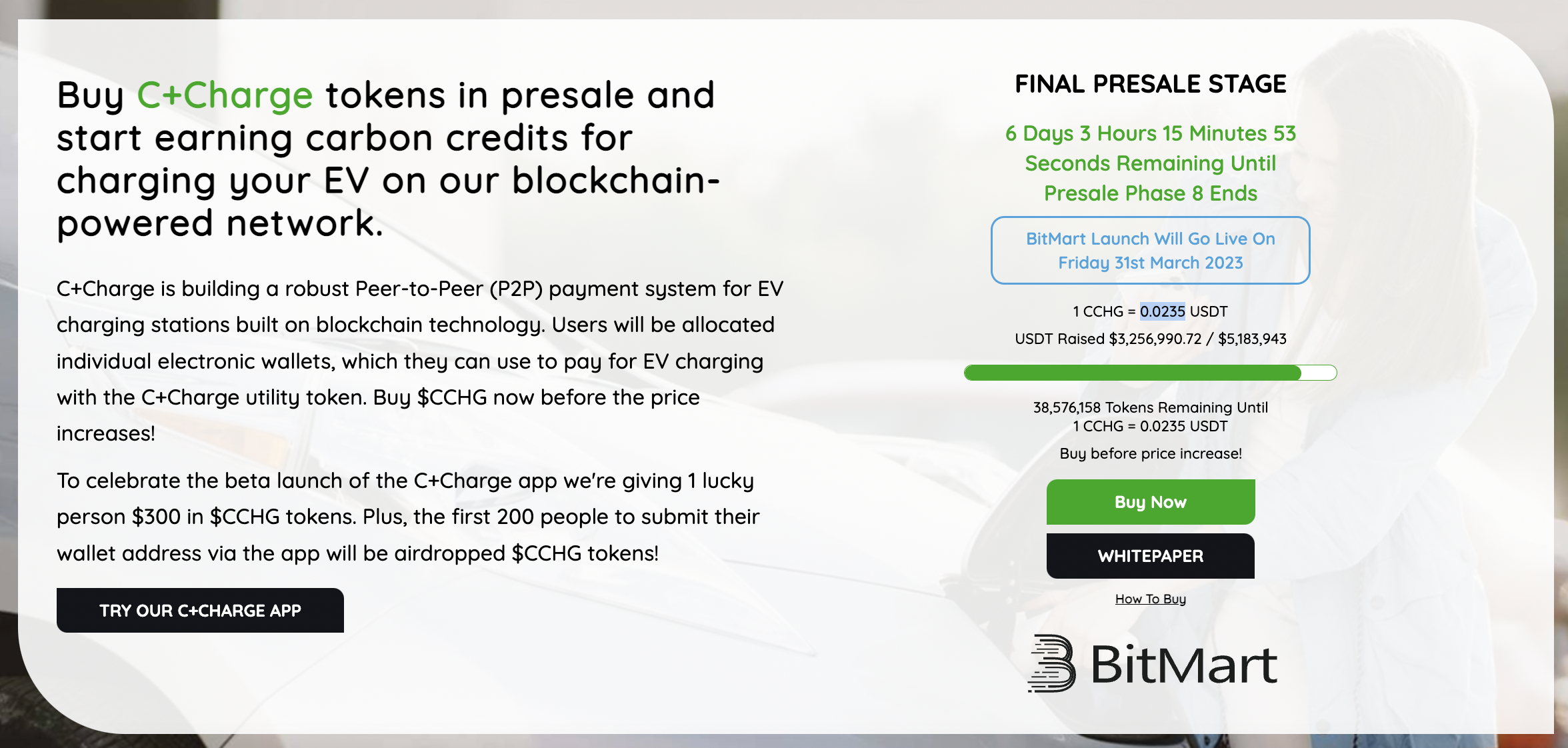

3. C+Charge – Gain Exposure to the Future of EV Charging in Web3

Next up on this list of the best micro-cap cryptocurrencies is C+Charge (CCHG). This innovative project is also nearing the end of its crypto ICO. Nonetheless, CCHG is still available to buy at just $0.0235 per token. This offers a great entry price before the exchange listing on Bitmart. Investors are bullish on the project’s innovation in the EV charging space.

Put simply, C+Charge rewards EV drivers for charging their cars at a partnered station. Rewards are paid in tokenized carbon credits, which have real-world value. To be eligible for the rewards, EV drivers must pay for their charge in CCHG tokens. Considering that C+Charge will partner with over 1.8 million charging stations worldwide, this could be the next cryptocurrency to explode.

We also like that C+Charge is developing its charge-to-earn concept on the blockchain. Not only does this guarantee transparency, but it allows users to store their carbon credit rewards virtually. C+Charge is also building a native app that doubles up as a CCHG wallet. This will make it a breeze for drivers to pay when charging their EVs.

| Presale Started | December 16, 2022 |

| Purchase Methods | BNB, USDT, Transak |

| Chain | Binance |

| Min Purchase | N/A |

| Max Purchase | N/A |

4. Tamadoge – Earn TAMA Tokens in the Metaverse by Minting an NFT Pet

Tamadoge (TAMA) is also one of the best micro-cap cryptos to buy today. This project has a broad ecosystem that covers a wide range of web3 products. But at its core, Tamadoge is a play-to-earn game that requires players to mint a virtual pet NFT. Tamadoge pets are randomly generated from Ethereum smart contracts. As such, each pet is unique and has its own traits.

Players can then train their pets to improve their strengths. Moreover, players can feed their Tamadoge pets and even enter battles with other users. There will be a leaderboard that rewards successful players with TAMA tokens. Tamadoge is also building a metaverse. Called the ‘Tamaverse’, this will offer play-to-earn games in an immersive environment.

The Tamadoge whitepaper also states that augmented reality will be incorporated into its NFT games. Tamadoge completed its presale in late 2022 and is now listed on many exchanges, including OKX, Gate.io, and Uniswap. Tamadoge has a market capitalization of just $12 million. As such, this is one of the best micro-cap tokens for long-term upside.

5. SushiSwap – Decentralized Exchange With Borrowing and Lending

SushiSwap (SUSHI) is one of the best micro-cap cryptos for investing in decentralized finance. Its proprietary exchange supports a range of services. This includes token swaps generated by an automated market maker (AMM) protocol. In simple terms, this allows a trader to buy a cryptocurrency without a seller.

This is because the AMM uses liquidity pools. Investors can provide liquidity to a pool to earn interest. SushiSwap offers attractive APYs and investors can withdraw their tokens at any time. SushiSwap also supports decentralized loans. SushiSwap has its own native token, SUSHI. Previously trading with a market cap of nearly $3 billion, SUSHI is now worth just $300 million.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

6. Gala – Blockchain Guild Hosting Play-to-Earn Games

While play-to-earn gaming projects generally create their own titles, Gala (GALA) does things differently. Put simply, Gala operates a gaming guild on top of the Ethereum blockchain. It enables developers to create and run their games on Gala, all of which offer play-to-earn rewards. Moreover, rewards are paid in the project’s native token, GALA.

Across 28 games, Gala has distributed more than $2.2 billion worth of rewards. All Gala games also come with in-game ownership, backed by an Ethereum NFT. Gala has also entered the world of decentralized music and film. This allows artists to sell their creations and dictate their own terms. GALA is currently trading with a market cap of just $290 million.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

7. inSure DeFi – Web3 Insurance for Crypto Wallet Scams

Launched in 2020, inSure DeFi (SURE) is looking to bridge the gap between insurance and crypto investments. In a nutshell, the project insures crypto wallets against the threat of a scam. For example, if the crypto wallet is hacked and the tokens are stolen, the user can make a claim. In terms of the specifics, users will first need to buy SURE tokens.

This is the utility token backing the project and the insurance kicks in seven days after making the purchase. Moreover, the SURE tokens need to be stored in a private wallet and not an exchange. After investigating and approving the claim, inSure DeFi will cover the loss, payable in SURE tokens. As of writing, inSure DeFi has a market capitalization of just $115 million.

8. Ribbon Finance – Yields Generated Through Automated Derivative Strategies

Ribbon Finance (RBN) is also one of the best micro-cap cryptocurrencies to consider today. It has built an innovative system that generates yields from crypto derivatives, such as options and futures. Some of its core strategies include covered calls, put-selling, and principal protections. Yields depend on the strategy and the token being traded.

For example, covered calls on Ethereum are currently yielding an APY of 70%. From the perspective of investors, the process is passive. Investors simply need to choose their preferred strategy and deposit some crypto. Ribbon Finance has some serious backers, including Coinbase Ventures and Paradigm. Its native token RBN has a market cap of just $125 million.

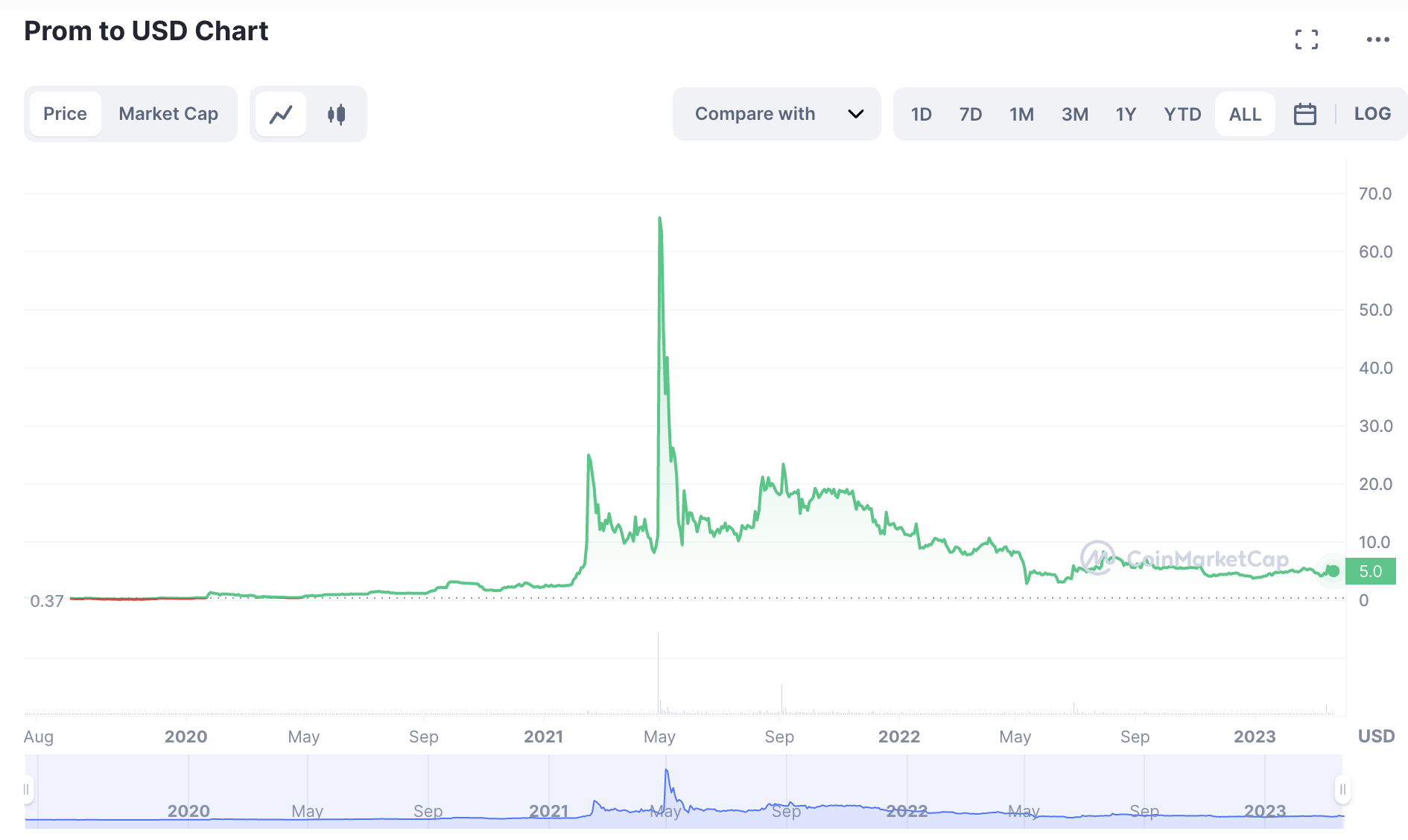

9. Prom – NFT Marketplace for In-Game Assets

While many blockchain games enable users to earn and buy in-game items, not all projects have an in-built marketplace. Prom (PROM) has solved this issue by creating a decentralized marketplace that allows users to sell their gaming NFTs. 27 games are supported with more being added in the coming months.

This includes MetaSoccer, Elips Battle, Cryptoblades, and Tiny World. Users can set their own price when listing an in-game NFT and multiple digital currencies are supported. Moreover, Prom also enables users to rent NFTs, allowing the owner to earn passive income. Its utility token PROM, has a market capitalization of just over $91 million.

10. Band Protocol – Cross-Chain Data Oracles for Smart Contract

Another project that caught our eye when searching for the best micro-cap cryptocurrencies is Band Protocol (BAND). Launched in 2019, Band Protocol specializes in data oracles for smart contracts. This means that it provides real-world data to the blockchain. Not only that, but Band Protocol has cross-chain functionality.

This means that it can provide real-world data to multiple network standards without requiring a third party. While its protocol receives an average of 33,000 requests per day, it is able to facilitate data blocks in just six seconds. According to CoinMarketCap, Band Protocol had a market cap of just $50 million at the start of 2023. It has since increased to $200 million.

11. JUST – DeFi Tools for the TRON Network

Although TRON has one of the most efficient blockchains for speed, fees, and scalability, it lacks a comprehensive range of DeFi tools. That was until JUST (JST) entered the market with its decentralized suite of lending and earning services. The platform specializes in TRC-20 tokens and popular liquidity pools cover TRX, BTT, USDT, and TUSD.

JST is the project’s native governance token, enabling holders to cast votes on how JUST is run. Users can also mine JST for additional rewards. When JUST was launched in 2020, it was trading at just $0.0084. As of writing, JUST is worth $0.026 per token – representing growth of 200%. This translates into a market capitalization of $228 million.

What is Micro-Cap Crypto?

Micro-cap cryptocurrencies refer to projects with a small market capitalization. This is often a valuation of under $300 million, similar to micro-cap stocks. While micro-cap cryptocurrencies can be ultra-volatile, they also offer an attractive upside.

This is because micro-cap cryptocurrencies have the potential to generate sizable gains. After all, it doesn’t take as much buying pressure to quickly increase the value of a micro-cap cryptocurrency. This is because there is less liquidity and depth in the market.

For example, if an investor buys $100,000 worth of a cryptocurrency with a market cap of just $5 million, this could increase the price by double-digit percentages. This isn’t the case with multi-billion dollar projects like Bitcoin. In fact, a $100,000 buy order would barely move the market at all.

How to Find Micro Market Cap Cryptocurrencies?

Read on to discover what methods seasoned investors use when researching the best micro-cap cryptocurrencies.

Use CoinMarketCap to Source Micro-Caps

CoinMarketCap is a great starting point when searching for the best micro-cap cryptos. By default, the data aggregator website lists cryptocurrencies in descending order by market capitalization.

This means that investors simply need to get down to $300 million and this will display thousands of micro-cap coins.

Investors can then research their chosen projects by reading the whitepaper, assessing the token’s use cases, and more.

Invest in Presales for the Best Entry Price

The vast majority of crypto presales will offer access to a newly launched micro-cap token. This is because presales are fundraising campaigns that help fund a new project.

The project will sell its native token at a huge discount to early investors. After the presale sells out, the token is then listed on an exchange.

Not only do presales allow micro-cap investors to secure an attractive entry price, but there is often an immediate upside on offer.

- For example, Love Hate Inu is currently offering its LHINU tokens at $0.00009.

- However, at the final stage of the presale, LHINU will increase to $0.000145.

- In other words, buying in the current Love Hate Inu presale stage offers an upside of 60%.

Once LHINU is listed on an exchange, this will enable the project to attract buyers on a global stage.

Look for Concepts That Could Become Global

Another strategy to consider when searching for the best micro-cap tokens is to focus on innovative concepts.

Think along the lines of investing in social media in the early 2000s or EVs in the 2010s. In doing so, investors can gain exposure to new markets before they have had the chance to blossom.

For example, Love Hate Inu is revolutionizing the way people vote through web3 technologies. Its vote-to-earn concept solves many real-world problems, such as voter fraud and intimidation. As such, by investing in Love Hate Inu during its presale, the long-term upside could be unprecedented.

Additionally, we also like the fitness-rewards ecosystem being developed by Fight Out. Users will play fitness games by completing challenges and entering tournaments, with tokenized rewards on offer.

Are Micro-Cap Crypto Gems a Good Investment?

Whether or not micro-cap cryptocurrencies are worth buying will depend on the goals and risk tolerance of the investor.

Here’s what to consider before proceeding:

Consider the Enhances Risk

All cryptocurrencies are considered risky investment products. However, those with a micro-cap valuation come with an even greater level of risk.

After all, if a whale sells a huge chunk of tokens via a single trade, this could wipe a sizable amount of value from the project.

Moreover, many micro-cap cryptocurrencies are backed by up-and-coming projects. Many of which never meet the expectations of their investors.

Long-Term Upside Can be Huge

While riskier than large-cap projects, micro-cap cryptocurrencies invariably offer a much higher upside. This is especially the case in the long run, as newly launched projects have time to grow organically.

Moreover, many micro-cap projects are at the start of their development phase. This means that it can take several years for the concept to reach the masses. But nonetheless, the upside potential of a token with a micro-cap valuation can be significant.

For instance, when Shiba Inu was launched in mid-2020, it was worth just a few million dollars. In just over a year, Shiba Inu went on to reach a market cap of over $40 billion. This translates into gains of over 10,000x.

Similarly, when Love Hate Inu completes its presale campaign, it will list on exchanges with a micro-cap valuation. With Love Hate Inu expected to generate huge hype, some investors believe it could be the next Shiba Inu.

Micro-Caps are Ideal for Small Investments

Those on a budget are constantly on the lookout for the best micro-cap cryptocurrencies. The reason for this is that even with a small investment, if a micro-cap ‘moons’ the returns can be sizable.

- For example, when BNB launched in 2017, it had a market capitalization of just over $10 million.

- Today, BNB is worth over $50 billion.

- This amounts to growth of over 500,000%.

- Therefore, investing just $100 in BNB in 2017 would now be worth $500,000.

This is why newly launched presales like Love Hate Inu and Fight Out are so appealing. After all, investors only need to risk a few dollars to gain exposure.

Conclusion

Finding the next 100x gem is often a case of focusing on quality micro-cap cryptocurrencies. This is because micro-caps have considerable room for growth, especially if they are behind innovative concepts.

Love Hate Inu meets this criterion, with the vote-to-earn project currently offering its native token at presale prices. This provides access to the growth of Love Hate Inu from the earliest stage possible.

Plus, the current stage of the presale is offering a 60% upside when compared to the exchange listing price.

FAQs

What is a micro-cap crypto?

Micro-cap cryptocurrencies have a market capitalization of under $300 million. In a similar way to micro-cap stocks, this market is attractive to investors that seek huge returns. This is why the Love Hate Inu (LHINU) and Fight Out (FGHT) presales are proving so popular.

What are the best micro-cap cryptos to buy?

Fight Out and C+Charge are well worth considering, especially for presale investors. Overall, however, Love Hate Inu is the best micro-cap crypto to buy today. The project is building an ecosystem with vote-to-earn rewards. The Love Hate Inu presale has just been launched and is offering early-bird discounts to investors.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

This news is republished from another source. You can check the original article here